Direct Pay Through the Inflation Reduction Act

What is Direct Pay (Elective Pay)?

The Inflation Reduction Act introduced and expanded tax credits for clean energy technologies, providing unprecedented policy certainty and opportunity for entities that manufacture, install, and produce clean energy over the next decade. In addition to providing incentives to spur private-sector investment, the Inflation Reduction Act includes game-changing new provisions that will enable tax-exempt and governmental entities—such as states, local governments, Tribes, territories, and nonprofits—to take an active role in building the clean energy economy, lowering costs for working families, and advancing environmental justice.

Thanks to the Inflation Reduction Act’s “elective pay” (often called “direct pay”) provisions, tax-exempt and governmental entities will, for the first time, be able to receive a payment equal to the full value of tax credits for building qualifying clean energy projects. Unlike competitive grant and loan programs, in which applicants may not receive an award, direct pay allows entities to get their payment if they meet the requirements for both direct pay and the underlying tax credit. For more information about using direct pay on projects that are receiving grants and forgivable loans, click here.

Applicable entities can use direct pay for 12 of the Inflation Reduction Act’s tax credits, including for generating clean electricity through solar, wind, and battery storage projects; building community solar projects that bring clean energy to neighborhood families; installing electric vehicle (EV) charging infrastructure; and purchasing clean vehicles for state or city vehicle fleets. See a full list of applicable tax credits for direct pay.

Who is currently eligible for direct pay? What are the benefits?

State, Local, and Territorial Governments

Who is eligible?

- States

- U.S. Territories

- Political subdivisions including cities, counties, municipalities, townships, and villages

- Agencies and instrumentalities of state, local, or territorial governments, including water districts, school districts, economic development agencies, and certain public universities and hospitals

Why apply for for direct pay?

Direct pay can make it easier for local governments to invest in clean energy and can potentially allow them to take on bigger projects faster to demonstrate climate leadership. Deploying more clean energy into local communities advances environmental justice, helps save residents money, cuts harmful pollution, and improves public health.

Example. The City of Vroomville buys a large electric garbage truck for municipal waste collection. Through direct pay, the city can get up to 30% or $40,000, whichever is lower, of the cost of the truck back by using the Commercial Clean Vehicle Credit.

Tribal and Native Entities

Who is eligible?

- Federally recognized Tribal governments, their subdivisions, and their agencies

- Alaska Native Corporations

Why apply for for direct pay?

Direct pay can help Tribes bring clean energy to their communities, providing power and transportation that is affordable, reliable, and resilient in the face of climate-fueled extreme weather. Clean energy cuts harmful pollution, improves public health, and can help Tribes boost their energy sovereignty and independence.

Example. A federally recognized Tribe is planning to build a solar array to power their community center. Through direct pay, the tribe can get up to 30% of the capital cost back under the Investment Tax Credit. On top of that 30%, the Tribe may qualify for an additional 20% off the capital cost under the Low-Income Communities Bonus Credit program, if they apply for and receive an allocation under that program. Additional information on the application process for the Low-Income Communities Bonus Credit Program will be issued later in 2023.

Rural Energy Cooperatives

Who is eligible?

- Any corporation operating on a cooperative basis that works to provide electricity to rural communities

- Tennessee Valley Authority

Why apply for for direct pay?

Direct pay can make it easier for rural electric co-ops to invest in clean energy, create jobs and economic opportunity, and continue to provide affordable, reliable electricity to rural America.

Example. The Geothermica Co-op is finishing construction of a geothermal well to provide electricity to a rural community. Through direct pay, Geothermica can earn up to 2.75 cents per kilowatt-hour of electricity produced from the geothermal well using the Production Tax Credit. Because Geothermica Co-op is located in an energy community, it is also eligible for an additional 10% increase for the Production Tax Credit through the Energy Communities Bonus Tax Credit.

Other Tax-Exempt Entities

Who is eligible?

