New Business Surge: Unveiling the Business Application Boom through an Analysis of Administrative Data

New businesses play a key role in fostering job creation and productivity growth in the U.S. economy. Business applications—a leading indicator of business formation that is reported through the Census Bureau’s Business Formation Statistics—have risen substantially during the past three years relative to any previous period since 2004, when the series began. In particular, nearly 16 million new business applications have been recorded since the start of the Biden-Harris Administration, this represents an approximately 85 percent increase in the average flow of monthly applications relative to the period between 2004 and January 2021.

Some have questioned whether this increase in applications reflects a surge in economic activity that will be accompanied by net new job creation, or if it merely reflects a bounce back from widespread pandemic period business closures, filing of business applications to take advantage of Federal support to small businesses, and/or an increase in gig employment. Each of these factors can affect business application behavior without also affecting job growth. In this blog, we examine additional sources of business statistics to evaluate each of these alternative explanations. Our findings are consistent with a persistent and accelerated pace of business formation and economic activity expected to drive robust job creation.

Is it just gig work or strategic business formation for tax purposes?

Not all applications to start a new business are associated with future job growth. Some applications are driven by gig workers who newly choose to formally associate their own labor with a business, or by individuals who file a business application to realize tax advantages of temporary federal business tax policies implemented during the pandemic. However, the recent surge in business applications coincides with a rise in applications for likely-employer businesses, suggesting future job growth.

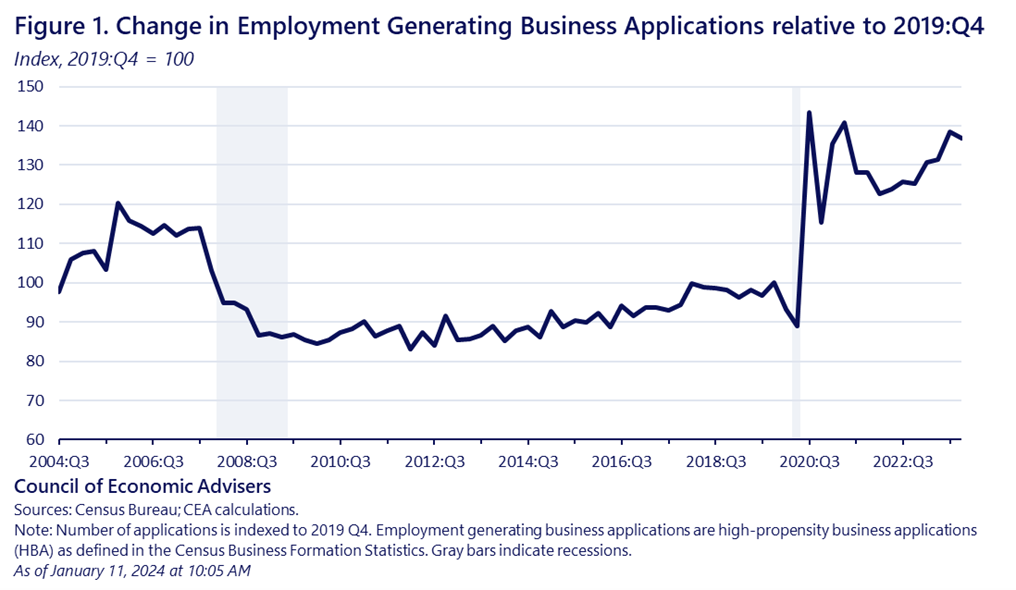

The subset of business applications that have a high probability of turning into employer businesses can be separated from aggregate application trends. Employment-generating applications either specifically indicate a plan to hire employees and pay wages, or are associated with certain industries that historically have had a high propensity to generate payroll employment, such as new retail, health care, and food service businesses. As seen in Figure 1, over 5 million new employment-generating applications have been recorded since the start of the Biden-Harris Administration; this represents a roughly 35 percent increase relative to the average monthly flow of applications between 2004, when the series began, and January 2021.

Is it just a bounce-back from the COVID-19 Recession?

The surge in business applications is unlike the last post-recession recovery and is, therefore, unlikely to be entirely explained by typical business-cycle patterns. Unusually high business failures, commonly seen during business cycle downturns, might be followed by abnormally high business creation as the economy recovers. Figure 1 tracks business applications across two business cycles – the Great Recession and the COVID-19 Recession – and reveals two different recovery patterns. In particular, employment generating business applications were characterized by a slow recovery during the quarters following the Great Recession, whereas we now see a surge in applications in the quarters following the COVID-19 Recession.

