Federal Income Support Helps Boost Food Security Rates

By Chair Cecilia Rouse and Brandon Restrepo

Hunger is an ongoing challenge in the United States, particularly in times of economic distress. U.S. food assistance programs are countercyclical and help stabilize the U.S. economy when it experiences a contraction.

In this blog, we provide analysis showing that the activation of pandemic relief programs was followed by improvements in food security among households that experienced financial hardship since the pandemic began. Likewise, as relief has subsided, hunger is now on the rise, demonstrating that the Federal government plays a critical role in helping needy families avoid food insecurity.[1] Fortunately, additional aid to families is imminent through the expansion of the Child Tax Credit (CTC), which policymakers expect will once again help reduce food insecurity.

Background

Upon its arrival, the novel coronavirus delivered a rapid and significant blow to the U.S. economy and workforce, immediately sparking a hunger crisis across the nation. Research from Northwestern University’s Institute for Policy Research indicates that in April 2020, when the effects of the pandemic took hold, the overall household food insecurity rate doubled relative to the rate that researchers predicted for March 2020.[2] This was especially true among households with children—a vulnerable population whose food insecurity rate jumped to a level that was three times higher in April 2020 relative to the predicted March 2020 food insecurity rate. Children did not just face food insecurity at home; with school closures, many lost access to free or reduced-price school meals.

Government aid helps decrease food insecurity rates in times of economic stress

While nongovernmental hunger relief organizations can and do significantly help to ensure that families meet basic needs during economic downturns, their support cannot substitute a robust response by a more resourceful public sector during major public health emergencies. The Federal government has a greater ability to marshal available resources and better coordinate actions across the nation than the nonpublic sector can do on its own. The public sector can, therefore, play an important role in promoting the food and nutrition security of needy families during tough economic times, which serves to complement and enhance the charitable actions of nonpublic actors.

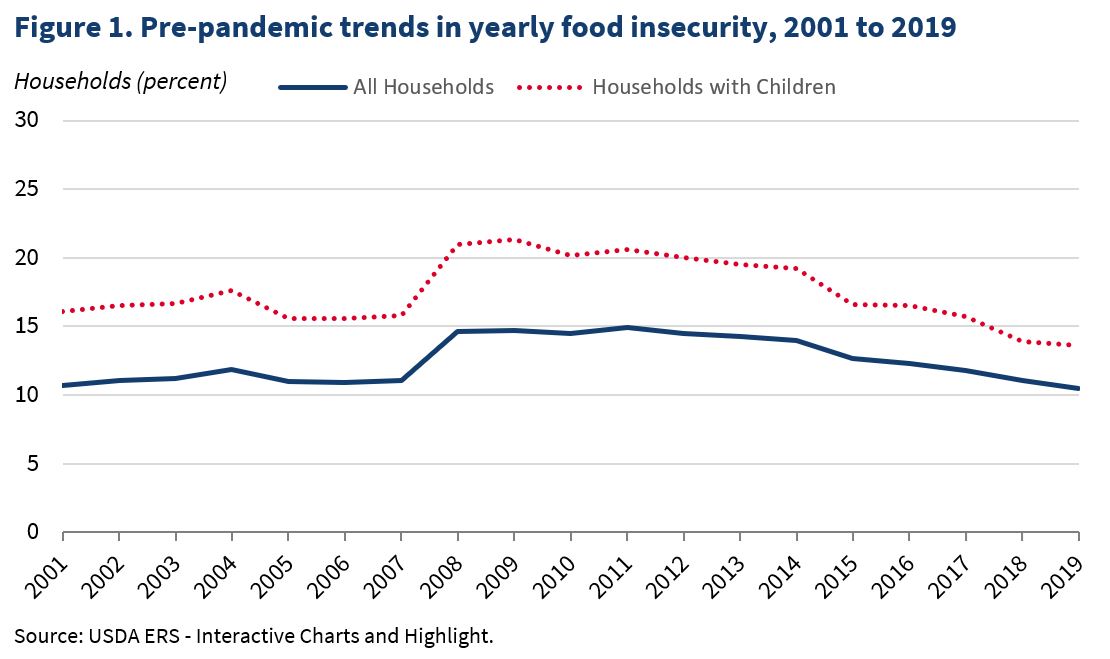

The idea that government aid in times of economic distress helps reduce hunger is not new. For example, according to the USDA’s Economic Research Service, yearly household food insecurity rates spiked at the onset of the Great Recession (Figure 1). Yet when the federal government increased Supplemental Nutrition Assistance Program(SNAP) benefits with the American Recovery and Reinvestment Act of 2009, food spending increased, and food insecurity rates in the low-income population fell. Moreover, the aid had a positive multiplier effect on GDP, which in turn supported additional jobs.

