The Employment Situation in February

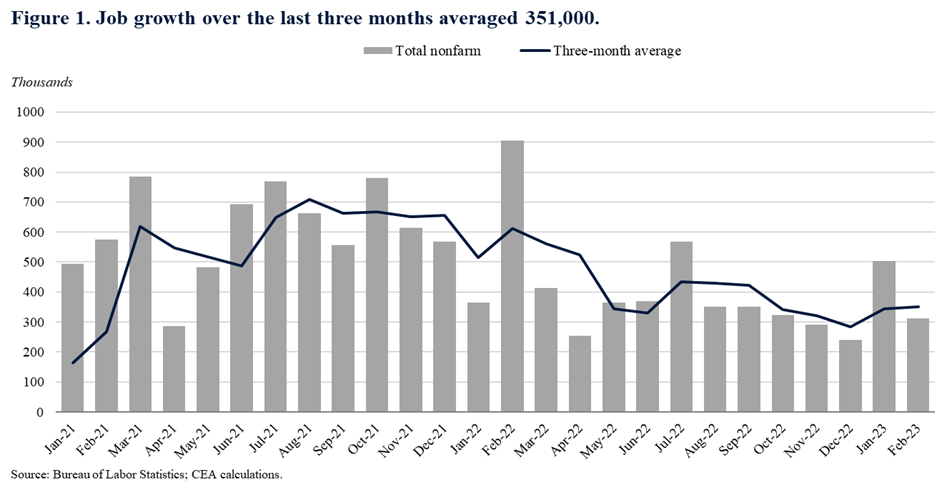

According to today’s jobs report, the economy added 311,000 jobs in February, for an average monthly gain of 351,000 over the past three months. The number of jobs added in February came in well above market expectations. Employment growth in December and January was revised down by a combined 34,000 jobs.

The unemployment rate edged up to 3.6 percent, largely driven by a rise in labor force participation. Labor force participation was 62.5 percent, a tick above January’s report, while the participation rate for 25-54 year-olds rose above its February 2020 level for the first time since the pandemic began. Monthly nominal wage growth ticked down to 0.2 percent in February; nominal wages have risen by 4.6 percent over the last year.

1. Average monthly job growth over the last three months was 351,000, a substantial slowdown from the average at the end of 2021.

Job growth in December, January, and February averaged 351,000 jobs per month (Figure 1), a slight acceleration from the 321,000 pace in the prior three months of September, October, and November but a slowdown from December 2021 through February 2022. Since monthly numbers can be volatile and subject to revision, the Council of Economic Advisers prefers to focus on the three-month average rather than the data in a single month, as described in a prior CEA blog.

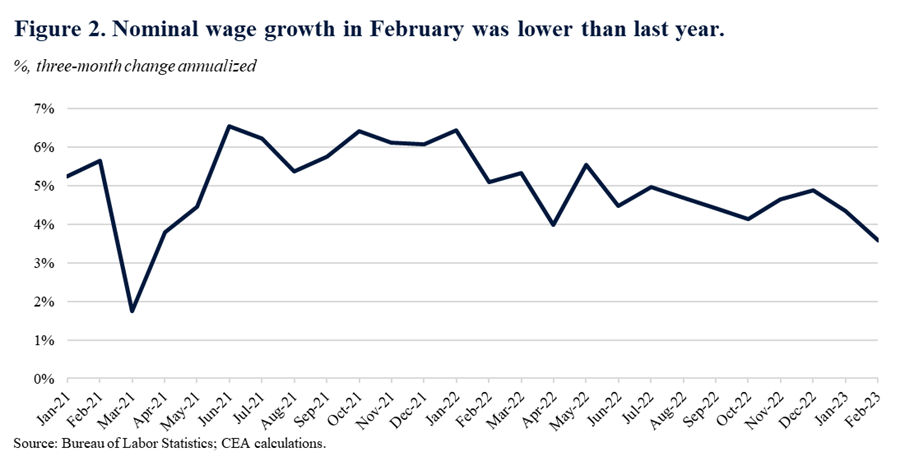

2. Monthly nominal wage growth ticked down to 0.2 percent in February.

Nominal average hourly earnings growth ticked down to 0.2 percent over the month, following growth of 0.3 percent in January (Figure 2). Three-month average wage growth was 3.6 percent annualized in February, substantially lower than the 5.1 percent average over the same three months last year, and lower it was over 2022. Year-over-year, nominal wage growth ticked up to 4.6 percent. We do not have the inflation report for February yet, which will include real wage growth.

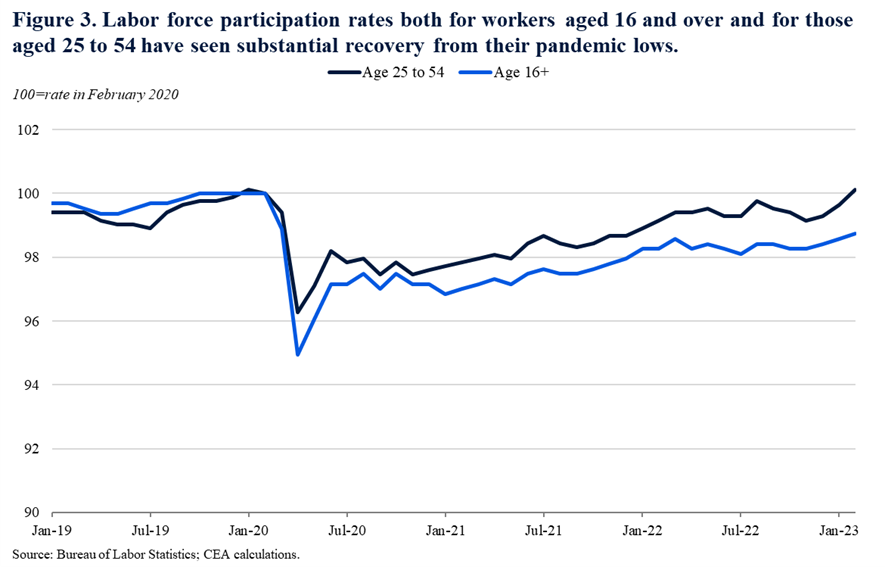

3. Labor force participation rates for workers aged 16 and over and prime-age (25 to 54) workers have seen substantial recovery from their pandemic lows.