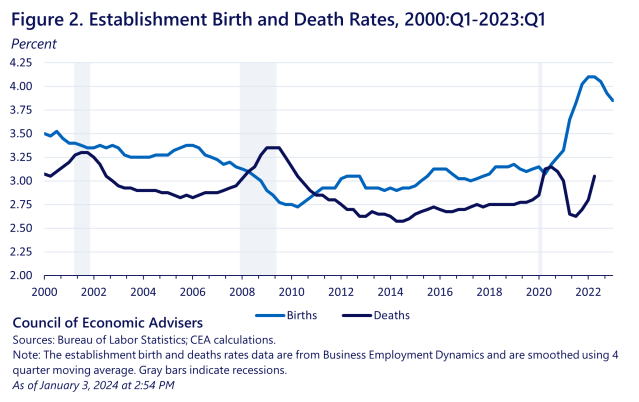

Moreover, alternative measures of business activity also signal robust growth in net-business creation, rather than a renormalization of business activity following the COVID-19 Recession. For example, the dynamics of business establishment births and deaths can provide an early indication of longer run trends in business creation. To this end, Figure 2 plots the establishment birth (light blue) and death rates (dark blue), captured by the Business Employment Dynamics data published by the Bureau of Labor Statistics, for 2000 to 2023. Establishment births accelerated in 2020 and reached an unprecedented 4.1 percent of total establishments in 2022, compared to a birth rate of 3.2 percent in the years between the Great Recession and the COVID-19 Recession. Establishment deaths, on the other hand, followed a similar pattern during the COVID-19 Recession and recovery as in previous business cycles, ranging between 2.6 and 3.1 percent. This has resulted in a wider gap between birth and death rates of establishments over the past three years than compared to the last business cycle and points to a persistent shift towards a high level of new business formation.

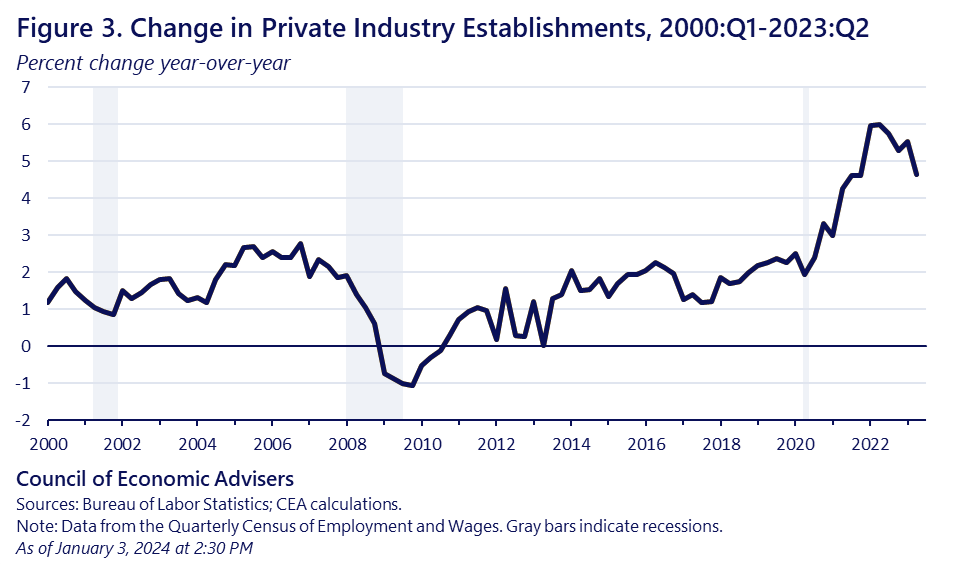

Trends in the number of business establishments over time provide another way to see that there has been a recent surge in the real growth of business formation above and beyond business deaths. Figure 3 reports that the year-over-year change in the number of private industry establishments grew from an annual rate of 1.4 percent between 2000 and 2019 to nearly 6 percent in 2022. In fact, over the past three years, the annual pace of establishment growth (5.4 percent) has been faster than in any single year in the last quarter-century.

Finally, a simple bounce-back story would suggest that a similar number of businesses operate in 2023 as in 2019, whereas accelerated births would lead to growth in the number of businesses. Indeed, establishment counts, which are reported as part of the Quarterly Census of Employment and Wages by the Bureau of Labor Statistics, provide additional external validation of the recent application trends by showing an increase in employment-generating establishments.

Each of the data series shown above are drawn from different surveys and administrative records and suggest that the increase in business applications since the Biden-Harris Administration took office is consistent with a sustained period of elevated business formation that has likely contributed to the strong U.S. labor market, both today and in the future. Recent economic research and popular media have pointed to several forces. For example, the pandemic ushered in new consumption patterns and preferences for work-life balance. In addition, a strong social safety net during this Administration allowed families the freedom to take on risks like starting a new business. These changes, coupled with sustained Federal support for small businesses and entrepreneurs during this Administration, likely presented an opportunity for entrepreneurs to meet these consumer and business needs in new and creative ways. Additional signs point to a more business-friendly economic environment in recent years. For example, minority-owned businesses have made significant gains during this time period, with Black business ownership growing at a faster pace between 2019 and 2022 than at any time during the last three decades. Although the specific economic factors underlying the increase in business activity remain uncertain, the rise in new business formation is an extremely welcome trend, suggesting growing pathways for budding entrepreneurs to pursue their dreams and, at the same time, contribute to job creation.