In the decade following, food insecurity dropped as the economy improved. Indeed, while 14.7 percent of households were food insecure in 2009, the food insecurity rate dropped to 10.5 percent in 2019. Over the same decade, the improvement was even larger among households with children: food insecurity dropped by almost 8 percentage points, from 21.3 percent to 13.6 percent.

The same pattern has held during the COVID-19 pandemic. After the pandemic struck and hunger went up dramatically, there were temporary reductions in food insecurity rates following the passage of the CARES Act in March 2020—when the first round of stimulus checks were released to many Americans. Food insecurity rates increased again in the fall and winter of 2020 as COVID-19 cases climbed and Federal aid waned. Starting in January 2021, food deprivation started to decrease again as a second round of stimulus payments were sent out under the Consolidated Appropriations Act of 2021[3]. A third infusion of cash made its way to households under the American Rescue Plan Act of 2021, with checks going out starting in March 2021.

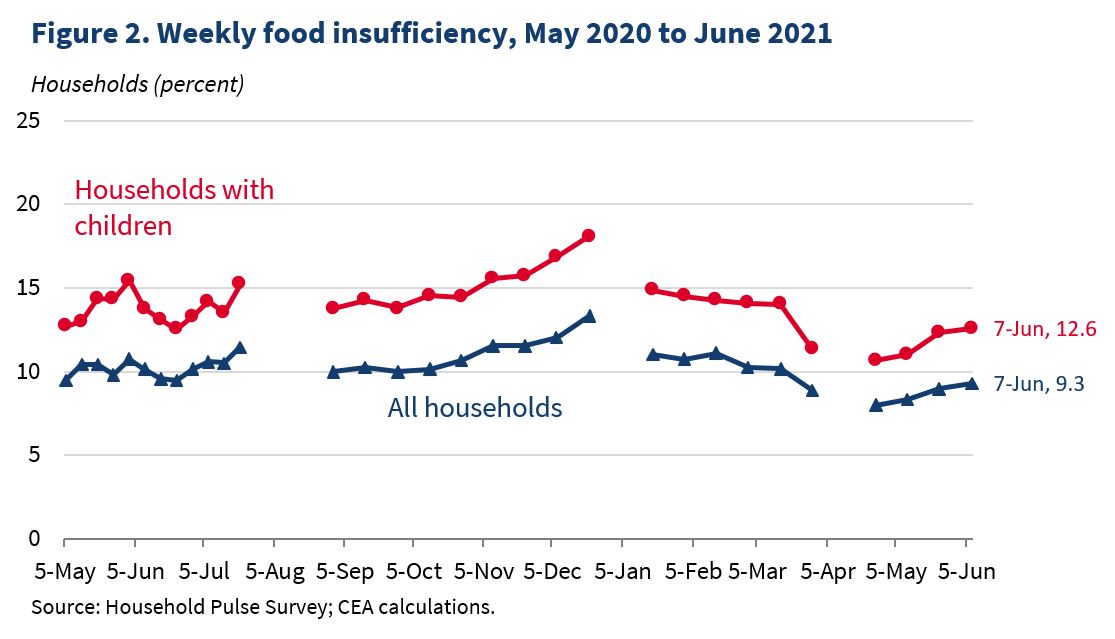

The food insufficiency rate for households overall reached 8 percent in mid-April 2021 (Figure 2),[4] which was the lowest point recorded during the pandemic, and more than 5 percentage points lower than the peak in food insufficiency seen in mid-December 2020. Over that same period, the decrease in food insufficiency among households with children—from 18 percent to 11 percent—was even more substantial.

