Ten Charts That Explain the U.S. Economy in 2023

The US Economy defied expectations in 2023. Many forecasters predicted a recession at the year’s outset, some even asserting it with a 100% probability. This blog post highlights ten trends that capture some of the most important economic developments of the past year. Taken together, they depict an economy characterized by robust growth driven by strong consumer spending backed by robust and steady job growth, growing real wages, and historic gains for women and Black workers. At the same time, the data show that the historic public investments that make up the Biden-Harris Administration’s economic agenda in critical sectors for future growth, resiliency, and security are beginning to come to fruition. Nevertheless, there is more work to do to lower costs for American families and ensure Americans feel the benefit of continued real wage growth, a strong labor market, and declining inflation.

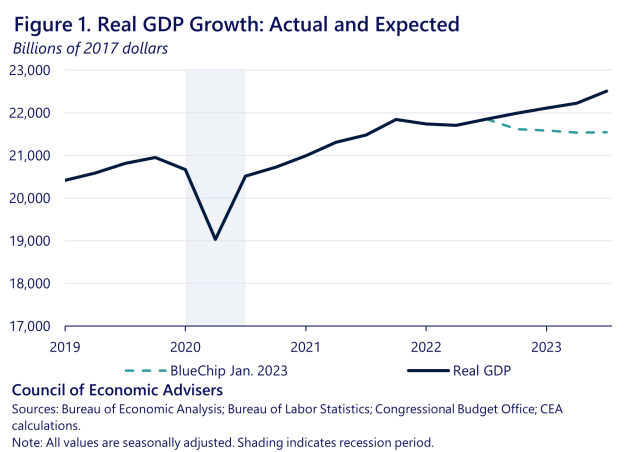

Growth was stronger than expected a year ago.

Defying pessimistic forecasts, US economic growth has progressed at a significant pace over the course of 2023. Last December, the private consensus for real economic growth as measured by the Blue Chip Economic Forecast was negative 0.1% for the year. The latest Blue Chip projection for 2023 growth, incorporating all available data to date, is positive 2.6%, driven by strength in consumer spending, a revival in manufacturing structures investment and increased state and local government purchases. The level of US real GDP in 2023 even exceeded some pre-pandemic forecasts, including that of the Congressional Budget Office and the International Monetary Fund. Sound household balance sheets and a strong labor market are the primary drivers of US consumer expenditures, which continue to grow at a pace close to the average among prior expansions.

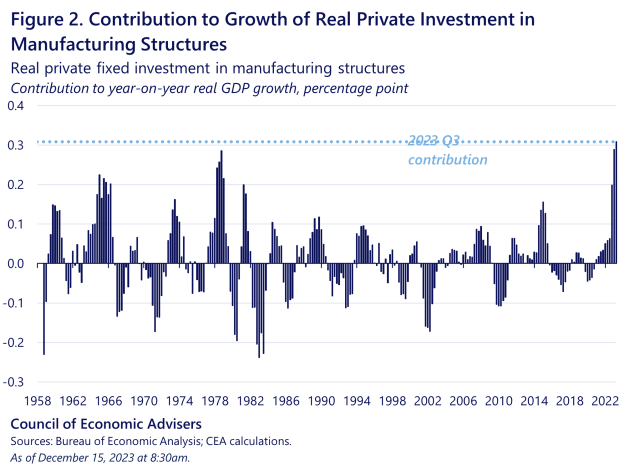

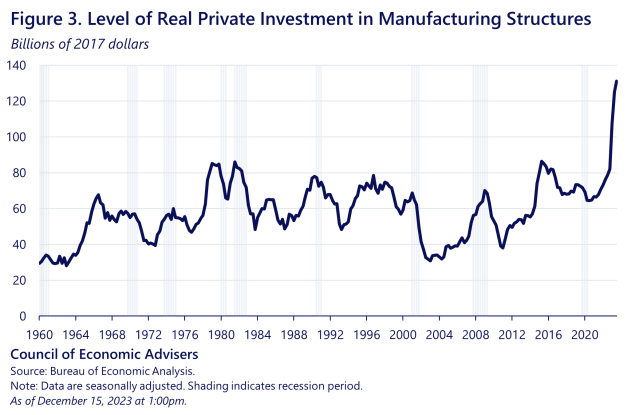

Manufacturing investment reached historic highs.

In 2023 Q3, real (inflation-adjusted) private manufacturing construction investment reached its highest level on record since 1958. Likewise, manufacturing construction contributed the most to year-on-year real GDP growth on record. A major factor in this historic manufacturing boom has been the Inflation Reduction Act.

