Why the Pandemic Has Disrupted Supply Chains

By Susan Helper and Evan Soltas

These are times of rapid transition for the U.S. economy. With the winding down of the worst of the pandemic, businesses have added jobs at a rate of 540,000 per month since January. Many consumers are making large purchases with savings accumulated during the pandemic, sending new home sales to their highest level in 14 years and auto sales to their highest level in 15 years.

While a fast pivot to growth is good news for businesses and workers, it also creates challenges. Entire industries that shrank dramatically during the pandemic, such as the hotel and restaurant sectors, are now trying to reopen. Some businesses report that they have been unable to hire quickly enough to keep pace with their rising need for workers, leading to an all-time record 8.3 million job openings in April. Others do not have enough of their products in inventory to avoid running out of stock. The situation has been especially difficult for businesses with complex supply chains, as their production is vulnerable to disruption due to shortages of inputs from other businesses.

These shortages and supply-chain disruptions are significant and widespread—but are likely to be transitory. Below, we describe the disruptions, the ways that supply chains have adjusted to disruptions in the past, and how the Administration is working to address both short- and long-term supply chain issues.

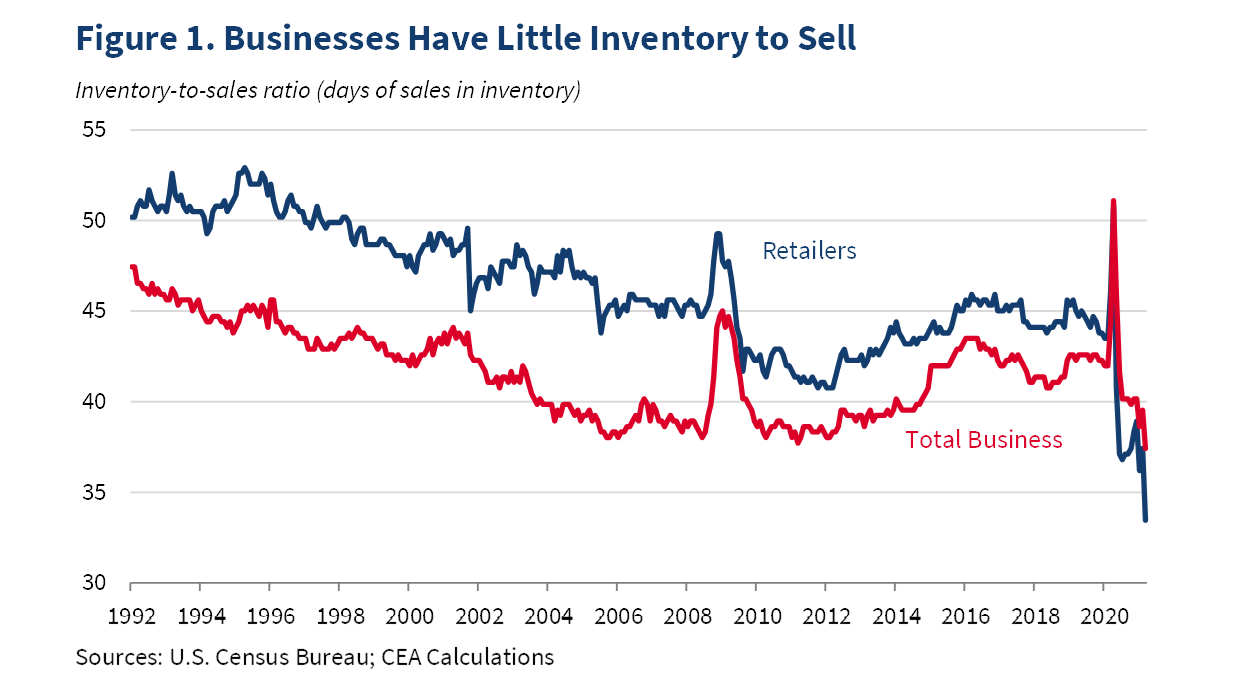

Figure 1 shows that both the economy-wide and retail-sector inventory-to-sales ratios hit record lows in March. These ratios measure how many days of current sales that businesses and retailers could support out of existing inventories. When the pandemic hit, businesses were stuck with billions of dollars in unsold goods, causing inventory-to-sales ratios to surge briefly before businesses liquidated these inventories. But, as the economy recovered and demand increased, businesses have not yet been able to bring inventories fully back to pre-pandemic levels, causing inventory-to-sales ratios to fall.