According to near real-time survey data from the Census Bureau, the number of households reporting that they sometimes or often did not have enough food to eat in the past week fell by 4.5 million from mid-December 2020 to early June 2021. About half of this reduction (2.3 million) occurred among households with children. With Federal aid payments now decreasing, however, it is not surprising that food insecurity is again on the rise (Figure 2).

Personal income data from the Bureau of Economic Analysis (BEA) provide suggestive evidence that the patterns in Figure 2 are at least partially attributable to personal income effects from Federal income support programs. BEA found there was a 10 percent increase in personal income from December 2020 to January 2021, and a 21 percent increase from February 2021 to March 2021. The decreases in food insufficiency in January and troughs in April shown in Figure 2 are consistent with positive personal income effects on food adequacy. Similarly, data from BEA that showed month-to-month decreases in personal income in April 2021 and May 2021, may help to explain the upward tick in food insufficiency rates starting in mid-April 2021.

Both the improvements and declines in food adequacy can be attributable to a multitude of factors. But, the analysis presented below suggests that elevated income support by the Federal government has played an important role in reducing food hardship; additionally, a fall in support—at a time when pandemic-related economic hardships have not ended—has arguably led to an increase in food insecurity.

New analysis of pandemic relief on food insecurity

In 2021 thus far, two pieces of legislation aimed at reducing economic hardship have been enacted. First, the Consolidated Appropriations Act of 2021 provided a round of Economic Impact Payments (EIP)—one-time $600 direct cash payments (known as stimulus checks) for qualifying adults and children—that were officially disbursed to the majority of Americans on January 4th, 2021. On March 11, 2021, President Biden signed a second piece of legislation, the American Rescue Plan Act of 2021 (ARP), which provided even larger one-time stimulus checks—$1,400 for qualifying adults and children—that were officially disbursed on March 17, 2021.

Research from the University of Michigan’s Poverty Solutions shows that food insufficiency dropped in the months after the two COVID relief bills were signed, especially for lower-income households. Below, we explore the potential hunger-reducing impacts of the stimulus checks with a more nuanced analysis to see if there is indeed solid evidence that food adequacy rose as a result of the income support provisions in the two COVID relief bills.

