Real Wage and Income Growth Continue to Support Consumer Spending

Both overall and core PCE price inflation came in at 0.3% in February, according to data out this morning from the Bureau of Economic Analysis. Over the year, inflation by this measure was up 2.5% overall and 2.8% for the core index (which leaves out volatile energy and food costs). Those rates are significantly down from their peaks, by 4.7 percentage points for the overall measure and by 2.8 percentage points for the core. In fact, the 2.8% core rate is the lowest in almost 3 years. CEA’s X thread takes you through these and other highlights of the report.

One remarkable attribute of the current recovery is that disinflation has occurred while maintaining a strong economy and labor market. This combination of lower inflation and a robust economy—we learned yesterday that real GDP grew 3.4% in 2023:Q4—has helped to support real wages and incomes, which in turn supports consumer spending. In February, real consumer spending rose 0.4%, well above expectations for a 0.1% increase.

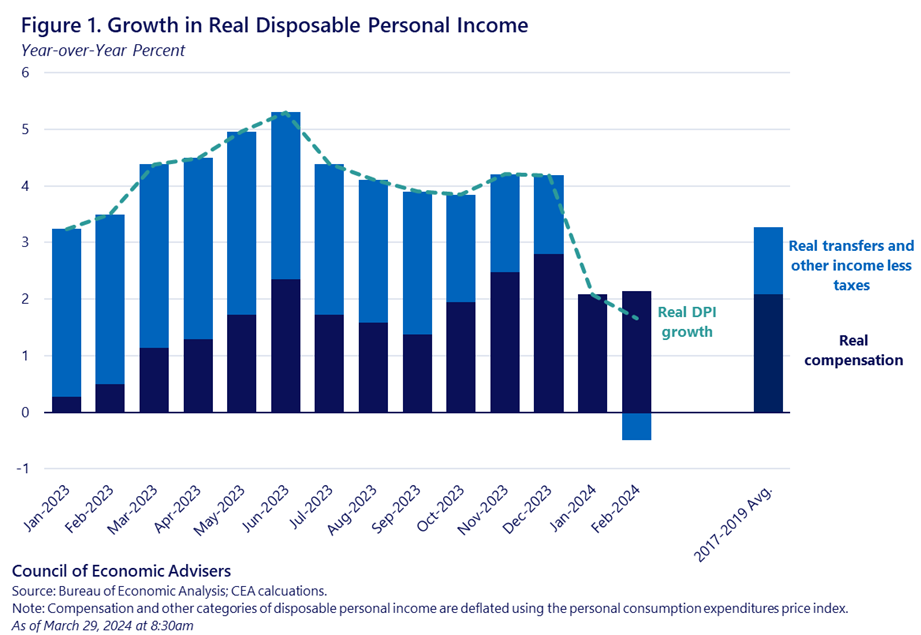

Figure 1 below plots the recent year-over-year growth in real disposable income (real DPI), decomposed into real aggregate compensation (which factors in real wage and job growth) and real transfers and other income (such as from rents or assets) less personal taxes. Figure 1 shows that as pandemic support has faded—shown by the decline in the light blue area—real labor market earnings have picked up some of the slack. In fact, as the bar at the end of the figure shows, the real compensation contribution to real DPI growth is near its pre-pandemic average of around 2%.

Rising compensation and real incomes are, of course, key to living standards. In the current climate, as we work to continue to cut costs, increases in real incomes provide working families with some breathing room. But they’re also important to support consumer spending, which amounts to roughly 70% of GDP. The figure below shows the correlation between yearly growth in real DPI and real consumer spending (both per capita), with the slope of the regression line equal to a statistically significant 0.6.

While the economy can always be exposed to unforeseen shocks that throw an expansion off track, this current growth recipe—strong labor markets and declining inflation, supporting solid wage, income, and spending growth—has helped to reliably propel the U.S. economy forward in recent years. By implementing President Biden’s agenda to lower costs while investing in our future, our team will continue to build on this progress.

As CEA stresses every month, monthly data can be volatile, and are subject to revision. Therefore, it is important not to read too much into any one monthly report, and it is informative to consider each report in the context of other data as they become available.