The Employment Situation in December

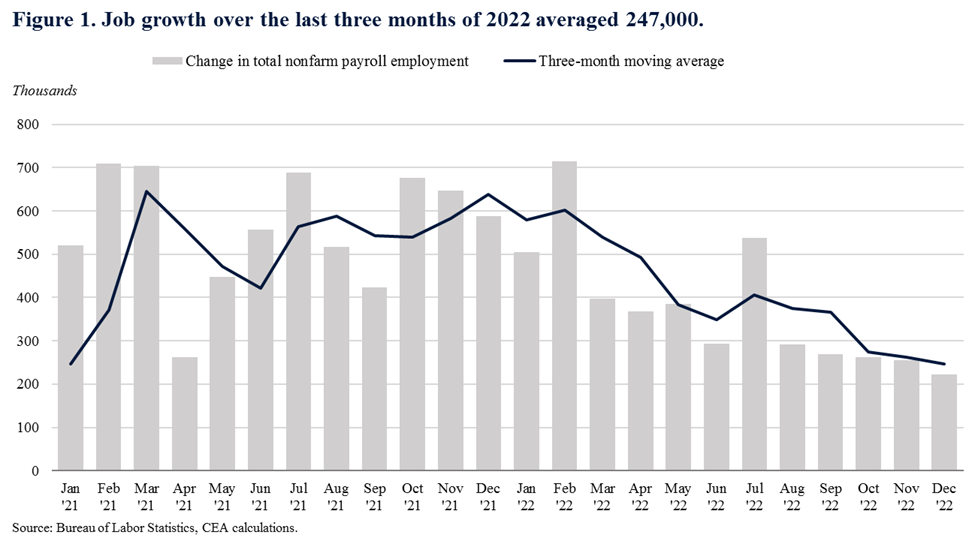

Today’s jobs report shows the economy added 223,000 jobs in December, for an average monthly gain of 247,000 over the past three months. The number of jobs added in December came in above market expectations. Employment growth in October and November was revised down by a combined 28,000 jobs.

The unemployment rate ticked down to 3.5 percent, tying its pandemic-era low. Labor force participation ticked up to 62.3 percent. Nominal wage growth declined to 0.3 percent in December; nominal wages have risen by 4.6 percent over the last year.

1. Average monthly job growth over the last three months was 247,000, a substantial slowdown from the 637,000 average at the end of 2021.

Job growth in October, November, and December averaged 247,000 jobs per month (Figure 1), a slowdown from the prior three months of July, August, and September (366,000 jobs per month on average) and the last three months of 2021 (637,000). Since monthly numbers can be volatile and subject to revision, the Council of Economic Advisers prefers to focus on the three-month average rather than the data in a single month, as described in a prior CEA blog.

One industry that has seen notable recent declines in employment is temporary help services, which has lost nearly 111,000 jobs (3.5 percent of total employment) since July. Declines in temporary help services can be a leading indicator of cooling in the labor market.

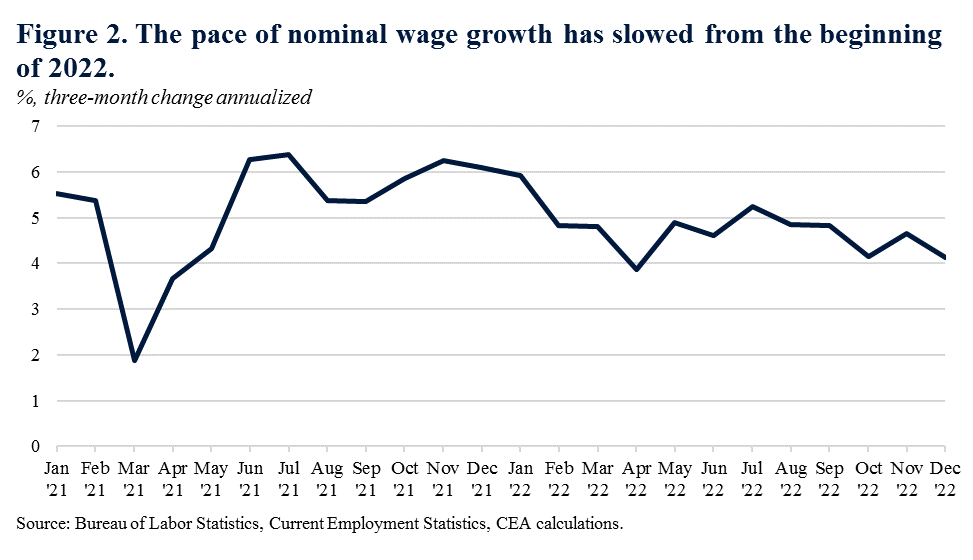

2. Monthly nominal wage growth ticked down to 0.3 percent in December.

Nominal average hourly earnings growth ticked down to 0.3 percent over the month, following growth of 0.4 percent in November (Figure 2). Notably, both nominal wage levels and monthly wage growth rates in October and November were revised lower; for example, growth in November was revised down from 0.6 percent. Three-month average wage growth was 4.1 percent annualized at the end of 2022, substantially lower than the 6.1 percentage average at the end of 2021. Year-over-year, nominal wage growth declined to 4.6 percent, the lowest yearly rate since August 2021. We do not have the inflation report for December yet, which will include real wage growth.

