The Employment Situation in March

By Chair Cecilia Rouse

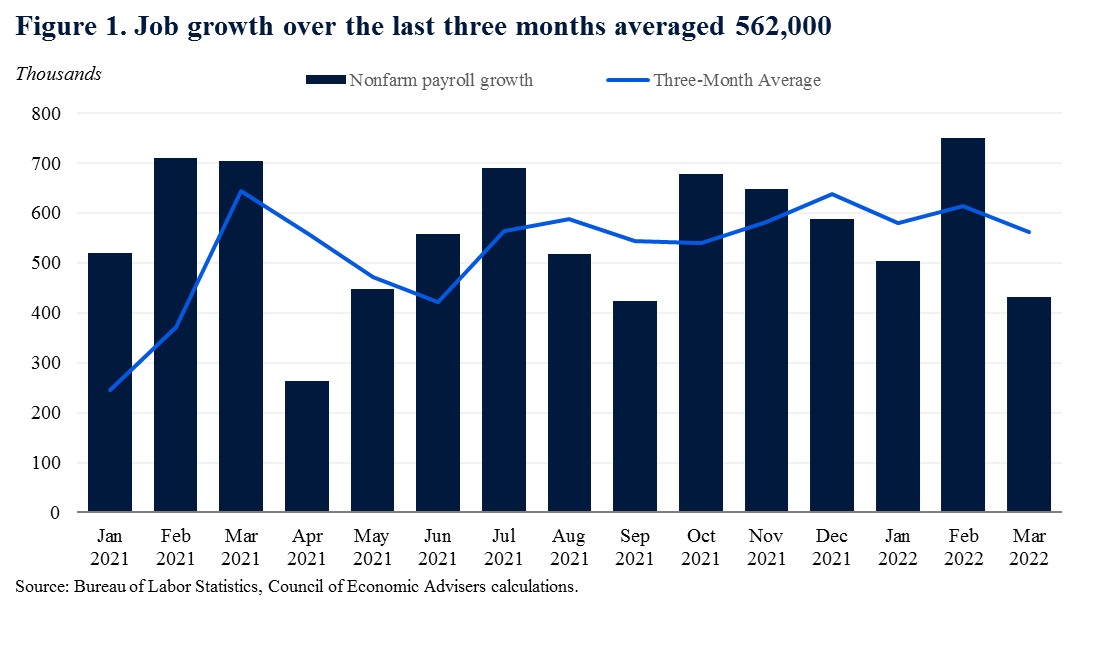

Today’s strong jobs report shows that the economy added 431,000 jobs in March, for an average monthly gain of 562,000 over the past three months. The number of jobs added in March came in slightly below market expectations. Employment in January and February was also revised up by 95,000 jobs.

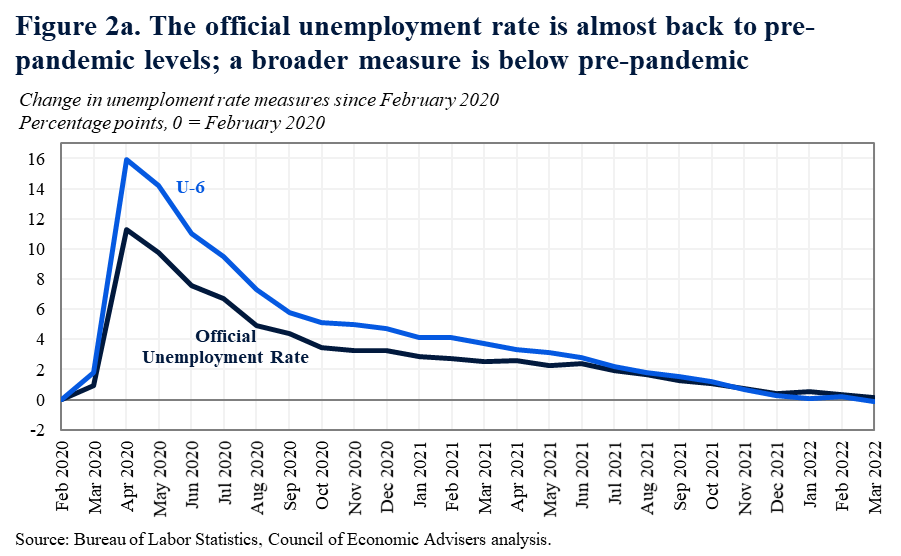

The unemployment rate fell to 3.6 percent, only 0.1 percentage point above where it was in February 2020. The labor force participation rate ticked up to 62.4 percent, reaching a new pandemic high. Nominal hourly wages rose 0.4 percent over the month and increased by 5.6 percent over the past year.

