The Advance Estimate of Second Quarter Real GDP

Real Gross Domestic Product, or real GDP, is a measure of the inflation-adjusted size of the U.S. economy. Real GDP grew at an annual rate of 2.4 percent in the second quarter of this year, according to the first or “advance” estimate released today. That is a strong pace, well above market expectations of 1.8 percent. Growth in Q2 was driven primarily by consumer spending and business investment, both of which contributed about a percentage point to the growth rate. Importantly, inflation slowed more than expected in the report. This suggests that in the second quarter, the U.S. economy expanded at a healthy clip while price pressures abated somewhat.

GDP is the sum of consumer spending, business investment, government spending, and net exports (exports minus imports). Consumer spending, which amounts to just under 70 percent of nominal GDP, grew by 1.6 percent in real annualized terms last quarter, and has been a consistent source of growth in this expansion, boosted in part by the strong U.S. labor market. Real compensation was up 2.7 percent in the second quarter, a function of rising wages and solid job growth. This combination of a strong labor market and rising real compensation is closely correlated with positive consumer spending growth and increased GDP.

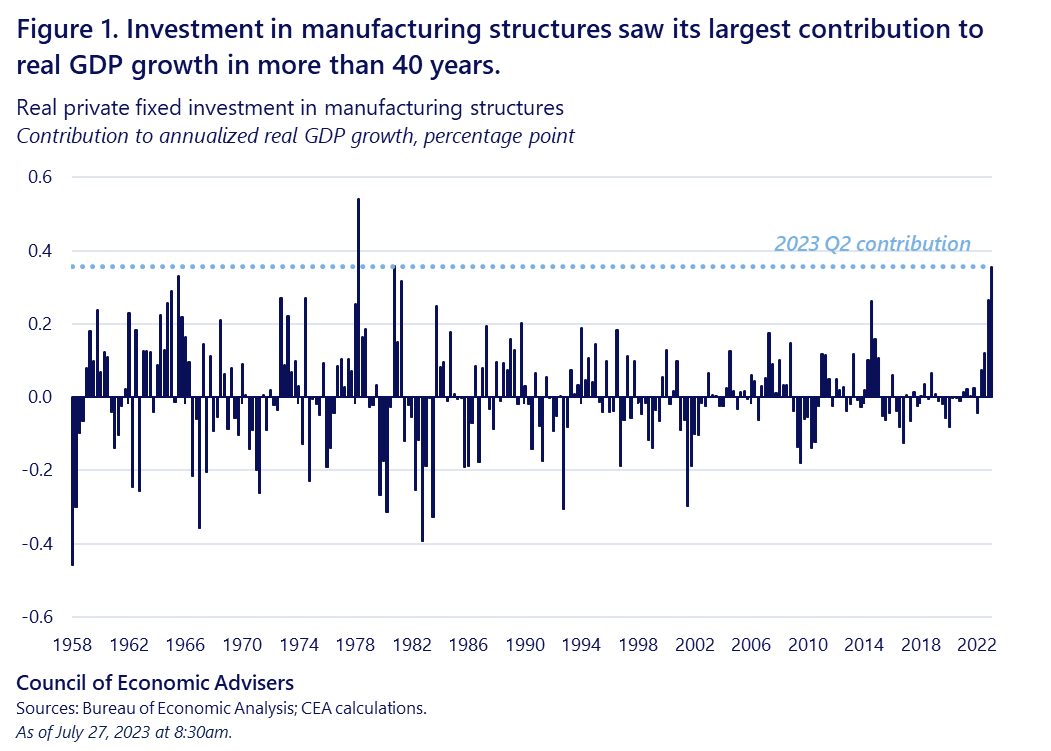

Business investment, up 7.7 percent in real annualized terms, contributed just under 1 percentage point to the 2.4 percent growth rate. While business investment represents a much smaller share of nominal GDP than consumer spending (13 percent vs. 68 percent), investment is important because it drives future growth, jobs, and higher household incomes. A noteworthy aspect of the current business investment outlook is investments in manufacturing facilities, some of which is supported by recent legislation, including the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIPS). In fact, today’s report shows that about 0.4 percentage point of real Q2 GDP growth came from investment in private manufactured structures, the largest such contribution since 1981.

As Figure 1 shows, investment in manufacturing structures has been on an upward trend in recent quarters, supporting both President Biden’s manufacturing agenda and his view that public investment can attract private investment. If this trend persists, it bodes well for future employment opportunities, and could portend an increase in domestic production in areas supported by CHIPS and IRA, such as microchips and clean energy products including electric vehicles and batteries.

It is worth noting that various measures of inflation in this report both slowed and came in below expectations. The overall GDP price index rose 2.2 percent annualized, its lowest increase since the second quarter of 2020 and 0.8 percentage point below expectations. The closely watched core Personal Consumption Expenditures (PCE) Price Index rose 3.8 percent annualized, down by more than a percentage point from Q1’s 4.9 percent rate and 0.2 percentage point below expectations, though still at an elevated rate relative to its prepandemic pace.

The CEA is careful to not over-interpret any one month’s or one quarter’s data. GDP reports also go through numerous revisions as the advance estimates are refined. But today’s report still gives us insights into how the American economy is performing. The advance estimate of GDP for the second quarter of 2023 showed the U.S. economy is expanding at a strong and better-than-expected clip. The growth came largely from consumer spending supported by our solid labor market as well as business investment, partly reflecting construction of new domestic manufacturing structures. Importantly, this activity occurred as inflation continued to slow.