- 501(c)(3) organizations such as public charities, private foundations, schools, hospitals, houses of worship, and others

- Religious or apostolic 501(d) organizations

- All other organizations exempt under section 501(a) of the tax code

Why apply for for direct pay?

Direct pay can help nonprofits afford to install clean energy, which can help them reduce their own energy use and save money so they can spend more resources on their mission. Nonprofits can also become local climate leaders by using their property to generate clean electricity that benefits their neighbors through technologies like community solar.

Example. EcoRun, a 501(c)(3) nonprofit, has a large roof on its headquarters, and wants to install solar panels to supply electricity to the building. Through direct pay, EcoRun can get up to 30% of the installation cost back under the Investment Tax Credit—or more if it is eligible for bonus credits.

Please consult the IRS website for a complete list of eligible entities.

How do I apply for direct pay?

Entities wishing to claim direct pay need to complete the following steps:

Confirm that the clean energy project you’re building or want to build qualifies for one of the IRA tax credits that are applicable for direct pay. You will need to obtain all necessary documentation for any tax credits and bonuses you want to claim. In general, Treasury and the IRS do not provide personalized tax advice on whether a specific organization’s project or activity is eligible for a tax credit. For more information about clean energy tax credits, visit IRS.gov/Cleanenergy. You may also choose to consult with a tax advisor.

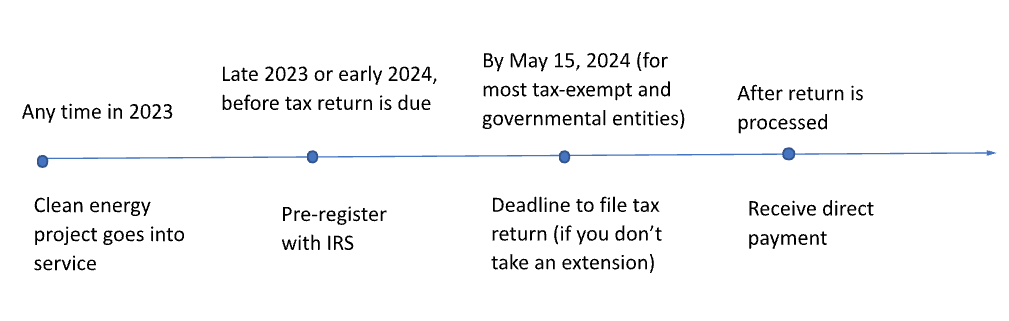

You can only use direct pay after you earn the tax credit. For Investment Tax Credits, you earn the credit during the tax year that your clean energy project is placed in service. In many cases, the tax year corresponds to the calendar year—so if your project is coming online in 2023, your tax year is also often 2023. More information on determining your tax year is available here.

For most tax-exempt and governmental entities, the return for a taxable year is due 4.5 months after the end of that taxable year. For example, if your tax year is the calendar year, and your project is coming online in 2023, your tax return will be due by May 15, 2024. Those without a filing requirement can also receive an automatic 6-month extension.

You’ll need to register with the IRS and receive a registration number before you can file a tax return and receive payment. In general, each registration number corresponds to one clean energy property in one tax year—you will need to renew the number if you need to use it in other tax years. During the pre-registration process, you will need to provide information about your organization, the credits you want to earn, and your eligible clean energy project in an online portal. More information about pre-filing registration will be available by late 2023.

You’ll need to provide your registration number and make the elective payment selection on your tax return (typically a Form 990-T for most entities that don’t normally file a tax return). You also need to provide additional required documentation and underlying credit forms when you file your return. You can find more filing tips for tax-exempt organizations here.

In general, payments occur after your return is successfully processed. Under the statute, organizations aren’t entitled to the direct payment until the due date of the return. You will receive the payment either electronically or via mail.

Here’s a sample timeline for claiming direct pay for most organizations with a calendar tax year*: