Employment Situation in May

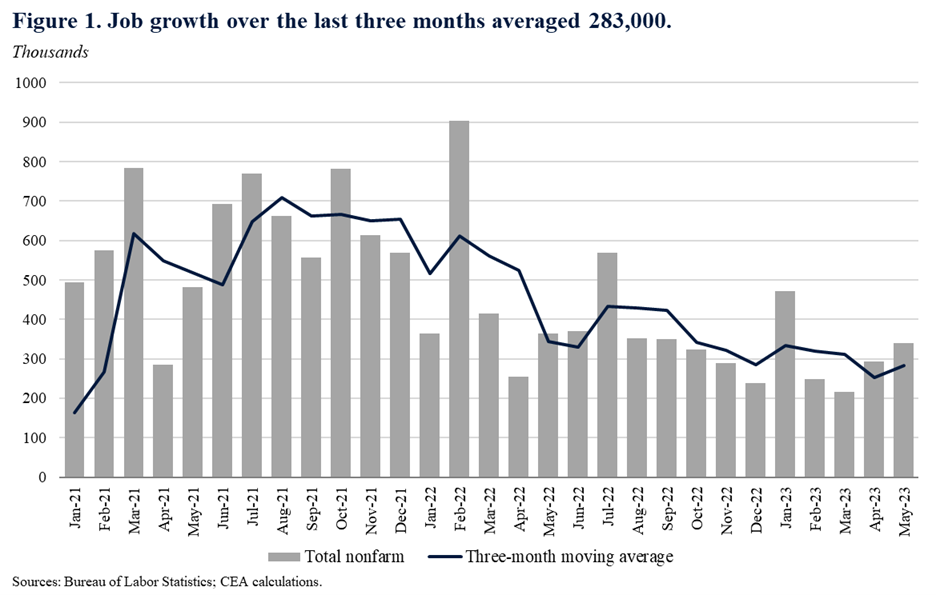

U.S. job creation remained solid in May, with an increase in payrolls of 339,000 and revisions to March and April adding another 93,000 jobs. Over the past three months, monthly job gains have averaged 283,000, a pace that is consistent with a strong labor market characterized by ongoing, robust job creation.

The unemployment rate rose from 3.4 percent in April to 3.7 percent in May. Unemployment has been below 4 percent since February 2022; since then, it has moved between 3.4 and 3.8 percent. This raises the question: how can we get both strong job creation and rising unemployment in the same month? In fact, this is not uncommon and stems from the fact that the monthly jobs report from the Bureau of Labor Statistics (BLS) contains data from two sources: the Establishment Survey and the Household Survey. The former is a survey of workplaces (establishments) from which the BLS derives the payroll count and wage growth. The latter—the Household Survey—provides the unemployment rate and labor force results. We discuss May’s unemployment increase in more detail below.

Turning first to the payroll numbers, Figure 1 shows monthly job gains (in bars) and the three-month moving average of monthly gains (line). The decelerating trend in the average is what we would expect as the labor market recovery matures. The overall economy has downshifted from the very strong pace of growth that occurred when the economy bounced back from the pandemic-induced recession. It is now approaching a slower and steadier pace of job creation. While the CEA is always careful not to over-interpret one month of data, today’s report along with other recent labor market data, e.g., the strong job vacancies number for April, suggest a persistently tight job market.

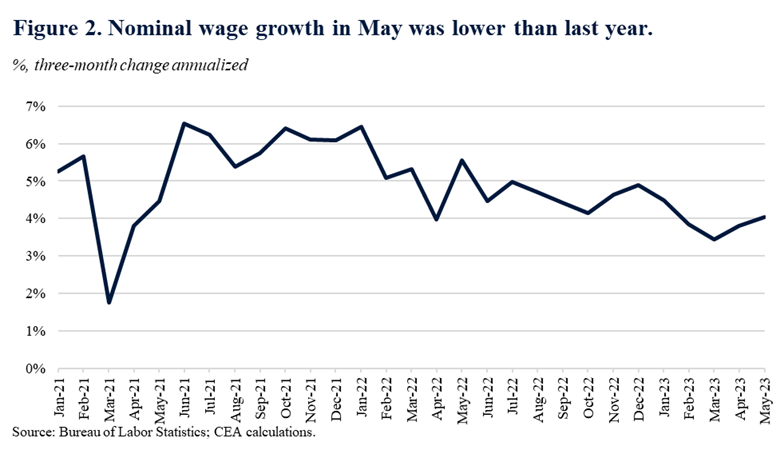

Tight job markets typically support wage growth, and last month, hourly wages were up 0.3 percent for the month and 4.3 percent over the past year. To get a better sense of recent trends in wage growth, we employ another smoothing approach to better tease the signal from the noise: 3-month annualized wage growth (see Figure 2). It shows a slight downward trend, from an annual rate of around 5.5 percent a year ago to about 4 percent this May.