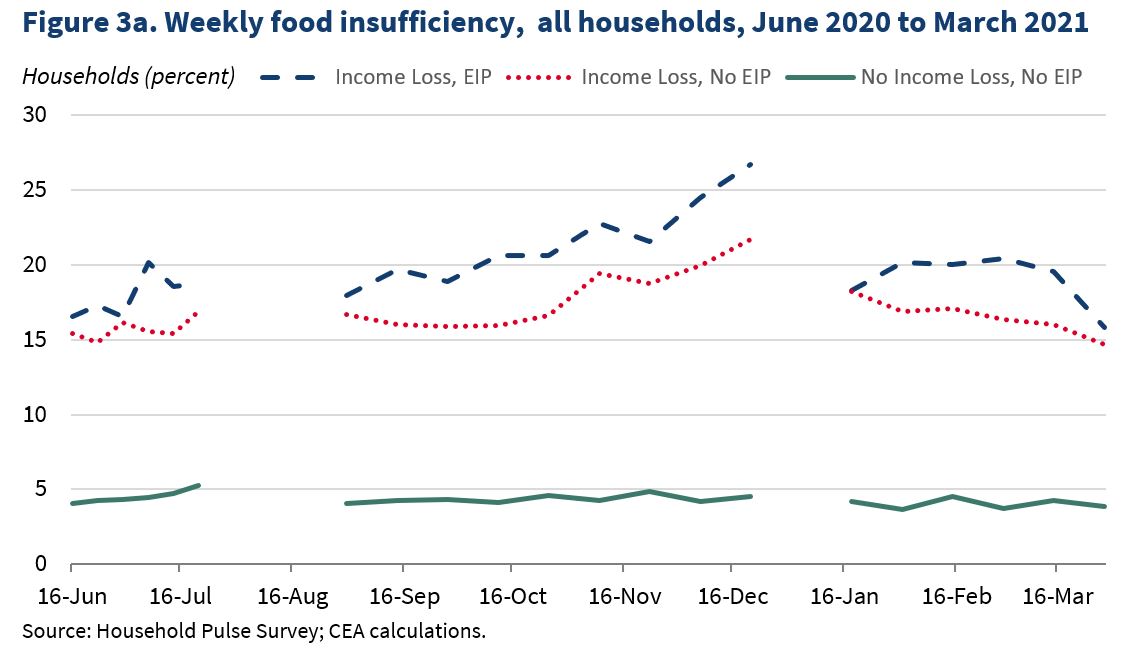

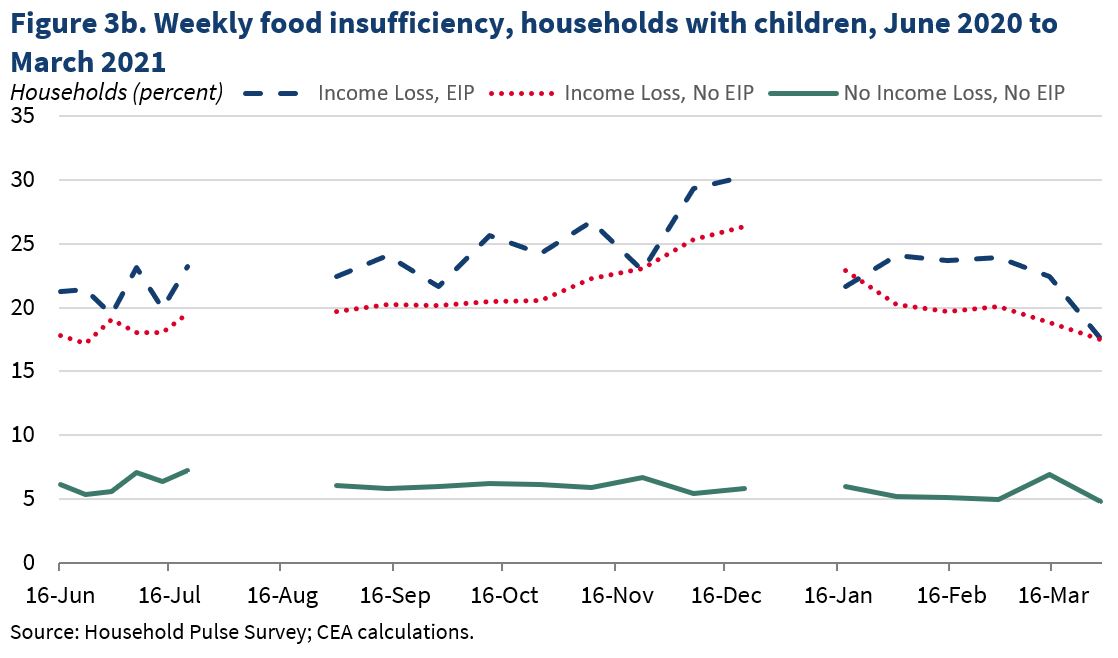

For each survey period from June 2020 to March 2021, Figures 3a and 3b plot trends in food insufficiency rates for three groups of households[5]: 1) Those that experienced a loss of employment income in the household since March 2020 and used EIP funds in the past week to meet spending needs (“Income Loss, EIP”); 2) Those that experienced a loss in employment income from March 2020 onwards but did not use stimulus check funds in the previous week to meet spending needs (“Income Loss, No EIP”); and 3) Those that experienced no loss in employment income in the household since March 2020 and did not use stimulus check funds in the previous week to meet spending needs (“No Income Loss, No EIP”).[6]

Food insufficiency rates for the last group of households—those that neither experienced a loss in employment income, nor relied on stimulus checks in the past week to meet their spending needs—were relatively stable throughout the study period. The smaller variation in food security over the course of the COVID-19 pandemic is not surprising, since these households likely experienced less pandemic-linked financial instability.

By contrast, food insufficiency rates for households that had experienced a loss of employment income and relied on stimulus checks in the past week to meet their spending needs were generally increasing from June to December 2020. Their food insufficiency rates then fell dramatically from December 2020 to January 2021. The approximately 8.5 percentage-point drop in food insufficiency rates occurred among all households (including those with children), which suggests that adults and children alike benefitted from boosting the income of financially strained households. In particular, food insufficiency rates dropped to 18 percent for households overall and 22 percent for households with children, from mid-December 2020 rates of 27 percent and 30 percent, respectively. Food insufficiency rates for these households reached their lowest points at the end of March 2021 (16 and 18 percent, respectively), which is the first survey period after the ARP stimulus checks were distributed.

From December 2020 to January 2021, food insufficiency rates also fell for households that lost employment income, but did not make use of an EIP to meet their past-week spending needs. However, these drops in food insufficiency rates were much smaller—roughly a third of the size—than the drops seen among the households that experienced a loss in employment income and did spend out of EIP funds in the past week. It is important to note that while these improvements in food adequacy may be explained by the use of EIP funds greater than a week prior to the survey, EIP fund usage beyond the past week is not captured in the data.

Establishing causality running from EIP spending to food hardship is difficult but, taken together, the patterns observed in the data after both official stimulus check disbursement dates strongly suggest that income support through the Federal government’s EIP program deserves at least partial credit for improvements in food security seen after January 2021.

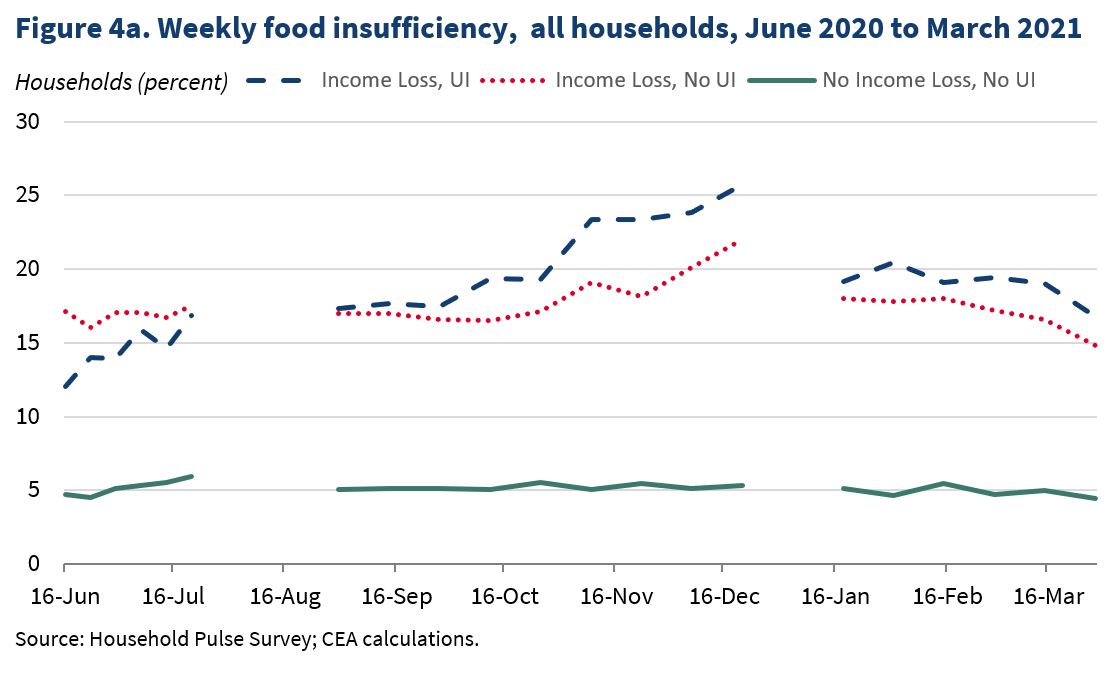

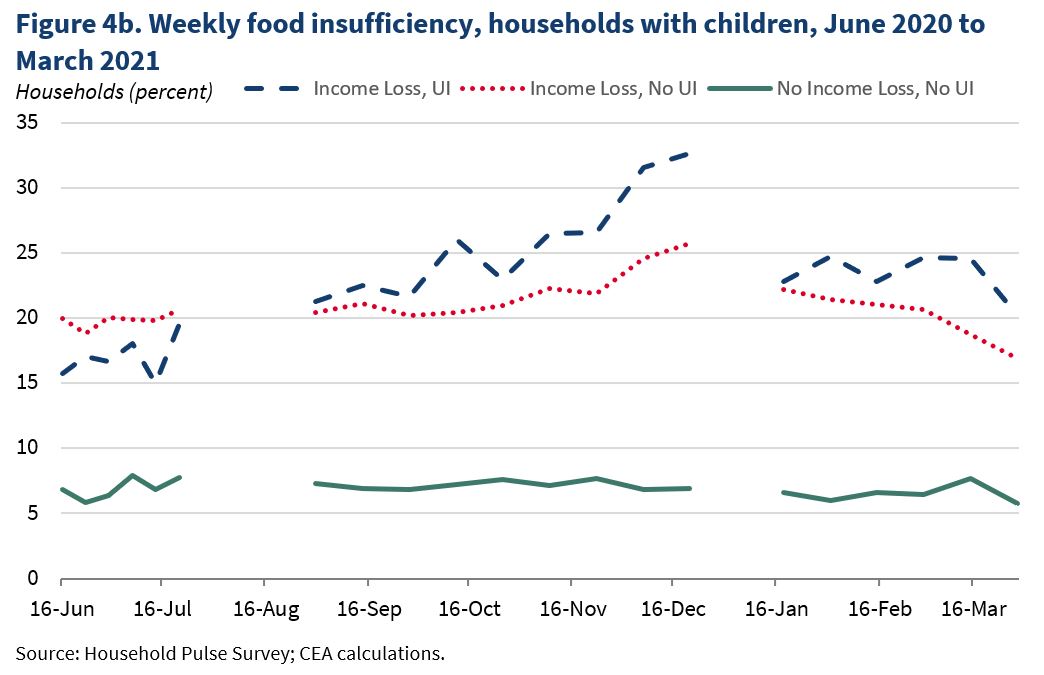

The Consolidated Appropriations Act of 2021 also provided supplemental unemployment insurance (UI) benefits ($300 per week) until March 2021, which was further extended by the ARP through September 2021. We now explore the potential effect of UI benefits on hunger in an analysis similar to the one performed above. Figures 4a and 4b plot trends in food insufficiency rates for the following three groups of households: 1) Those that experienced a loss of employment income in the household since March 2020 and used UI benefits in the past week to meet spending needs (“Income Loss, UI”); 2) Those that experienced a loss in employment income from March 2020 onwards, but did not use UI benefits in the previous week to meet spending needs (“Income Loss, No UI”); and 3) Those that experienced no loss in employment income in the household since March 2020 and did not use UI benefits in the previous week to meet spending needs (“No Income Loss, No UI”).

The patterns in Figures 4a and 4b are similar to the ones presented in Figures 3a and 3b and thus lead us to draw similar conclusions.

Compared with other households, those that relied on UI benefits to meet their past-week spending needs show steeper increases in food insufficiency rates after the $600 Federal UI benefit boost expired in July 31, 2020, showing even sharper drops in January 2021. In January 2021, the $300 UI benefit boosts began to roll out across U.S. states, which suggests that, like the Federal EIP program, the extra aid paid out to beneficiaries of the Federal UI income support program also helped to reduce food hardship.

