A Strong Year for the Labor Market

With this morning’s employment report for December, we now have data for the full year of 2023, enabling comparisons of calendar year trends (for a deep dive into the monthly numbers, see our X thread).[1] The year 2023 was a strong year for jobs, labor supply, and wage growth. Combined with the past few years, the data reveal a uniquely strong labor-market-bounce-back from the pandemic-induced recession. Here are some of the key comparisons.

2023 was a year of…

Strong Job Gains

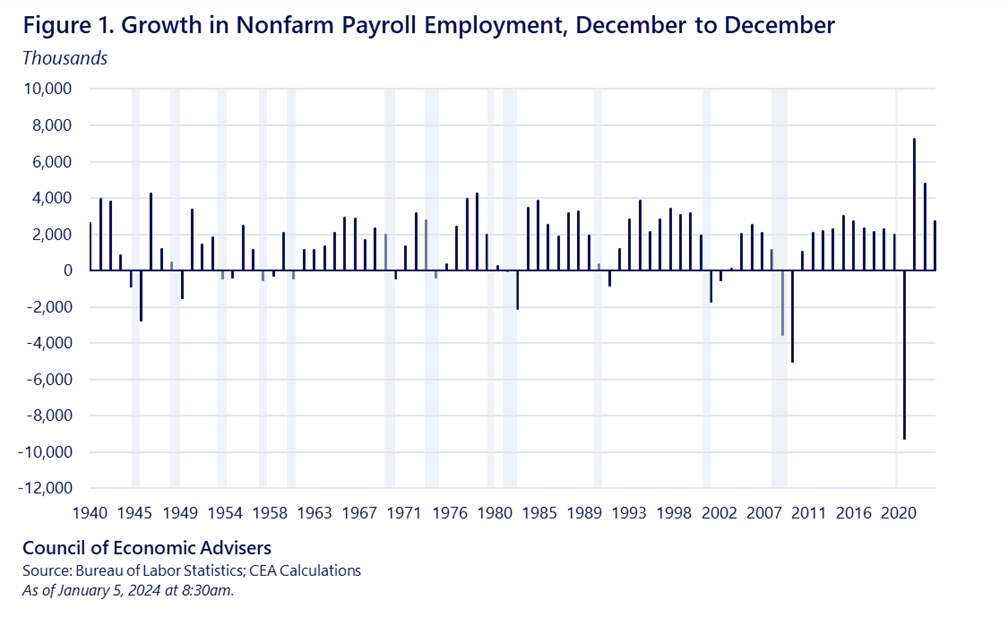

Last month, payrolls were up 216,000 and the unemployment rate held steady at 3.7 percent. From December 2022 to December 2023, payrolls grew by 2.7 million, or an average of 225,000 per month. This average is a strong number for this stage of the jobs’ recovery, well above the so-called breakeven level of about 100,000, (the number of new jobs needed to hold the unemployment rate steady given labor-supply growth). Second, as Figure 1 shows, yearly job gains over the past three years reveal a steady downshift from the breakneck pace of job gains of 2021 to a more steady, stable pace in 2023.

Cumulatively, payroll employment is up 14.3 million since President Biden took office, meaning more jobs were created in this period than created in any other President’s full four year-term.

