Early Signs That Bidenomics is Attracting New Foreign Investment in U.S. Manufacturing

There has been a sharp increase in U.S. construction spending for manufacturing facilities, with real manufacturing construction doubling since the end of 2021 (Treasury 2023).

Moreover, while prior analysis has shown evidence of this increase, in this post, we focus on the international dimension, with an emphasis on foreign direct investment in new facilities on U.S. soil. The increased investment is welcome news for future potential output in the U.S. manufacturing sector and various commentators have linked this manufacturing construction boom and President Biden’s Investing in America (IIA) agenda (e.g., Krugman 2023, Brusuelas 2023). Part of the IIA agenda is intended to crowd in private investment (see Boushey 2023) to support the reinvigoration of America’s manufacturing sector—especially in sectors like semiconductors and clean energy technologies—and includes historic legislation like the Bipartisan Infrastructure Law, CHIPS and Science Act, and Inflation Reduction Act. The sheer scale and pace of America’s manufacturing construction uptick is unique compared to similar indicators from other advanced countries like Germany, Japan, Australia, and the United Kingdom, lending support to the IIA’s role as a prominent driver for U.S. trends (see Figure 1) (Treasury 2023).

Foreign investors are contributing to the increase in U.S. manufacturing construction through investments that will support expanded manufacturing capacity.

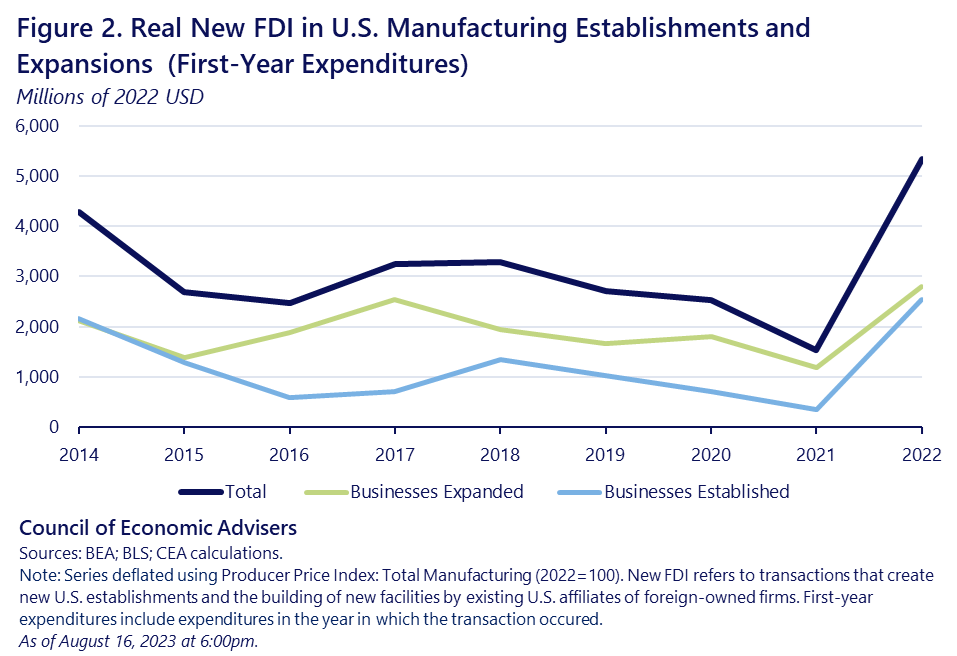

The Bureau of Economic Analysis’s Survey of New Foreign Direct Investment (FDI) in the United States identifies capacity-expanding transactions that create new U.S. establishments and the building of new physical facilities by existing U.S. affiliates of foreign-owned firms, as well as other transactions from foreign investors for new acquisitions of U.S. businesses.[1] Most new foreign direct investment is associated with investors based in close trading partner countries. Looking across all transactions in 2022, over 85 percent of transactions are associated with European investors (57 percent, with the United Kingdom accounting for 20 percent of the total on its own); Canadian investors (21 percent); and Japan, Singapore, and South Korea (collectively, around 9 percent). Chinese investors account for less than ½ a percent of the 2022 total. Figure 2 zeroes in on transactions in the manufacturing sector, showing reported FDI data for new manufacturing establishments and expansions (i.e., isolating capacity-expanding FDI by excluding acquisitions) and limiting the sample to only first-year project expenditures (i.e., expenditures in the year in which the transaction occurred).

Last year’s new foreign direct investment in U.S. manufacturing was almost double its prepandemic average level.