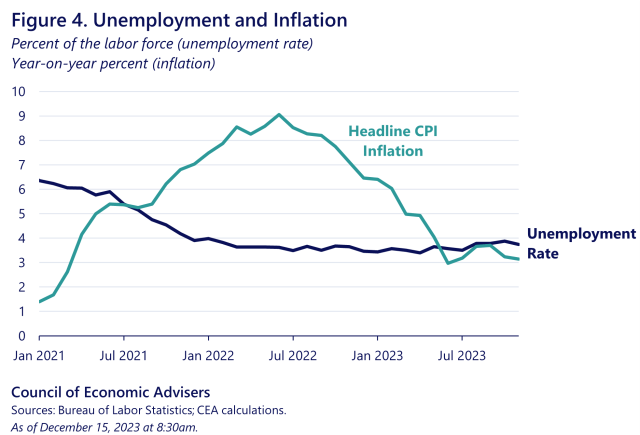

Jobs growth cooled towards a steady & stable pace, while the unemployment rate stayed low despite falling inflation.

Job gains continued at a very strong pace in 2023, although down from the torrid rates seen in 2021 and 2022 immediately following the pandemic recession. Monthly nonfarm payrolls grew by 232,000 per month on average in 2023, 55,000 more jobs per month than the average pace in 2018 and 2019. As a result, total job gains achieved under the Biden administration reached 14.1 million through November 2023. Meanwhile, the unemployment rate has, to date, stayed below 4% for 22 straight months, a run not seen in more than 50 years. This is especially remarkable given the fall in inflation.

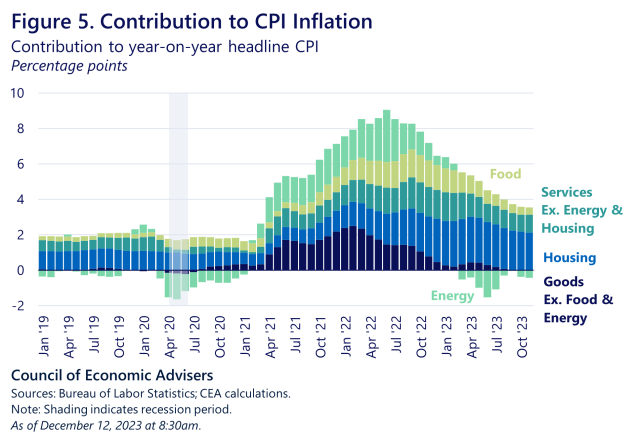

Inflation decelerated throughout the year

After peaking in summer 2022, inflation has been on a downward trend for a year and a half thanks to a retreat of food, energy, and goods inflation. Inflation in the services sector—which heavily depends on wages as labor is the most important cost in the production of services— has decelerated more slowly and in lockstep with a gradual moderation of wage inflation. Meanwhile, market data on new leases suggest that housing price pressures should continue to ease.

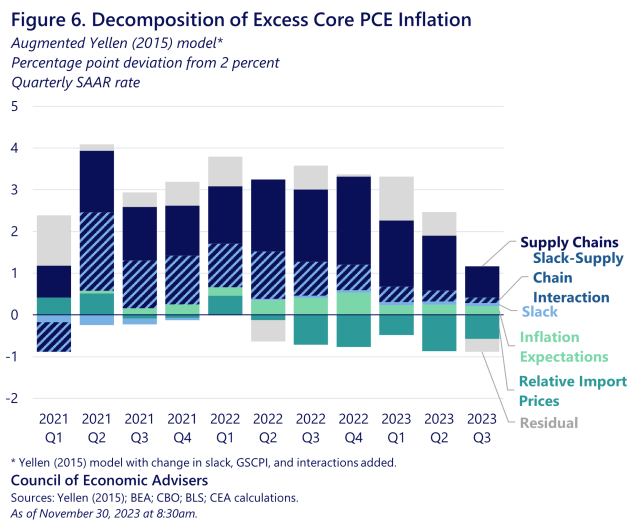

…in large part thanks to healing supply chains.

As CEA has highlighted, the rise and subsequent fall of inflation during the pandemic was overwhelmingly linked to supply-side forces, including the unsnarling of global supply chains and the rise in prime-age labor force participation. Our analysis finds that the unsnarling of supply chains, either by themselves or in tandem with cooling demand, explain 80 percent of the disinflation that has occurred thus far. In fact, one of the most important economic developments of the year was the achievement of significantly lower inflation without a substantial rise in the unemployment rate.

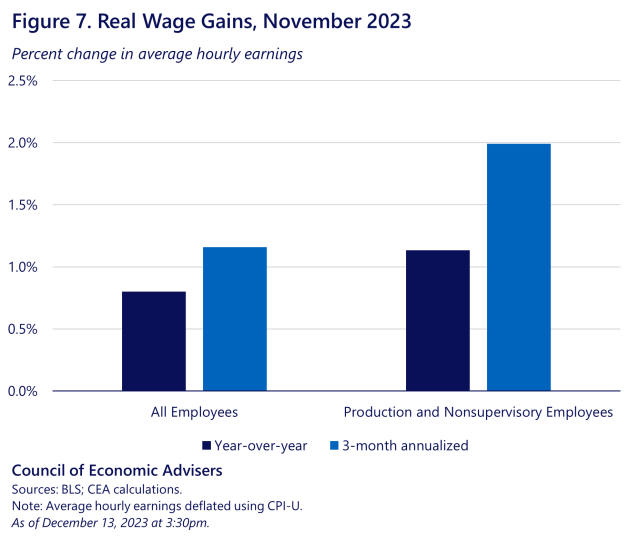

Real wages grew and wage inequality fell.