Strong Labor Force Growth for Prime-Age Workers

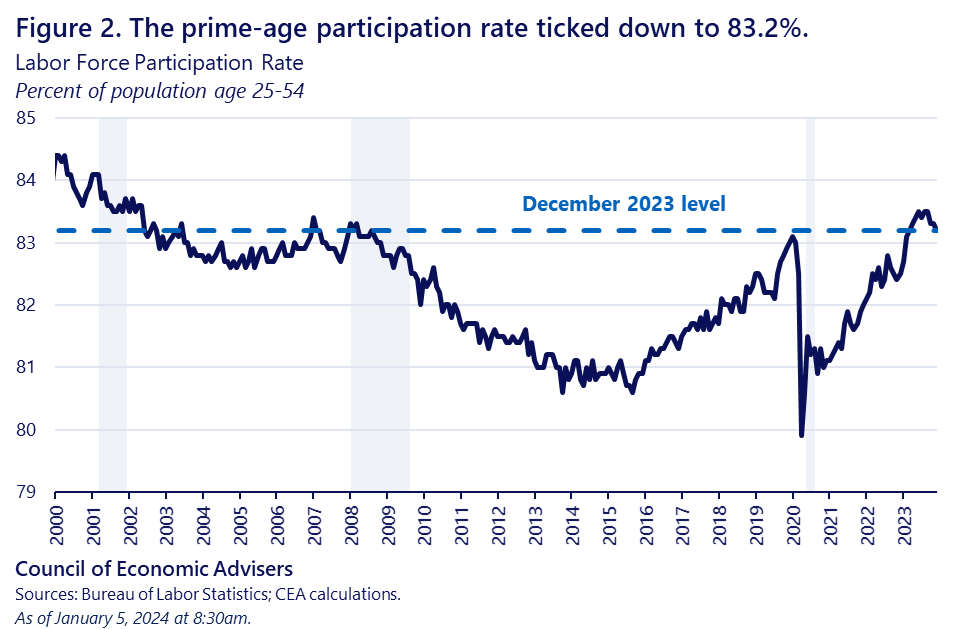

In December 2023, the labor force participation rate fell by 0.3 percentage points, while the prime-age rate (25-54) ticked down slightly. Over the course of 2023, however, the prime-age labor force saw continued growth, rising 0.7 percentage points over the calendar year (0.7 for women and 0.5 for men). Since President Biden took office (January 2021), prime-age LFPRs are up a strong 2.1 percentage points overall, 2.4 and 1.6 percentage points for women and men, respectively. The figure below shows that even as the prime-age LFPR is slightly down over the past few months, it has more-than-recovered from its pre-pandemic peak.

Strong Wage Growth

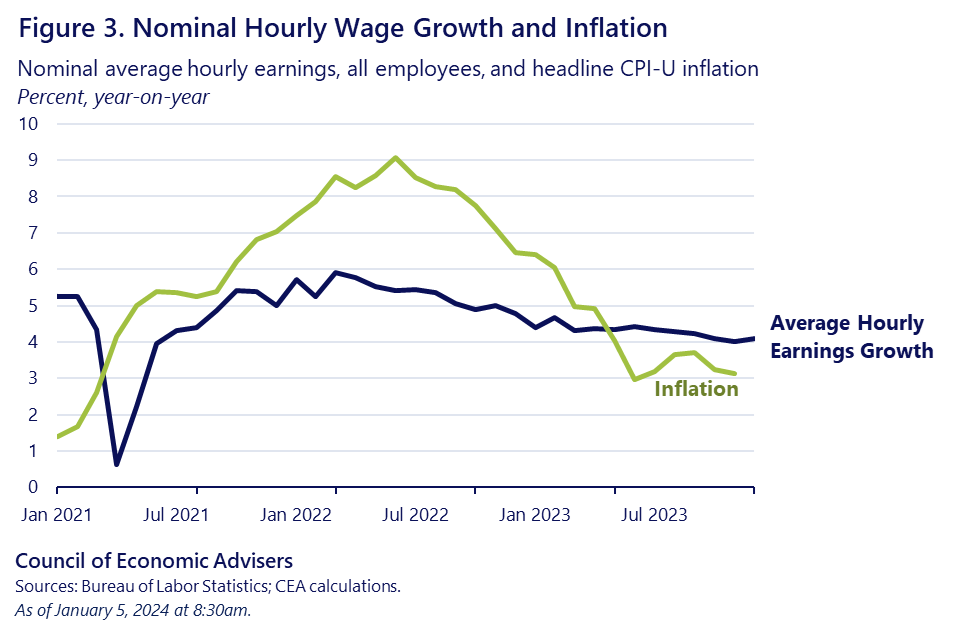

Hourly earnings were up by 4.1 percent over 2023 for all private sector workers and by 4.3 percent for middle-wage workers (the 81 percent of the workforce that’s blue collar or non-managerial). As with job-gains, the pace of nominal wage growth has slowed to a pace that remains strong in historical terms while closing in on paces consistent with steady, stable growth.

A key point regarding wage growth in 2023 is the extent to which it overtook price growth, implying real wage gains. While we do not yet have December’s inflation data, we know that the rate of inflation slowed significantly over the year such that for both all private-sector workers, and for production and nonsupervisory workers, yearly wage growth outpaced inflation for most of 2023 (see figure below). CEA will update this figure next week when the December CPI is released.

