The Signal and the Noise: Trend Job Gains Reveal Transition to Steady Growth

Jared Bernstein

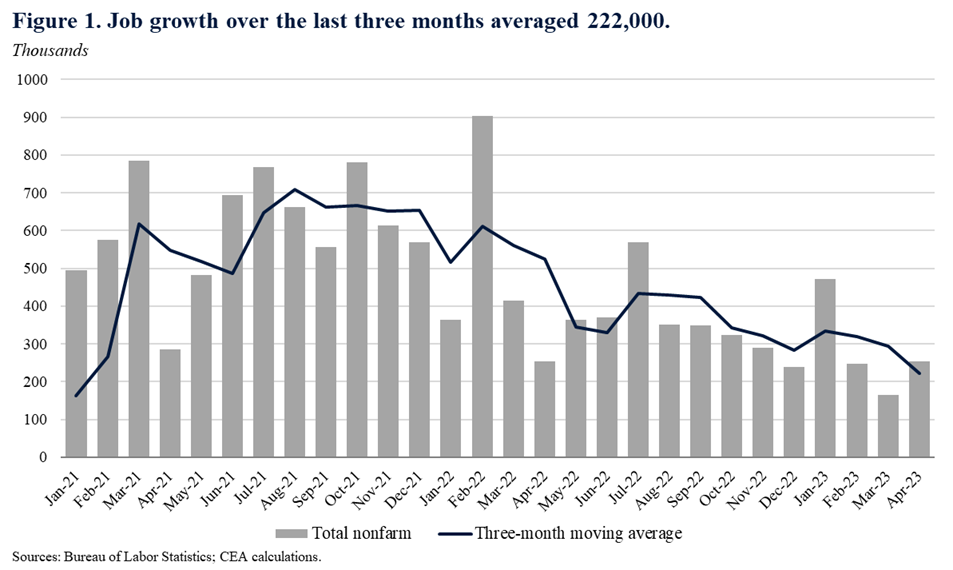

Payroll employment posted a solid increase of 253,000 jobs last month, and the unemployment rate ticked down to 3.4 percent, the lowest unemployment rate since May 1969. Because monthly data tend to be somewhat “noisy,” we at the CEA find it useful to look not just at the monthly number, but at the three-month moving average. This procedure helps us separate the signal, or more persistent trend, in the data relative from the monthly noise.

Factoring large downward revisions of 149,000 to the monthly gains in February and March, the average over the past three months is 222,000. As this point in a labor market expansion that’s been ongoing for about three years, this is a solid number, representing a pace of employment growth that is creating robust opportunities for those in or entering the job market.

The figure below shows both the monthly job gains (bars) and the 3-month moving average (line). What’s particularly notable is the clear deceleration of the line over time. A year ago, in April 2022, the average was over 500,000 jobs, well over twice the comparable number derived from today’s report. While the labor market remains historically strong—and is even posting important records I’ll highlight in a moment—it is important from a macroeconomic perspective to see this deceleration towards a slower, more normal pace of job gains, a pace consistent with a transition to a more stable, ongoing expansion.

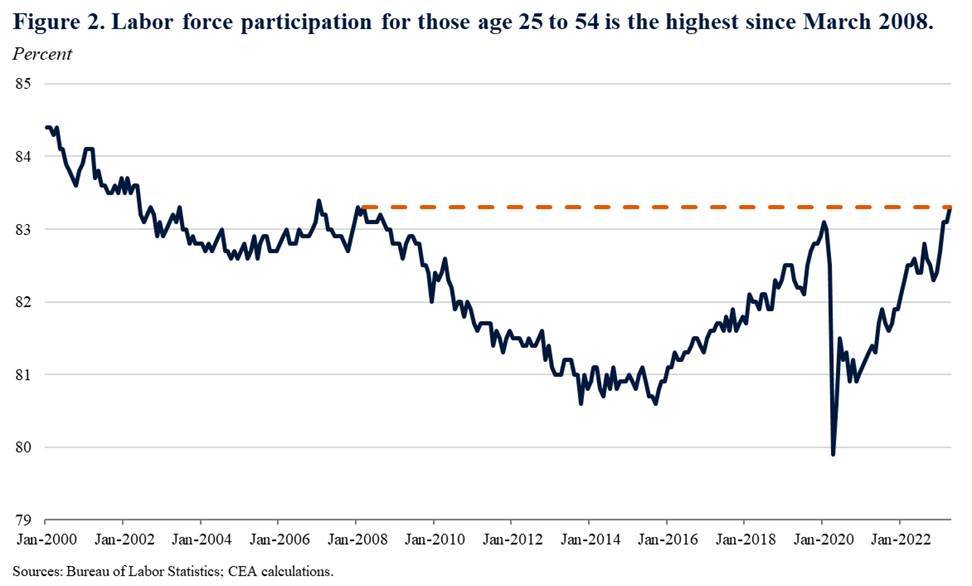

Another important sign of post-pandemic, labor market normalization is the recent improvement in labor force participations rates (LFPRs), a measure of labor supply. CEA highlighted this development in a recent blog post, but new data out today shows that, while the overall LFPR held steady at 62.6 percent, the closely watched “prime-age” (25-54 year-olds) LFPR ticked up 20 basis points (two-tenths of a percentage point) to 83.3 percent. The prime-age rate, because it leaves out most retirees and students (two groups that tend to be less connected to the job market) is considered a cleaner measure of underlying labor supply, and thereby provides yet another way to pull signal from noise. As the next figure shows, the prime-age LFPR is now above its pre-pandemic level and the highest since March 2008.

A few other key indicators from today’s report:

- An important fact about U.S. labor markets is that when they remain persistently tight, they tend to deliver important opportunities to economically vulnerable groups of workers. Last month, CEA highlighted the point that the Black unemployment rate, at 5.0 percent, was the lowest on record since this data series began in 1972. But in this April report, the Black unemployment rate carved out even a lower bottom, ticking down to 4.7 percent (though this was largely driven by a decline in the Black LFPR, a good reminder about monthly noise).

- The LFPR for prime-age women increased by 40 basis points to 77.5 percent, 50 basis points above its pre-pandemic level and its highest rate on record in a series that dates back to 1948. The men’s prime-age rate ticked up slightly, to 89.2 percent and is back at its pre-pandemic level.

- Nominal wage growth accelerated last month, up 0.5 percent in the month and 4.4 percent over the past year. On a three-month, annualized basis (another way to amp up the signal), wage growth was 4.2 percent in April compared to 3.4 percent in March and 4.5 percent in January.

In analyzing economic data over time, it is important to try to draw out the underlying trend so as not to be overly swayed by monthly ups and downs, which can reflect more noise than signal. When we do so based on data in today’s jobs report, we see robust job gains around a slowing trend and normalization of labor supply back to pre-pandemic levels (and perhaps even somewhat higher for certain groups), both developments that are consistent with a transition from the breakneck pace of growth earlier in the expansion to a steadier, more normal growth pace. At the same time, faster wage growth suggests ongoing pressures in the job market. CEA will continue to closely track these trends as new data come in.