Protecting Competition Through Updated Merger Guidelines

Introduction

Competition is imperative to the functioning of product, service, and labor markets. The Council of Economic Advisers has repeatedly outlined the economic evidence supporting this thesis—describing how competition benefits workers, consumers, and businesses.

Over the past decade, as markets have become more concentrated across a wide array of industries, academic studies have documented a number of concerning trends across the broader macroeconomy. For example, since the 1990s, corporate profits as a share of GDP and the economywide ratio of markups to costs have both increased. Meanwhile, the share of GDP accruing to labor has fallen, especially in highly concentrated industries. By one estimate, since 2000, rising markups have led labor income to fall by more than $1.4 trillion. When markets become less competitive, businesses can exert their market power to extract greater profits from consumers while also offering lower wages to workers.

At the same time, the U.S. economy has evolved, particularly due to a number of significant technological developments. The 2023 Economic Report of the President documents how technological advancements and the widespread adoption of internet-based technologies have propelled digital two-sided platform markets—where an intermediary business (the “platform”) brings together buyers and sellers, such as on a ride-sharing or restaurant delivery app—to become nearly omnipresent in the lives of consumers and business owners. These developments raise new concerns for antitrust enforcement.

The United States’ primary antitrust enforcement authorities—the U.S. Department of Justice and the Federal Trade Commission (“the agencies”)—regularly update their framework for evaluating mergers based on the evolving nature of the economy, advances in the field of economics, and the experience of antitrust enforcement. Now, as called for by the President in the Executive Order on Promoting Competition in the American Economy, the agencies reviewed their Guidelines and have proposed edits to make sure that the legal profession, business community, and broader public understand how the agencies’ thinking reflects current economic evidence and the realities of the market.

Revised to Reflect Shifts in Economic Understanding and Economic Conditions

Mergers can bring about a number of benefits, including lower costs or increased innovation. At the same time, some mergers harm competition, which in turn may lead to increased prices, reduced quality, or lower wages. Recent papers on hospitals, home appliances, and beer all find substantial increases in the price of consumer goods following a merger or a joint venture. In addition to the price effects, certain anticompetitive mergers can also disrupt or stifle innovation. For example, one paper documents the rise of acquisitions in the pharmaceutical space which appear to be for the purpose of eliminating potential future rivals while discontinuing their innovative projects.

Another advancement in the economics literature is the development of a significant body of evidence showing that market power has negative effects on wages and working conditions. This is known as “monopsony power” because there is a single or limited number of employers in the market. Multiple studies have quantified the effects of market power and reduced competition arising from monopsonistic labor markets in industries like healthcare.

Much of the aforementioned research has been published since the Horizontal Merger Guidelines were updated in 2010. Based on this more recent evidence, the new draft Guidelines provide clarity around how the agencies are considering the competitive effect of mergers.

Addressing mergers in concentrated industries

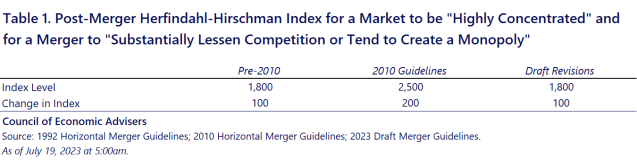

All else equal, courts and the agencies are more concerned about mergers in already concentrated markets. This is because the harm caused by a loss of competition is likely to be more acute in markets where there are already few other participants. In order to quantify the concentration in a market, the agencies and the courts have generally relied on the Herfindahl-Hirschman Index—the higher the index, the more concentrated a market, and the larger the change in the index due to the merger, the more likely it might be to cause harm. In 2010, the agencies increased the thresholds at which they began to consider a market “highly concentrated” as well as what change in index driven by the merger would cause them concern, effectively allowing more mergers to proceed. The draft Guidelines would restore both values to the pre-2010 levels.

Considering series of acquisitions by dominant firms

The draft Guidelines make it clear that the agencies consider mergers in the context of the broader market and trends, rather than assessing each merger in isolation. For example, they describe how the agencies may examine mergers in the context of the firm’s broader merger activity—e.g., patterns of serial acquisitions. In addition, the draft Guidelines outline how agencies consider acquisitions by a dominant firm of potential future competitors.