- Average monthly job growth over the last three months was 562,000, a fast pace.

Job growth from January to March averaged 562,000 jobs per month (see Figure 1). Since monthly numbers can be volatile and subject to revision, the Council of Economic Advisers prefers to focus on the three-month average rather than the data in a single month, as described in a prior CEA blog.

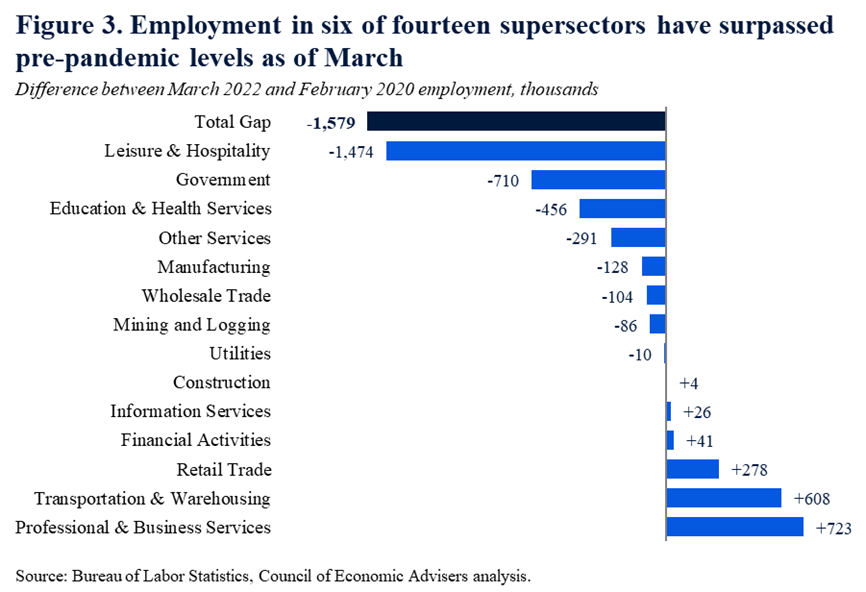

Nevertheless, the labor market has not fully recovered: employment remains about 1.6 million jobs (1.0 percent) below the pre-pandemic level.

