Unsnarled Supply Chains Appear to Help Ease Goods Inflation

The global pandemic and Russia’s invasion of Ukraine contributed to a protracted period of supply chain disruptions that coincided with high price pressures concentrated in goods sectors. As global supply chains have gradually recovered from pandemic-era and commodity market disruptions, there has been a clear cooling in the inflationary pressures on core goods, even as we still have further work to do on overall inflation. This blog post further explores these recent developments.

The onset of the pandemic in early 2020 caused a large, negative shock to both supply and demand. In the scramble to socially distance, producers slowed production while at the same time consumers slowed spending, especially for services, giving birth to the deep, pandemic-induced recession. Thanks in part to savings from this foregone spending as well as strong fiscal support, aggregate demand quickly recovered, but the supply shock persisted. Global supply chains, which rely on the smooth functioning of suppliers, producers, and transporters across many countries, were particularly affected by rolling international lockdowns and other COVID-related issues.

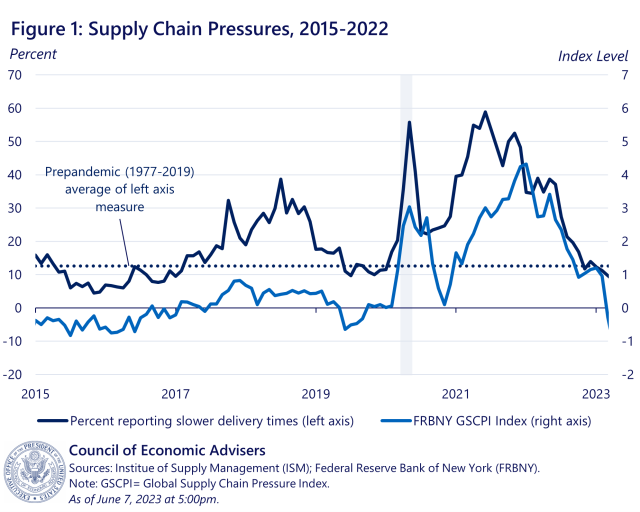

Figure 1 plots the share of respondents in the Institute of Supply Management Manufacturing Survey who report slower delivery times compared to the previous month (left axis) and the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index (right axis), a composite series that incorporates the ISM survey and the HARPEX index of shipping costs. The ISM Survey series reached an all-time high in May 2021, and remained above its prepandemic average from January 2020 to September 2022, a record duration. In a strong sign of supply chain normalization, the ISM Survey measure has stayed below its prepandemic average since December 2022.

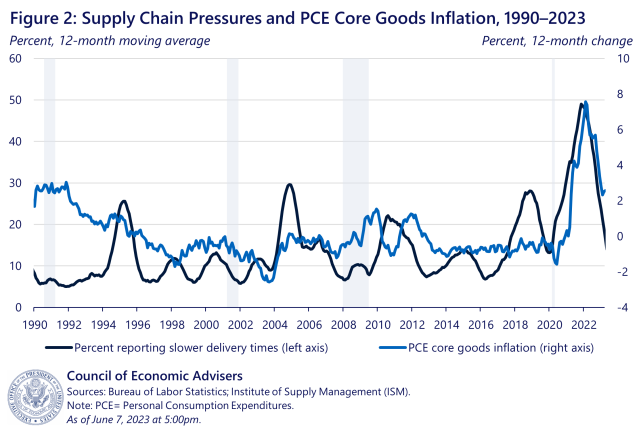

Figure 2 plots the 12-month moving average of ISM survey respondents who report slower delivery times against the 12-month change in the PCE Price Index for core goods. The two series are usually weakly correlated, but their correlation jumps to 0.9 when the sample is restricted to the last five years and the ISM measure is lagged by six months. The year-over-year Personal Consumption Expenditures (PCE) Price Indexes for food, energy, and goods overall have been declining since their peak in the summer of 2022.

Supply chain measures tend to be even more correlated with the price indices that capture input prices, such as the Producer Price Index (PPI) for intermediate core goods. The most recent PPI report shows that prices in many categories are moderating, including several months of low or negative price growth in various goods price indices such as food and transportation. Although one month of data can be noisy and overall inflation remains elevated relative to prepandemic levels, observed declines across many different goods inflation measures are a positive development for consumers. Moreover, while correlation is not causation, the high correlation between PPI and supply chain pressures suggests that the easing we are seeing in supply chains may continue to show up in measures of inflation.

Because supply chain measures reflect the flow of goods, they are less correlated with the services component of inflation. For example, inflation in PCE non-housing core services has remained elevated in recent months and is unlikely to be resolved by lessening supply chain frictions alone. But as supply chains have normalized, goods inflation has also trended downward, helping to provide some much-needed breathing room for American consumers.