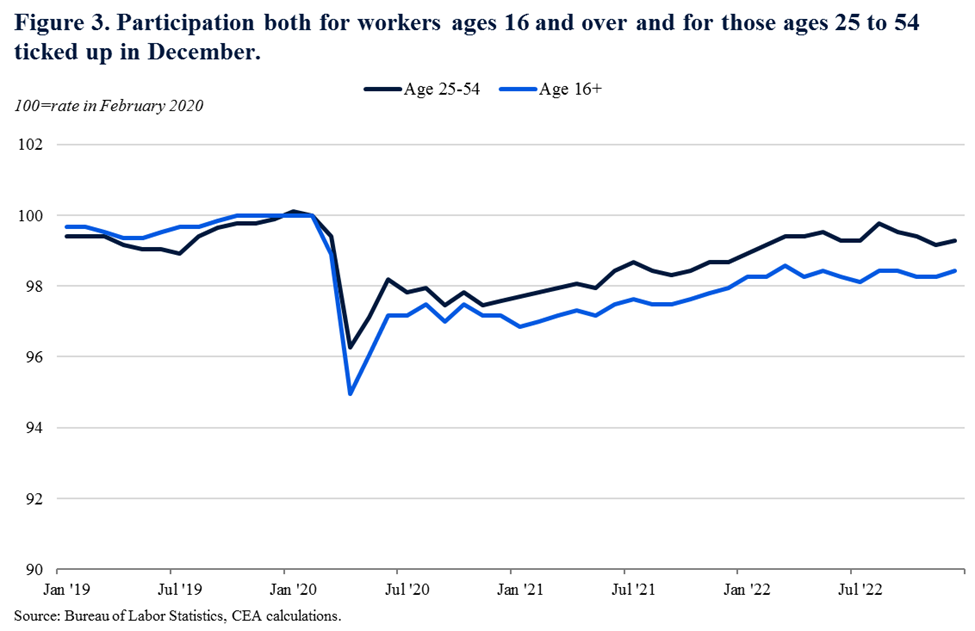

3. Labor force participation rates for workers ages 16 and over and prime-age (25 to 54) workers both ticked up.

Labor force participation for workers ages 16 and over ticked up to 62.3 percent. Participation for prime-age workers, which is less sensitive to the aging of the population and so is preferred by many economists, also ticked up. Both measures have seen substantial recovery from their pandemic lows. Overall, the growth in labor force participation has been relatively robust in this recovery compared to past recoveries. At the same time, both overall and prime-age labor force participation have largely held steady in 2022.

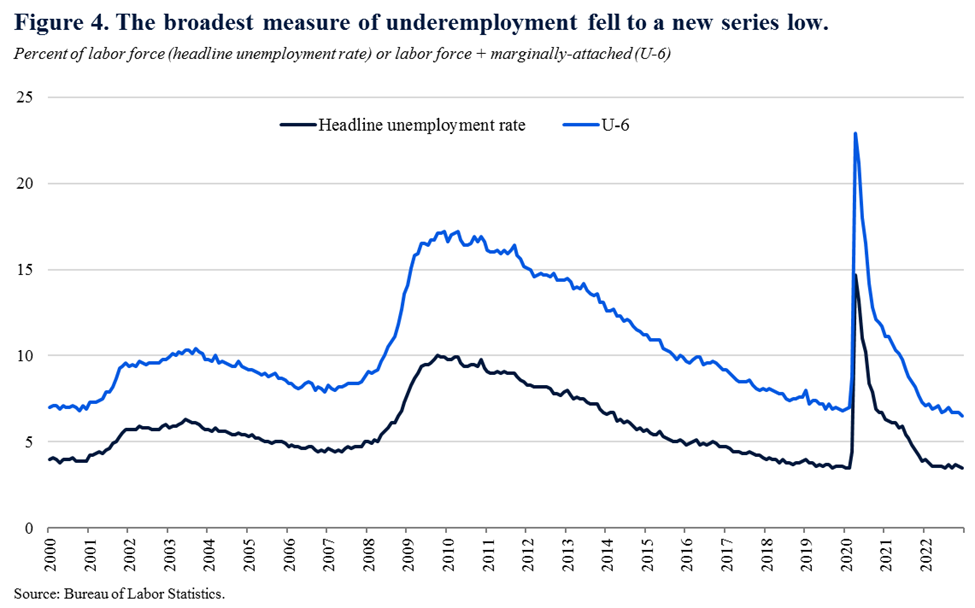

4. The unemployment rate ticked down to 3.5 percent, tied for a pandemic-era low. The broadest measure of underemployment fell to a series low.

The unemployment rate ticked down to 3.5 percent, tied for its pandemic-era low. The broadest measure of underemployment, which includes workers who are out of the labor force but would take a job if offered and workers who are working part-time but would prefer full-time work, fell to 6.5 percent, a new low since the series began in 1994. Both measures have remained roughly around these low rates since March 2022.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.