The Employment Situation in August

Payrolls were up by 187,000 last month, slightly above market expectations of 170,000. The unemployment rate rose from 3.5 percent to 3.8 percent, making this the 19th month in a row with the jobless rate below 4 percent. Today’s report is consistent with an economy that is transitioning to steady and stable growth, an important and necessary deceleration that is helping to ease price pressures while maintaining a strong labor market.

Unemployment may rise for two primary reasons in the monthly jobs report. It could be that more workers lost than gained jobs (a fall in the employment-to-population ratio). Alternatively, more people could have come into the labor market looking for work, a more positive source of a higher unemployment rate (a rise in the labor force participation rate). In August, the 30 basis point increase in the unemployment rate was entirely due to the latter factor, as over 700,000 entered the labor force and the participation rate increased to a new post-pandemic recovery high of 62.8 percent. In contrast, the employment-to-population ratio remained flat in August.

Job gains in June and July were revised down by a total of 110,000, a large but not unprecedented two-month revision. Because these monthly data are noisy and subject to revisions, CEA finds that we can more effectively pull the signal from the noise if we average over a few months. Over the past three months, payrolls were up by 150,000 per month.

The three month average gain of 150,000 jobs is spot-on-consistent with our expectations at this stage of the current recovery, as stated by no less than our forecaster commander-in-chief, President Biden, from a May 2022 op-ed :

WITH THE RIGHT POLICIES, THE U.S. CAN TRANSITION FROM RECOVERY TO STABLE, STEADY GROWTH AND BRING DOWN INFLATION WITHOUT GIVING UP ALL THESE HISTORIC [LABOR-MARKET] GAINS. DURING THIS TRANSITION, GROWTH WILL LOOK DIFFERENT. WE WILL LIKELY SEE FEWER RECORD JOB-CREATION NUMBERS, BUT THIS WON’T BE CAUSE FOR CONCERN. RATHER, IF AVERAGE MONTHLY JOB CREATION SHIFTS IN THE NEXT YEAR FROM CURRENT LEVELS OF 500,000 TO SOMETHING CLOSER TO 150,000, IT WILL BE A SIGN THAT WE ARE SUCCESSFULLY MOVING INTO THE NEXT PHASE OF RECOVERY—AS THIS KIND OF JOB GROWTH IS CONSISTENT WITH A LOW UNEMPLOYMENT RATE AND A HEALTHY ECONOMY.

Second, consider the number of jobs each month that would need to be added to maintain constant unemployment and participation rates from month to month, given expectations of population growth. As the CEA noted on Twitter, “100,000 jobs a month is roughly consistent with steady unemployment & participation.” (Readers can use this excellent Atlanta Fed calculator and enter their own assumptions.) The fact that the labor market is beating that breakeven number is one reason the unemployment rate has stayed so low during this expansion.

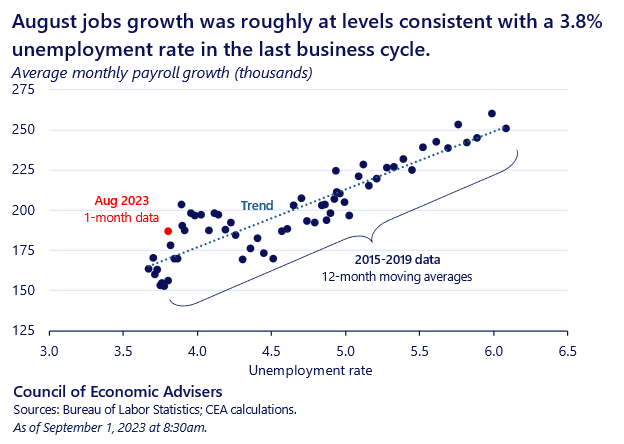

Third, we revisit a scatterplot wherein each dot represents the intersection of average monthly payroll gains (y axis) and the 12-month moving average of the unemployment rate (x axis) from a similar point during the last business cycle (2015-2019) to avoid pandemic distortions. The intuition behind the positive slope of the regression line is the same as in the President’s op-ed: as labor market expansions age, unemployment falls as does the average number of monthly job gains. Note that the red dot, representing today’s report, is close to the regression line, another reminder that the underlying pace of job growth is sustainable and what we would expect.

This transition to steadier, more stable growth is showing up in other important indicators as well. Real second quarter GDP was revised down from 2.4 percent to 2.1 percent, still a perfectly solid growth rate, but closer to the economy’s underlying trend. We also learned earlier this week that job vacancies fell by 338,000 in July, a month when unemployment was 3.5 percent (it is, of course, much better for workers to experience job market cooling through fewer vacancies versus actual job losses). According to yesterday’s Personal Income report, personal consumption expenditures (PCE) inflation grew at a 2.1 percent annualized rate over the past three months, a rate close to that measure’s prepandemic trend.

Equally important to these stabilization dynamics is the increase in labor supply. As noted, the overall participation rate rose in August to a new pandemic recovery high, and the prime-age rate (25-54 year-olds) ticked up as well. At 83.5 percent, it is half a percentage point above its prepandemic level. Increasing labor supply is an important piece of the puzzle, supporting a strong, growing labor market and economy while making sure employers have the supply of workers they need to grow and prosper.

Our goal is to maintain the gains we have made while continuing apace on the transition to steady, stable, and sustainable growth. And, of course, the CEA will be carefully tracking the dataflow to gauge the extent to which these rates slow down and speed up, as any one month can go either way. But for now, as we like to quip here at the CEA: the trend is our friend, and a fine friend she is!