FDI in new U.S. manufacturing production capacity increased 247 percent from 2021 to 2022, reaching $5.3 billion and reversing a multi-year downward trend that began in 2019. Compared to prepandemic (2014-2019) average expenditures, 2022 outperformed by a factor of 1.7—almost double. New establishments and expansions of existing affiliates contributed roughly equally to the 2022 increase in new manufacturing FDI. While small relative to overall FDI inflows and overall U.S. manufacturing investments, the directional trend is encouraging and is also reflected in other series—including planned expenditures.[2]

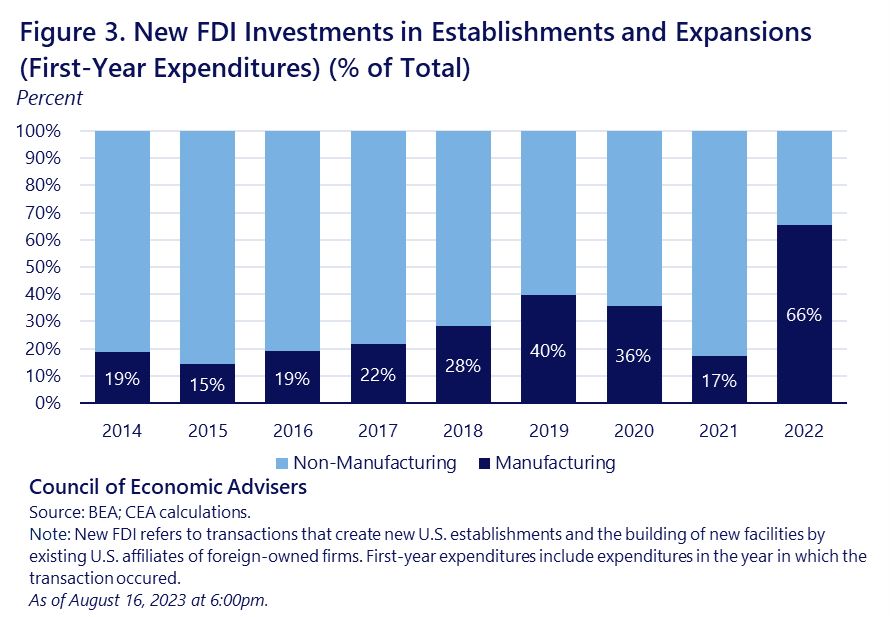

In 2022, first-year expenditures for new foreign direct investments in establishments and expansions were concentrated in U.S. manufacturing.

Manufacturing represented 66 percent of total 2022 new FDI (Figure 3).[3] The concentration of new FDI investments in manufacturing is a marked deviation from prior years when the share of manufacturing averaged less than one third of totals from 2014 to 2021. Within the manufacturing sector, capacity-expanding computer and electronic products investments (which includes semiconductor manufacturing) were amongst the largest at $1.8 billion in 2022 (BEA 2023). Looking at speculative planned investment expenditures, the increase in capacity-expanding FDI in the computer and electronics sector is striking, rising from $17 million in 2021 to $54 billion in 2022 in real terms and representing roughly two-thirds of 2022 planned capacity-expanding manufacturing FDI.[4]

The increase in capacity-expanding foreign investments can help support a reinvigoration of America’s manufacturing sector and the broader economy.

Foreign capital investments help to expand the productive capacity of the economy and FDI can also contribute to higher wages and productivity, including via potential spillovers to other domestic firms in the same sector (Keller & Yeaple 2009; Hale & Xu 2020). Moreover, foreign investors provide intangible assets like technological knowledge transfer and exposure to alternative management practices. Federal government initiatives like the Department of Commerce’s SelectUSA—which facilitates greater FDI in the United States by showcasing its attractiveness as a market for doing business—can help encourage the continuation of these welcome trends.

[1] CEA uses data from the survey of new FDI in the United States because they provide relatively transparent indicators of FDI that is likely to contribute directly to expanded production capacity. The survey picks up investment transactions with a value of over $3 million where a foreign person (in the broad legal sense, including a company) owns, directly or indirectly, 10 percent or more of the voting securities of an incorporated U.S. business enterprise or an equivalent interest of an unincorporated U.S. business enterprise (BEA 2018). Alternative metrics, like the BEA’s U.S. International Financial Transactions for Direct Investment, can be a noisy proxy for identifying foreign investments that directly support new productive capacity and include a whole host of transactions like acquisitional equity, reinvested earnings that can be used for normal business operations or other acquisitions, intercompany debts, and miscellaneous fund transfers.

[2] While more speculative, FDI data on new planned manufacturing investment expenditures paint a similar picture, with 2022 seeing a large spike and reaching $80 billion. Planned total expenditures include first-year and anticipated expenditures for all investments until completion, as well as expenditures from past years. Traditional FDI inflow statistics on manufacturing FDI transactions, also deflated using the producer price index, point a moderate recovery of inflows in 2021 and following a multi-year declining trend that began in 2016; 2022 inflows, while lower than 2021, were still above their 2019 level.

[3] Specifically, $5.3 billion of $8.1 billion in total 2022 first-year capacity-expanding investment spending, which fell from its 2021 total level of $8.9 billion, in real terms.

[4] As above, deflated using manufacturing producer price index (2022=100).