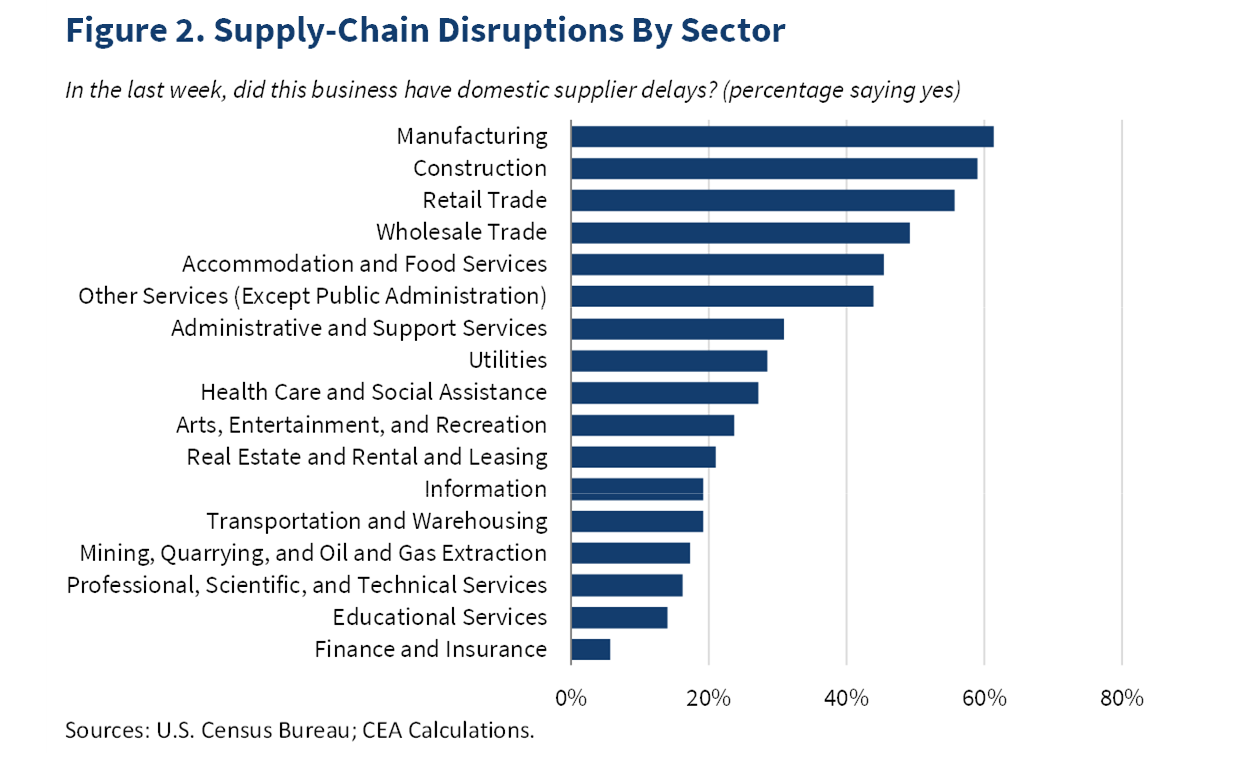

The figure shows that while retailers had 43 days of inventory in February 2020, today they have just 33 days. Inventories of cars and homes are also at or near record lows, sufficient for just one month of car sales and 4.4 months of home sales, as compared to pre-pandemic levels of about two months for cars and 5.5 months for homes. These low inventories have caused cascading issues in industrial supply chains. In the latest U.S. Census Small Business Pulse survey, held from May 31 to June 6, 36 percent of small businesses reported delays with domestic suppliers, with delays concentrated in manufacturing, construction, and trade sectors, as shown in Figure 2. While no comparable survey data exist from before the pandemic, industry-specific surveys on input shortages suggest these levels are much higher than usual.

Data also suggest these shortages are holding back business activity in some sectors. A record share of homebuilders, surveyed by the National Association of Homebuilders in May, reported shortages of key materials such as framing lumber, wallboard, and roofing. Homebuilders appear to be responding to these shortages in part by delaying new construction, as housing starts have been volatile for several months.

Another impact of the shortages has been abrupt price increases. Between May 2020 and May 2021, prices of commodities tracked within the Producer Price Index rose by 19 percent, the largest year-over-year increase since 1974, in part reflecting base effects. Some increases have been especially dramatic. Facing a shortage of lumber, homebuilders briefly sent prices to $1,711 per thousand board-feet last month, an amount that implies a typical 2,000-square-foot house would require more than $27,000 in framing lumber alone, relative to a lumber bill of about $7,000 before the pandemic.[1] Lumber prices have now rapidly come back down, falling 38 percent from their record high, in an early sign that some shortages may be short-lived.

Supply-chain disruptions are also having a material impact on consumer prices, especially in the motor vehicle sector. Over half of the May increase in core inflation as measured by the Consumer Price Index comes from this sector, if we include prices of new, used, leased, and rental automobiles. This sector also accounted for one-third of the economy-wide increase in prices compared to a year ago.[2]

A key reason for the acute problems in motor vehicles is that automakers appear to have underestimated demand for their products after the start of the pandemic. Expecting weak demand, they cancelled orders of semiconductors, an item with a long lead time and with a secular increase in demand from other industries. This problem is compounded by the fragmentation in recent decades of the auto supply chain across many countries and many firms. This phenomenon has made it difficult for automakers to trace the root causes of bottlenecks, since for example a semiconductor may be designed by one firm, manufactured by a second firm, embedded into a component (such as an air bag) by a third supplier, and only then delivered to an automaker’s assembly plant. In most cases, neither the automaker nor the semiconductor manufacturer can trace what goes on in these intermediate layers (or “tiers”) of the supply chain, due in part to lack of trust among parties in supply chains, who fear that the information might be used to replace them or to bargain for a price reduction. While these problems are most acute in semiconductors, they are found in other parts of the auto supply chain as well. The auto sector is “the industry of industries,” so the price of cars is affected by the prices of the 30,000 parts in the car, from semiconductors to steel to plastic to rubber, and the logistics of transporting these parts across multiple national borders.

While the economy-wide nature of these shortages is unusual, the history of supply disruptions in specific industries may offer insights as to how the shortages will be resolved over time. In the past, many industries have been surprised by strong demand and caught with too little inventory of specific goods. Others have been hit with a supply shock due to a crop failure or a natural disaster which took key factories temporarily offline, such as after the 2011 earthquake in Japan. In many such cases, markets made their way back to equilibrium relatively quickly.

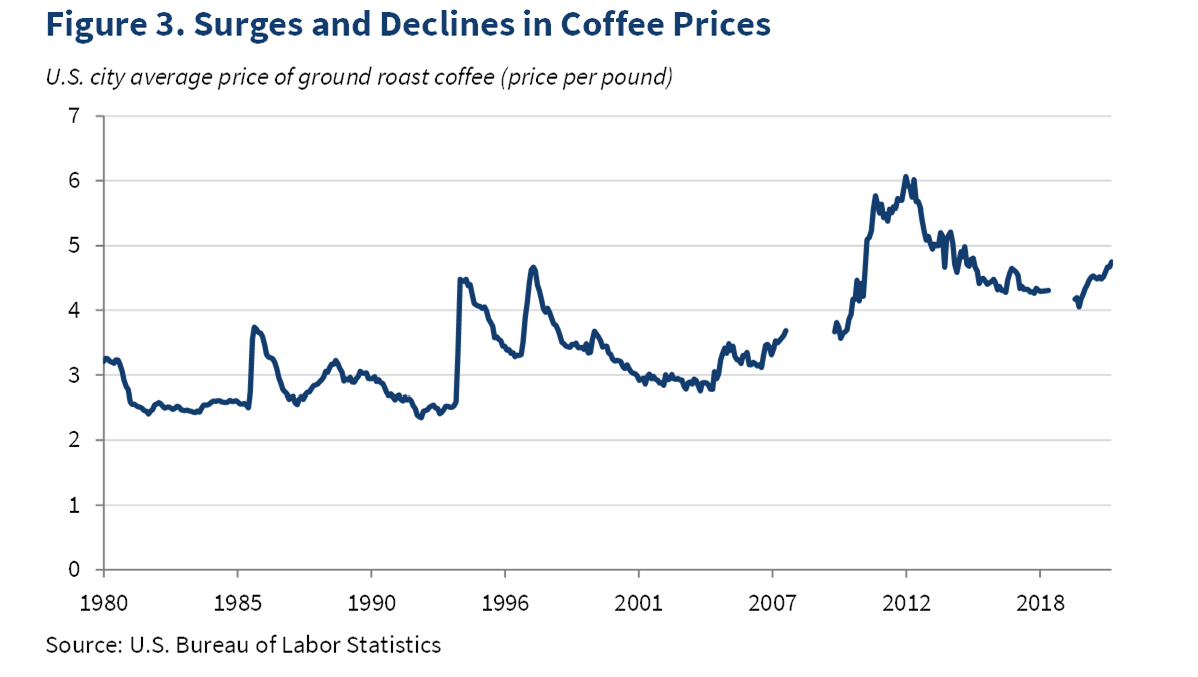

Take coffee, for example. As some coffee drinkers can remember, coffee prices have spiked repeatedly due to frosts that damage coffee harvests, most recently in late 2010. Each time, the weather normalized, harvests improved, and prices fell back towards their previous levels. Similar transitory price spikes have occurred in markets for agricultural goods and other commodities—peanut butter amid a drought in 2011, or eggs amid an outbreak of bird flu in 2015.