Examining platform competition

The draft Guidelines explicitly address platform economics—where a firm operates in a two-sided market by facilitating economic activity between two other parties—and the potential for firms to entrench themselves. A rising share of the economy involves platform markets, from purely digital services like social media to traditional services that have been reimagined like ride-hailing. While these kinds of platforms are not new, their rising importance and the widespread collection of data to power them justifies a more explicit treatment of how related mergers may be assessed.

Accounting for monopsony power, especially in labor markets

While businesses are generally thought of as sellers in the marketplace, they often also function as buyers. For example, they may purchase inputs from upstream firms or operate as “buyers” in the labor market. In these cases, firms may benefit from uncompetitive markets if they operate in “monopsonistic” (as opposed to monopolistic) markets. A broad base of economic literature has outlined the adverse effects that arise from monopsonistic markets. The agencies historically have protected competition by enjoining mergers deemed to be anticompetitive between competing buyers, though the draft Guidelines now explicitly spell out how the agencies think about mergers that may substantially lessen competition for workers.

Together, these proposed updates reflect an evidence-informed understanding of the complex competitive effects that may arise from mergers. These draft Guidelines outline how the agencies are conducting merger review within the context of broader markets, taking into consideration the role of dominant firms, entrenched market positions, platforms, and monopsony power.

Revised to Ensure Accessibility

Antitrust law is complex, which can leave businesses unclear about the basic rules governing market structure and competition. Market participants need clear guidance so they can make informed investment decisions. And providing clarity on the rules that govern the playing field can reduce a barrier to firm entry. Clear, accessible guidelines ensure that any business—especially a young or small firm—is able to understand the rules. To that end, the draft Guidelines now:

Use more straightforward language

The expanded overview section gives more background for readers who are not already antitrust practitioners, and the core of the document now outlines the agencies’ thinking on antitrust enforcement in simple and straightforward language. Many of the technical details that dominated the 2010 Guidelines have been moved into a series of appendices as an additional resource.

Provide the relevant case law

Throughout the draft Guidelines, the agencies clearly and explicitly reference the relevant court decisions that inform their approach, connecting those decisions to the analytic frameworks described in the Guidelines. This legally binding precedent provides important context for understanding how the agencies approach merger review.

Combine Guidelines for horizontal and vertical mergers

Historically, antitrust practitioners have often distinguished between “horizontal” and “vertical” mergers. The former is typically used to refer to mergers between companies that directly compete for the same consumers (e.g., two firms that both sell personal computers). The latter refers to mergers in which one of the companies supplies inputs for the other (e.g., a soda company acquiring an upstream firm that supplies aluminum cans). In practice, many firms produce multiple products and have many different kinds of relationships, making it difficult to categorize any particular merger as only one or only the other. The draft Guidelines describe the beginning of a merger analysis as a question that applies to both horizontal and vertical mergers: “How does competition present itself in this market and might this merger risk lessening that competition substantially now or in the future?”

Conclusion

Since they were first published in 1968, the Merger Guidelines have outlined the law and economics behind how the United States’ antitrust enforcement authorities review transactions in order to protect competition. While they are non-binding, these Guidelines provide clarity to a broad audience about which types of mergers may substantially lessen competition in a way that would harm other market participants, including workers and consumers. Over time, as the economics literature expands, the legal precedents develop, and the U.S. economy evolves, these Guidelines are updated to reflect the agencies’ thinking on merger enforcement.

Since the beginning of his administration, President Biden has affirmed a commitment to promoting competition as a core pillar of his economic agenda. Today, the Department of Justice and Federal Trade Commission have released a draft of the updated Merger Guidelines, a key resource for the public to better understand how the U.S. antitrust enforcement agencies are protecting competition across the U.S. economy. The goal of this update is to make the Guidelines easier to understand while ensuring that they reflect the best available economic thinking and evidence. At the same time, these draft Guidelines are not yet final; over the next 60 days, the agencies will once again solicit comments from the public to ensure that the Guidelines best serve their purpose in communicating the agencies’ approach to protecting competition.