The labor force participation rate for workers aged 16 and over was 62.5 percent in February, a new pandemic recovery high. Participation for prime-age workers, which is less sensitive to the aging of the population and so is preferred by many economists, was 83.1 percent, rising above the rate in February 2020 for the first time since the onset of the pandemic. Both measures have seen substantial recovery from their pandemic lows. Overall, the growth in labor force participation has been robust in this recovery compared to past recoveries.

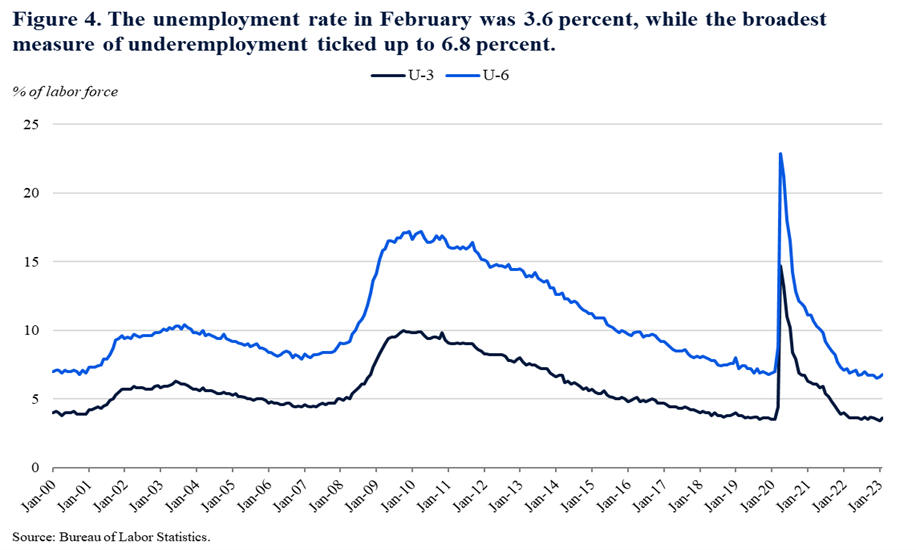

4. The unemployment rate in February ticked up to 3.6 percent.

The unemployment rate ticked up to 3.6 percent, driven primarily by the rise in labor force participation. The broadest measure of underemployment, which includes workers who are out of the labor force but would take a job if offered and workers who are working part-time but would prefer full-time work, was 6.8 percent. Both measures have remained roughly around these low rates since March 2022.

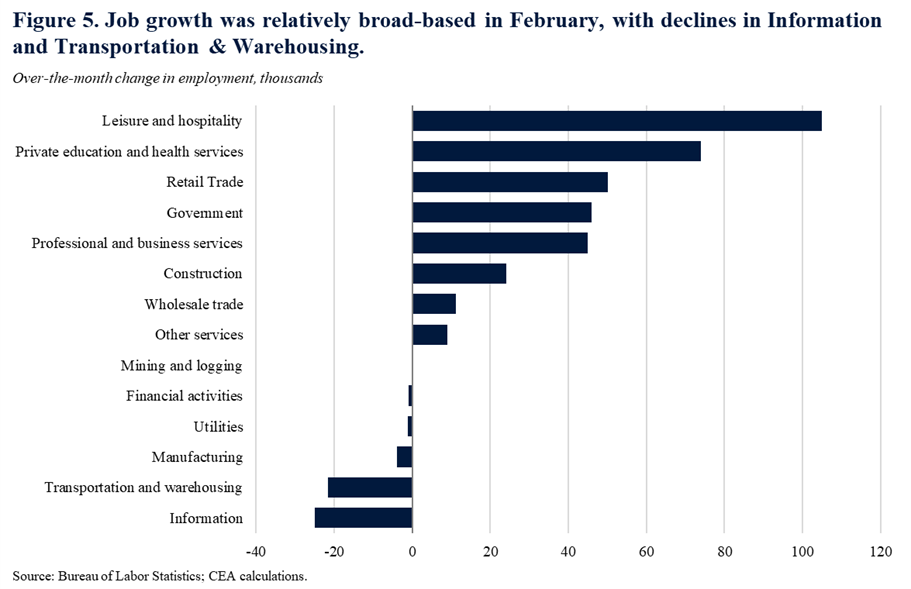

5. Job growth in February was relatively broad-based across industries, but there were notable declines in the Information and Transportation & Warehousing sectors.

Job gains in February were relatively broad-based, but especially strong in the Leisure & Hospitality and Private Education & Health Services sectors, which grew by 105,000 and 74,000 jobs respectively. There were notable declines in employment in the Information and Transportation & Warehousing sectors. Despite widespread coverage of layoffs in technology companies, employment declines in the Information sector were concentrated in the motion picture and publishing industries.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.