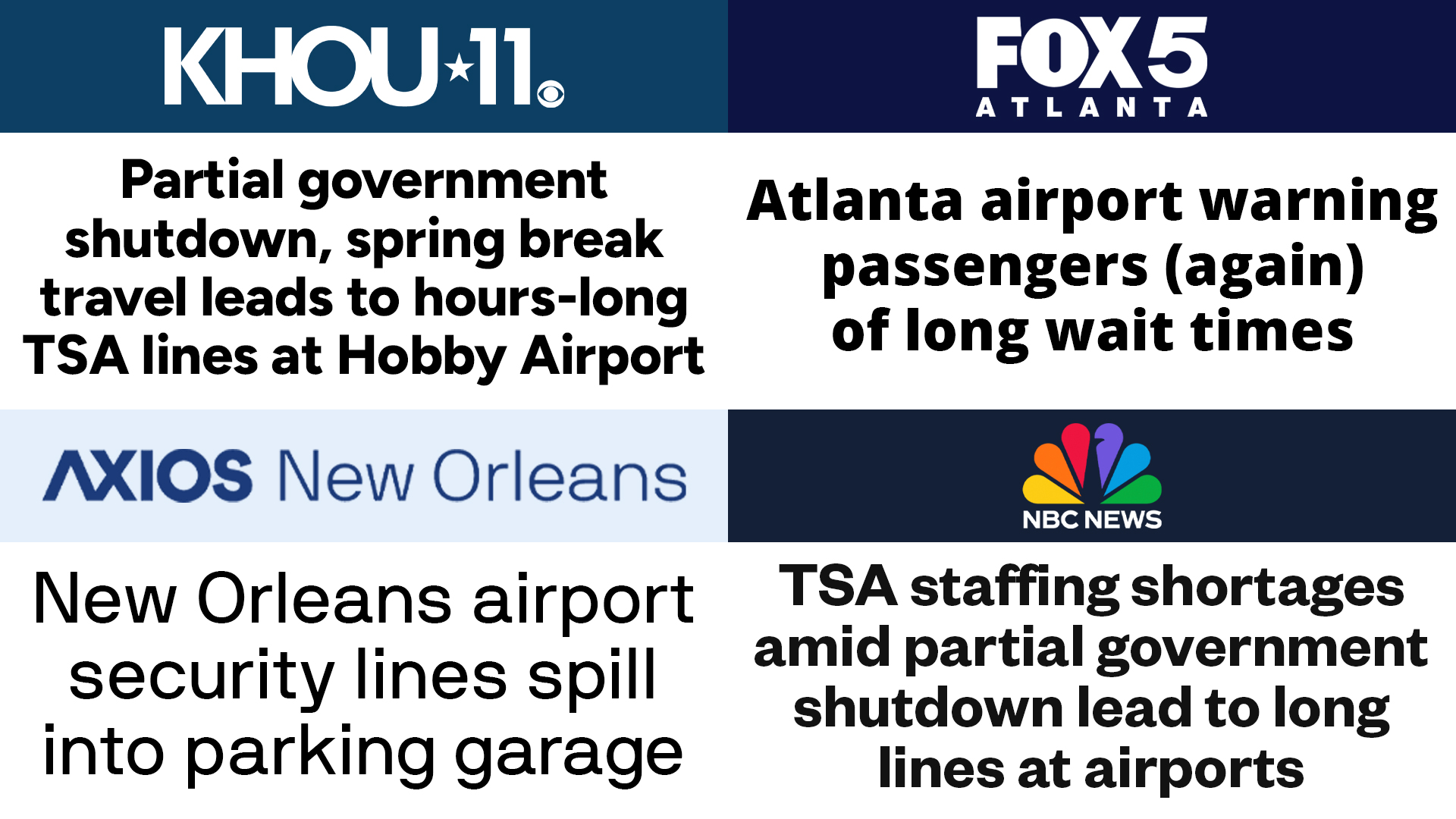

Democrats’ Reckless DHS Shutdown Hits Americans Hard as 100,000+ Workers Go Without Pay

As Radical Left Democrats drag the Department of Homeland Security shutdown into its 24th day, everyday Americans are paying the price. Now, as TSA officers work without paychecks for the third time in nearly six months, crippling staffing shortages and hours-long security lines are gripping airports as millions of families head out for spring break.

The chaos unfolded this weekend at airports across the country:

- “There’s been a lot of frustration. A lot of people are very upset,” said a traveler at William P. Hobby Airport in Houston — where TSA wait times neared four hours.

- “This is ridiculous. This is crazy. We get here, we go through Customs — and it’s so packed in here, you can’t even find the direction they’re trying to give,” said a traveler at Louis Armstrong New Orleans International Airport — where lines snaked through multiple floors and spilled into the parking garage.

- “It’s the longest I’ve ever seen it. I’ve flown into Atlanta several times, and this is by far the longest I’ve ever seen it in my life,” said a traveler at Hartsfield-Jackson Atlanta International Airport — where passengers were met with mounting wait times and ground delays.

- “We’re fed up. We’ve had enough. This is the third shutdown in a matter of six months,” said a 10-year veteran TSA officer in Phoenix.

It’s not just airports reeling from the effects of the Democrat Shutdown. Democrats have cut off resources and funding for FEMA, the U.S. Coast Guard, and thousands of federal law enforcement officers — jeopardizing America’s border security, maritime safety, and ability to respond to emergencies.

Americans’ safety and security are on the line each day the Democrat Shutdown continues. Democrats negotiated a bipartisan, full-year DHS funding bill — then walked away from the table, choosing illegal aliens over public safety and forcing these essential workers to serve without pay yet again.

Radical Left Democrats must stop playing politics with our homeland security.