Looking forward: food insecurity again on the rise

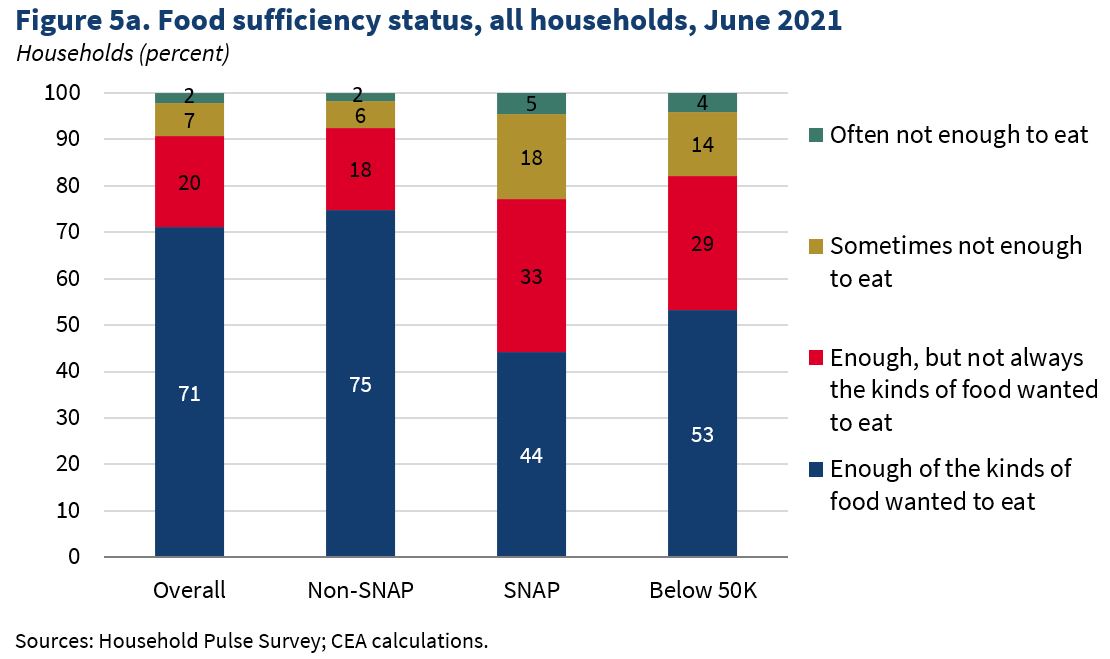

With the ending of the ARP stimulus monies, food insecurity rates are again increasing. Indeed, the latest Household Pulse Survey data from May 26 to June 7, 2021 indicate that a significant share of the U.S. population is still currently not eating enough. Overall, almost 1 in 10 households (9 percent) said that they sometimes or often did not have enough food to eat in the household over the past week (Figure 5a).

Rates of food insufficiency are higher among lower-income households (those with incomes below $50,000)[7] and higher still for those who are receiving SNAP benefits—a particularly vulnerable low-income subpopulation. Among those receiving SNAP benefits, over 3 in 20 households (18 percent) reported sometimes not having enough food to eat, and 1 in 20 households (5 percent) reported often not having enough to eat.

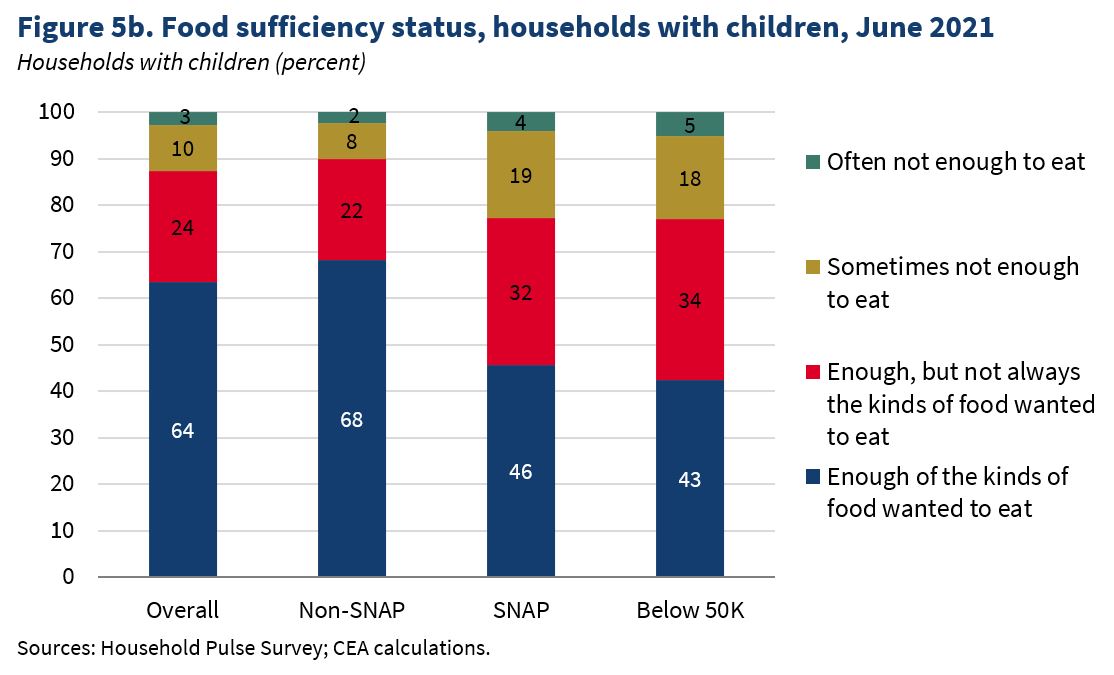

Figure 5b presents similar data, but focuses on households with children. Among SNAP households with children, the share that reported they sometimes or often did not have enough food to eat in the past week was almost twice as high (23 percent) as households overall (13 percent).