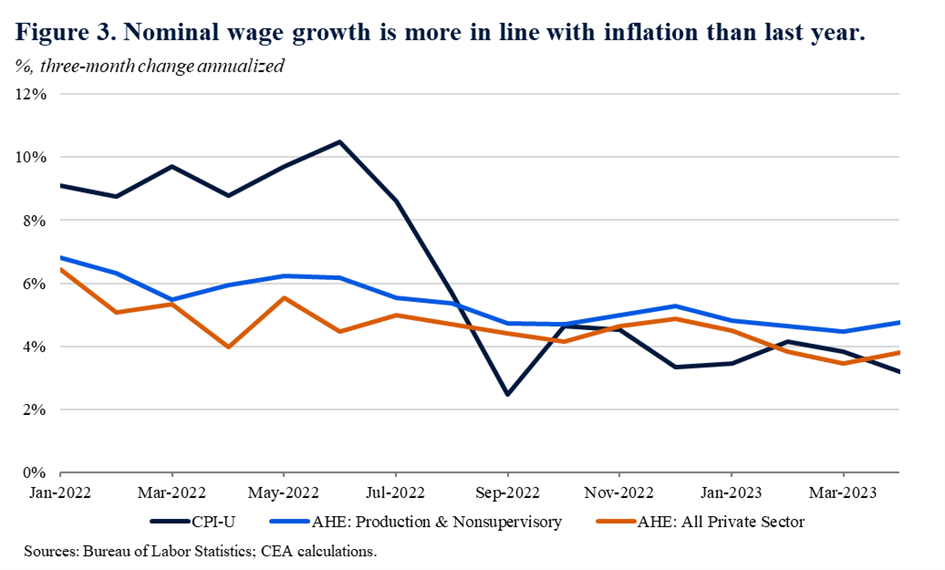

Figure 3 meanwhile compares 3-month annualized trends in hourly wage growth for all private workers, for production, non-supervisory workers (the 80 percent of payroll employment that is blue collar in manufacturing or non-managers in services) and for CPI inflation. (Note: we do not yet have CPI data for May.) A year ago, there was a very large gap between inflation and wage growth. More recently, that gap has largely disappeared, and since last June, real wages are up about 1 percent for both wage series.

Turning to the household survey, unemployment rose from 3.4 percent in April to 3.7 percent in May. While this increase seems large, unemployment estimates can be volatile from month to month. Unemployment remains quite low, below 4 percent, and has varied between 3.4 and 3.7 percent over the course of the last year. Given continued strength in the payroll report, low levels of unemployment insurance claims, and a very low layoffs rate in April, we suspect this increase in the unemployment rate is likely statistical noise and not an indication of increased layoff activity.

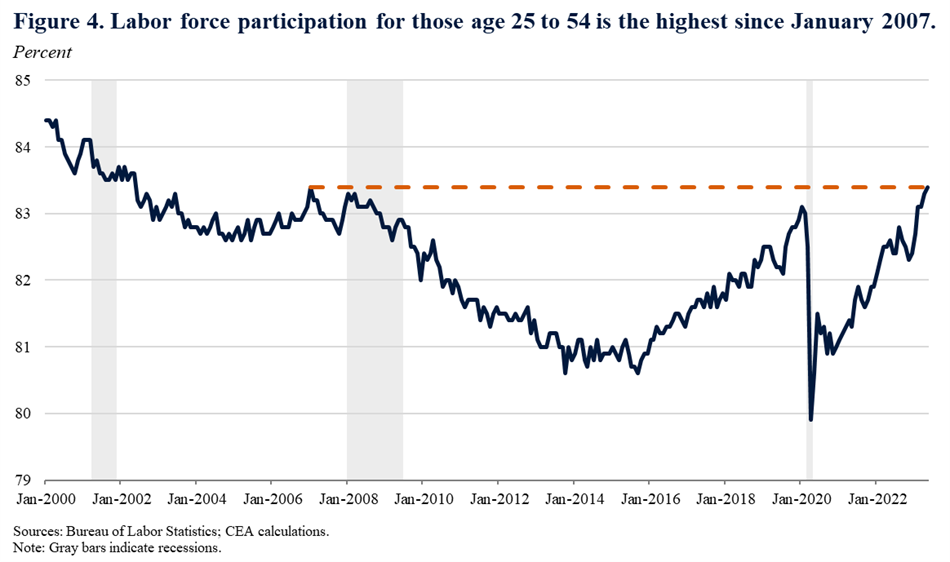

While overall labor force participation held steady, prime-age labor force participation increased another 0.1 percentage point in May and is now at its highest level since January 2007 (Figure 4). Prime-age women’s labor force participation also ticked up in May, reaching its highest level since the data series began in 1948. While aging demographics continue to pose headwinds for overall labor supply, the continued strong recovery in prime-age labor force participation demonstrates how the strength of demand in the current labor market pulls in workers.

The U.S. job market remains in a historically strong period of job creation. Though the jobless rate rose last month, it is still at historically low levels, and labor supply is particularly robust for prime-age workers. The tight job market is generating wage gains that in recent months have beat inflation, especially for blue collar workers. This dynamic, in turn, continues to support solid consumer spending, a fundamental force in the U.S. economy that represents just under 70 percent of nominal GDP. While significant headwinds exist in today’s economy, today’s report confirms that the job market remains a strong tailwind.