The Economic Impact of Extending Expiring Provisions of the Tax Cuts and Jobs Act

Executive Summary

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest tax cut in history and a generational reform of the tax code designed to strengthen domestic investment, boost economic growth, increase take-home pay, and reduce poverty. The TCJA lowered taxes across-the-board for workers, families, and American businesses. Among its most consequential reforms, the TCJA fundamentally reoriented the corporate tax system by reducing the statutory corporate tax rate from one of the highest in the world at 35 percent to a much more internationally competitive rate of 21 percent—making it more attractive for firms to locate in the United States—and by shifting the United States from a worldwide toward a territorial tax system. This further enhanced the competitiveness of American corporations and removed tax barriers to repatriating foreign earnings. International tax provisions in the TCJA put an end to corporate “inversions”, whereby domestic companies move overseas in search of a more favorable tax environment.

Importantly, the TCJA also instituted full expensing for equipment investment, which paved the way for businesses to grow and expand by enabling them to immediately deduct the full value of these capital expenditures. The TCJA also prioritized the health and vitality of small businesses by enacting a 20 percent deduction for pass-through entities and by reducing their marginal tax rates. In addition to benefiting from the higher wages and job opportunities created by these reforms, workers and families have seen their take-home pay increase from the reduction in lower individual income tax rates. They have also benefited from the TCJA’s doubling of the child tax credit from $1,000 to $2,000 per child and its near doubling of the standard deduction, which greatly simplified the tax code by reducing the number of taxpayers who itemize. One of the more innovative pillars of the TCJA was the creation of Opportunity Zone (OZ) tax incentives, which reward long-term investment and economic development in distressed communities designated as OZs, helping to create economic opportunity for communities most in need.

While most of the TCJA corporate reforms were made permanent, many of the other provisions are scheduled to expire at the end of 2025. If these provisions expire:

- Individual marginal tax rates will increase;

- The standard deduction will fall by nearly half;

- The child tax credit will be cut in half from $2,000 to $1,000;

- Small businesses will lose the 20 percent pass-through deduction (Section 199A);

- Businesses will have to deduct investment slowly over time rather than immediately; and

- Distressed communities will see decreased investment from the disappearance of OZs.

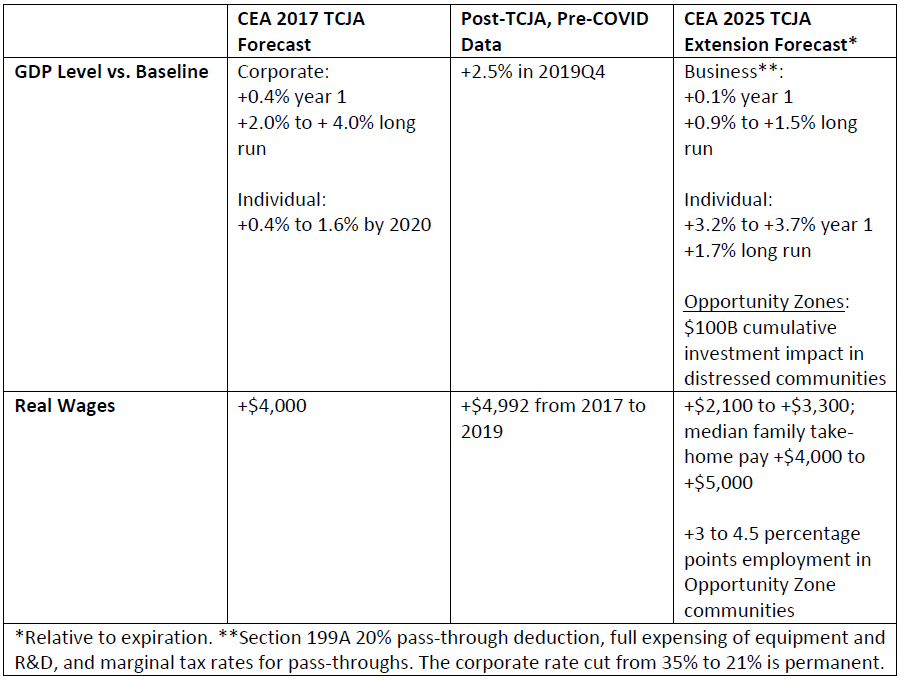

Before passage of the TCJA, the Council of Economic Advisers (CEA) accurately forecasted the impact that the tax reforms would have on the U.S. economy. Specifically, the CEA estimated that the TCJA would result in a 2.0 to 4.0 percent long-run increase in real GDP and a $4,000 increase in real (inflation-adjusted) wages per worker. The data validate the CEA’s forecasts: real GDP was 2.5 percent higher at the end of 2019 relative to the pre-TCJA baseline from the Congressional Budget Office (CBO), and real wages increased by $4,992.

Extending the expiring provisions of the TCJA will deliver enormous benefits for the U.S. economy, our workers, and our families. The TCJA’s extension, together with the full suite of Trump Administration policies—such as deregulation, which the CEA previously estimated would add 0.1 to 0.2 percentage points to real GDP growth rates over a decade—is expected to result in 3.0 percent annual real GDP growth rates over the next 10 years. The TCJA’s extension will also prevent the unthinkable consequence of a more than $4 trillion tax hike on Americans. Applying the same successful methodology to forecast the effects of extending the TCJA, the CEA predicts that extension, relative to allowing the reforms to expire, would:

- Boost the level of short-run real GDP by 3.3 to 3.8 percent and long-run real GDP by 2.6 to 3.2 percent;

- Raise annual real wages by $2,100 to $3,300 per worker;

- Increase real annual take-home pay for a median-income household with two children by roughly $4,000 to $5,000;

- Save over 4 million full-time equivalent jobs from being destroyed; and

- Facilitate $100 billion of investment in distressed communities.

The table below demonstrates the accuracy of the CEA’s original TCJA forecasts and presents estimates for the impact of extending the TCJA.

Academic and industry research validates the CEA’s conclusions. For example, in one

academic study, Chodorow-Reich, Smith, Zidar, and Zwick (2024) find that the TCJA

induced an investment boom, with effects varying by how much a firm’s effective tax

rate fell. Firms experiencing the average tax reduction increased domestic investment

by 20 percent and boosted domestic labor compensation. In another academic study,

Hartley, Hassett, and Rauh (2025) conclude that TCJA-induced declines in the user cost

of capital led to a strong positive investment response, with each percentage point fall

in the user cost of capital translating to a 1.27 to 2.39 percentage point rise in the

investment rate. According to EY, one of the world’s largest consulting firms, extending

TCJA provisions would save almost 6 million jobs, boost aggregate wages by $540 billion,

and increase GDP by $1.1 trillion compared to if TCJA expires.

The remainder of this paper is organized as follows: section 1 provides background on

the TCJA and the expiring provisions, section 2 summarizes the economic impacts of the

TCJA, and section 3 provides a methodological overview. The paper concludes by

summarizing the key findings and dispelling some of the arguments made against TCJA

extension.