2. Almost all of the remaining employment shortfall stems from lower labor force participation.

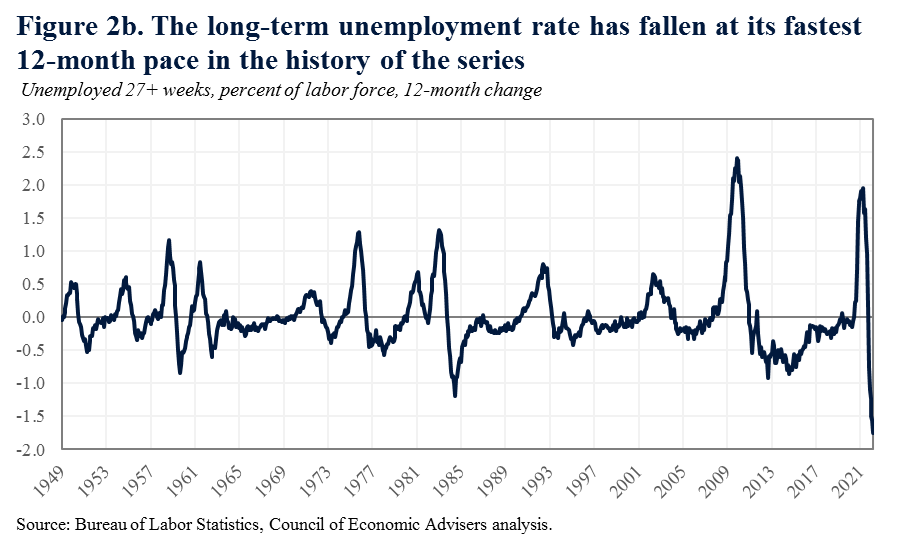

With the official unemployment rate falling to 3.6 percent this month—only 0.1 percentage point higher than it was in February 2020—the unemployment gap has almost entirely closed. In fact, in March the U-6 rate—a broader measure of underemployment that includes the unemployed, the marginally-attached, and workers who are part-time for economic reasons—ticked below its February 2020 level (see Figure 2a). Moreover, the long-term unemployment rate saw its fastest 12-month decline since modern data began in 1948 (see Figure 2b).

This suggests that the remaining shortfall in employment is primarily explained by labor force participation. After ticking up 0.1 percentage point in March 2022, the labor participation rate is 1 percentage point lower than it was in February 2020. CEA estimates that between one-fourth and one-third of the March 2022 participation gap is further explained by the aging of the population since 2020, such as due to retirements that would have happened even absent the pandemic.

3. Jobs gains were broad-based, with construction becoming the latest major industry to fully recover to pre-pandemic employment level

Construction added 19,000 jobs in March and has now exceeded its pre-pandemic employment level by 4,000. It is the sixth major industry to fully recover to February 2020 levels. Professional and business services, transportation and warehousing, and retail trade employment are well above pre-pandemic levels. However, while leisure and hospitality added 112,000 jobs in March, it still accounts for 1.5 million of the overall 1.6 million employment gap.

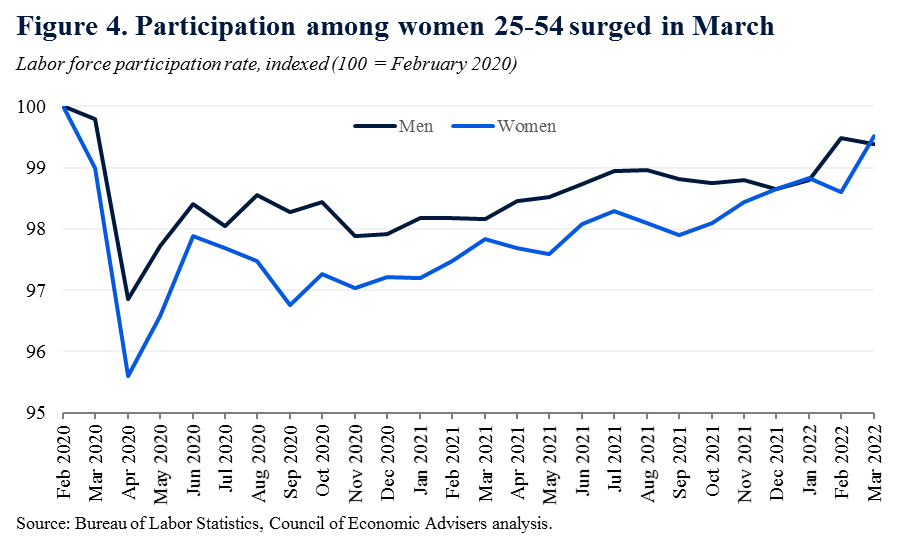

4. The labor force participation rate for women 25-54 rose by 0.7 percentage point in March.

In March, prime-age workers (age 25-54) saw strong labor market gains. The prime-age employment-to-population ratio grew by 0.5 percentage point, and the prime age labor force participation rate grew by 0.3 percentage point. These March gains were mostly due to women, who saw their employment-to-population and participation rates rise 0.9 and 0.7 percentage points, respectively. Prime-age men, in contrast, saw a slight decline in participation in March, following a strong 0.6 percentage point rise in February. As of March, prime-age women’s labor force participation remained 0.5 percent below its pre-pandemic level; the labor force participation rate for prime-age men remained 0.6 percent lower than pre-pandemic.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.