Real wages began to grow in 2023 as inflation fell from its 2022 peak and workers received robust nominal wage gains. In the year ending in November, real wages grew by about 0.8 percent for all workers and 1.1 percent for the 80% of workers who are production and non-supervisory workers. Further, wage inequality fell. The ratio of wages at the 90th percentile compared to the 10th percentile fell by nearly 6 percent over the year. One reason to continue to be optimistic about this trend in 2024 is the historic union activity and wins in 2023. Strong unions help grow the economy by reducing inequality and raising incomes.

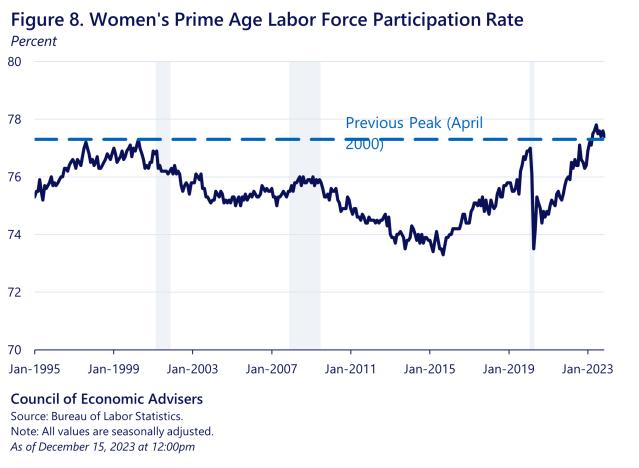

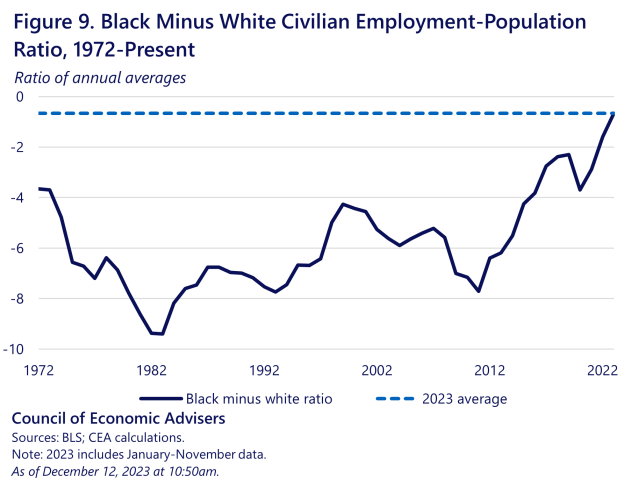

Women and Black Americans made historic gains in the labor market.

The year 2023 saw the highest rate of prime-age women participating in the labor force on record since 1948. The previous high of 77.3 percent in April 2000 has been surpassed in each of the last eight months. The record labor force participation of this group has served to boost incomes of American households and keep consumer spending strong.

In 2023, the economy achieved the smallest gap on record between the employment rates for Black versus white American workers, averaging–0.7 percentage point. The strong economy fostered by President Biden’s economic policies reduced some long-running inequities in the labor market and squeezed this gap to its lowest level on record.

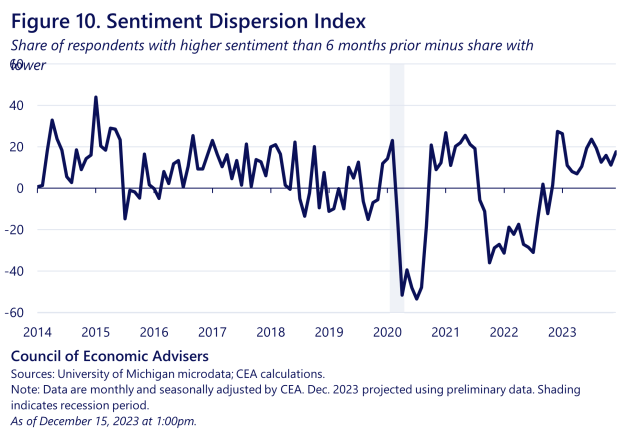

Consumer sentiment improved in 2023.

With more work to do on lowering costs, consumer sentiment has further room to grow. However, 2023 saw momentum in the recovery of consumer attitudes. One way to see this is by tracking the same workers over time in the University of Michigan Survey of Consumer Sentiment. Figure 10 shows the difference between the share of respondents who report higher sentiment than they did six months prior and those who report lower sentiment over the same period. Values greater than zero indicate that more respondents are reporting improved sentiment over the period versus a decline in sentiment. Throughout 2023, the net share of respondents reporting higher sentiment than they had 6 months prior reached between 10-20 percentage points, a level of momentum historically associated with robust economic growth.