The toilet-paper shortage in the early days of the pandemic offers another useful case study. Stay-at-home orders led to a sudden 40-percent increase in demand for retail toilet paper, the fluffier kind used by households. Yet supply cannot rise overnight to satisfy demand. Toilet paper is bulky to store, and demand is ordinarily very stable, which led retailers to keep only two to three weeks of sales in inventory and manufacturers to operate their plants at 92-percent capacity. Worried they would be left without toilet paper, Americans cleaned out store shelves.

How did U.S. toilet-paper manufacturers respond to the shortages? None appear to have added production lines or built new plants to expand capacity. That is because the modern toilet-paper manufacturing process is highly mechanized and capital-intensive, requiring four-story-tall machines that cost billions of dollars and months to assemble before a single roll comes off the line. And few appear to have converted factories from scratchier commercial toilet paper to retail varieties, unlike the rapid retoolings that allowed U.S. manufacturers to ramp up production of cleaning wipes and hand sanitizer. Nor did many sell commercial toilet paper to households.

Instead, manufacturers wrung a bit more out of their existing processes. They ran plants at nearly 100-percent capacity and restarted idled machinery. Some streamlined their product offerings, reducing machine downtime and, in particular, shifting to large-roll products that could get more paper to households without costly changes to machinery. Others invested in their distribution systems, so that they could anticipate and respond more quickly to local shortages.

These resilient responses from manufacturers helped to shorten the stressful period of empty store shelves.

There is evidence indicating that the current disruptions are likely to be mostly transitory. Indices of current delivery times are at record highs in surveys of manufacturers by three regional Federal Reserve Banks, but Fed indices for future delivery times are in their typical ranges. While current indices report conditions at the time of the survey, the future indices report expectations about conditions in six months. Taken together, the data suggest that manufacturers anticipate current supply-chain issues will have abated within six months or so.

While markets will eventually adjust, they can be slow and the impact on producers and consumers can be costly. The public sector can play a valuable role in reducing these costs by facilitating short-term adjustments and by addressing vulnerabilities in U.S. supply chains. The U.S. government has, at critical moments, provided such support: helping Japan respond after the 2011 earthquake, for instance, or producing COVID-19 vaccines through Operation Warp Speed. Last week, the Biden-Harris Administration released the conclusions of its 100-day review of supply chains for four critical products: semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients. Guided by these reviews, the Administration will act to address both short-term strains and long-term vulnerabilities, such as those due to excessive concentration of production of key inputs in a few firms and locations.

The Administration has established a Supply Chain Disruptions Task Force to monitor and address short-term supply issues. This Task Force is convening meetings of stakeholders in industries with urgent supply-chain problems, such as construction and semiconductors, to identify the immediate bottlenecks as well as potential solutions.

For the longer term, the Administration proposes a variety of actions to strengthen our industrial base, increasing resilience and reducing lead times to respond to crises. It vows to reverse long-time policies that have prioritized low costs over security, sustainability and resilience. Because these policies ignored the costs of being unprepared for risk, the United States has ended up with brittle supply chains that are, adjusted for the costs associated with this risk, also quite expensive. The Administration proposes to reverse this damage by investing in research, production, workers, and communities that will rebuild sustainable manufacturing capacity across the country. In particular, the Administration recommends that Congress support at least $50 billion in investment to advance domestic semiconductor manufacturing and research. Another proposed action would address international vulnerabilities to supply chains. Because it does not make sense to produce everything at home, and because U.S. security also depends on the security of our allies, the United States must work with its international partners on collective approaches to supply chain resilience, rather than being dependent on geopolitical competitors for key products.

Restarting the economy after a pandemic and a recession has not been and will not be simple. Hundreds of thousands of small and large businesses have to reopen, millions of laid-off workers have to find new employers, and manufacturers have to bring back production lines idled during the pandemic. Such changes take time. The Biden-Harris Administration is working to speed up the resolution of these transitory shortages and supply-chain disruptions—to make our supply chains more resilient to future shocks and to build back better,.

[1] Calculations assume 16,000 board-feet of framing lumber in the house.

[2] “Core inflation” is a measure that removes from the price index those products, like food and energy, whose prices are usually volatile.