Policymakers expect the ARP Child Tax Credit (CTC) payments—due to begin in July 2021 for nearly all working families and almost 9 in 10 children—will have the same effect as the prior Federal aid for those who receive them.

Under the new law, the maximum CTC in 2021 is $3,600 for children under the age of 6 and $3,000 per child for children between ages 6 and 17.[8] A total of 66 million children in the U.S. will benefit from the CTC expansion, which is the largest contributor to the ARP’s projection to this year lift 5 million children out of poverty and cut child poverty by more than 50 percent. Starting next month on July 15th, about 39 million U.S. households will begin automatically receiving advance monthly payments to help with monthly expenses as the U.S. economy continues to improve. Through these advance monthly payments, U.S. households will receive up to 50 percent of the total CTC amount until next tax season, when households can claim the other half.

Research has shown that the Earned Income Tax Credit (EITC) program, which also benefits many households with children, is associated with more food spending and greater spending on healthy foods, such as fresh fruits and vegetables during the months when EITC refunds are paid out. These findings suggest that, while food insufficiency has ticked upward since mid-April, the forthcoming monthly payments from the CTC should help to further promote food and nutrition security among households with children.

Conclusion

People living in every part of the American landscape—cities, towns, rural communities, and tribal lands—have suffered adverse consequences associated with the COVID-19 pandemic. The beginning of the pandemic-induced recession was deep and caused food hardship to increase dramatically across America.

To promote a robust economic recovery, the Federal government helped needy families through multiple Federal income support programs—including stimulus checks and supplemental UI benefits. The analysis presented in this blog shows that the extra Federal aid was followed by marked improvements in food security among households that had experienced financial hardship and were reliant on those funds to meet their basic spending needs.

While there have been substantial gains in America’s fight against the pandemic-induced hunger crisis, more is clearly required to further reduce food deprivation as the U.S. economy recovers from the COVID-19 pandemic shock—particularly when it comes to hunger experienced by lower-income households with children. The Household Pulse Survey data from the Census Bureau indicate that many U.S. households are still deprived of adequate food, particularly among lower-income households with children. Moreover, after decreasing for many months this year from January to March, food insufficiency rates started increasing in mid-April, with a pronounced increase among households with children. These increases may be partly due to households depleting their one-time stimulus payments, as well as reductions in payments from the Pandemic Unemployment Compensation program. Taken together, these patterns signal the need for more action from the Federal government to provide additional hunger relief to families in need. Programs such as the expansion and extension of the CTC in the ARP, the proposed expansions of the CTC, as well as other programs to address food insecurity in the American Families Plan, have the potential to provide an important lifeline to the most vulnerable families and communities.

[1] Households are considered to be food insecure if, during a certain period of time (e.g. past month or past year), they are uncertain of having—or unable to acquire—enough food to meet the needs of all their members because they had insufficient money or other resources for food.

[2] March 2020 food insecurity data were not available, so the researchers calculated what they expected the food insecurity rate to have been based on the March 2020 unemployment rate.

[3] This Act was passed and signed into law in December 2020, with checks distributed in early January 2021.

[4] Food insufficiency is a measure of food adequacy that is related to the concept of food insecurity, although food insufficiency is closer in severity to very low food security than to overall food insecurity.

[5] Figure 3a focuses on households overall, while Figure 3b focuses on households with children.

[6] This analysis is restricted to this period because the Census Bureau did not collect information on whether households lost employment before June 2020 or after March 2021.

[7] This analysis does not adjust for family size.

[8] For the year 2021, the ARP also provides additional economic relief for those without qualifying children, by almost tripling the maximum EITC for these households from $543 to $1,502.