Low Unemployment Amid Declining Inflation

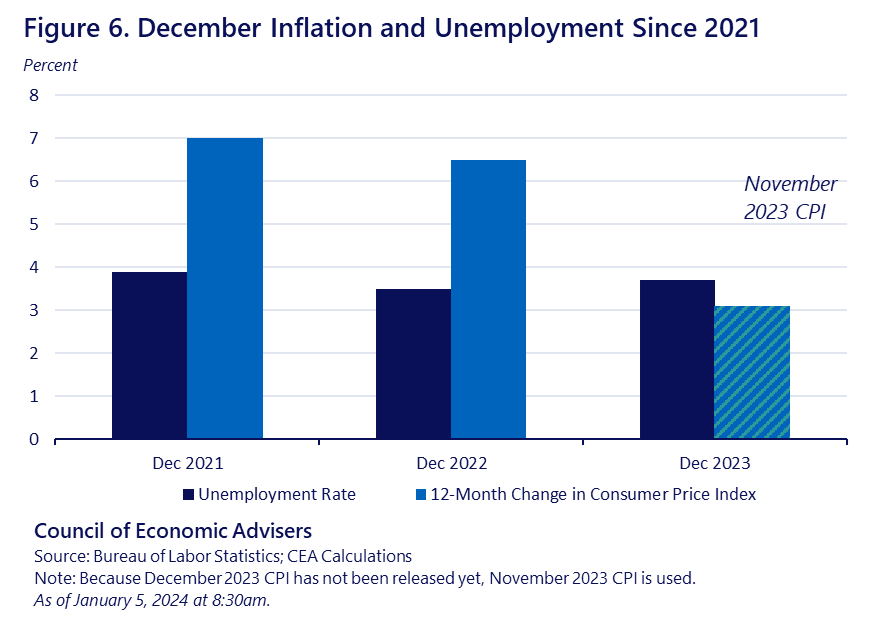

December’s unemployment rate held steady at 3.7 percent, making the average for 2023 3.6 percent, the same average rate as 2022. The jobless rate has been below 4 percent for 23 months in a row, an over 50-year record and indicative of the persistently tight labor market.

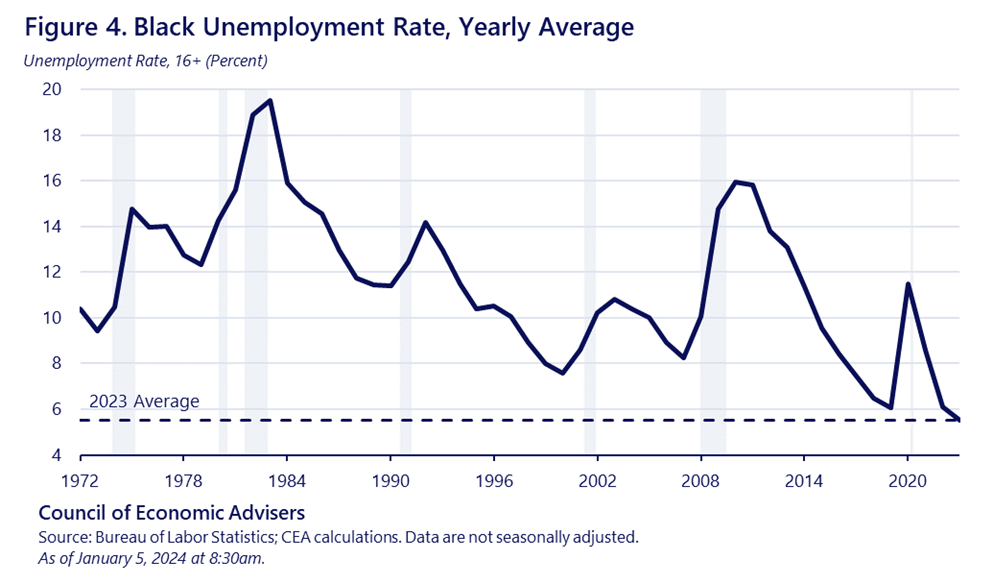

Such persistently low unemployment carries many important advantages to working people. It helps to boost the employment opportunities of groups who are too often left behind in weaker labor markets. In December, the Black unemployment rate ticked down from 5.8 percent to 5.2 percent. For the year, the average Black rate was 5.5 percent, the lowest annual average rate for Black workers on record, with data back to 1972.

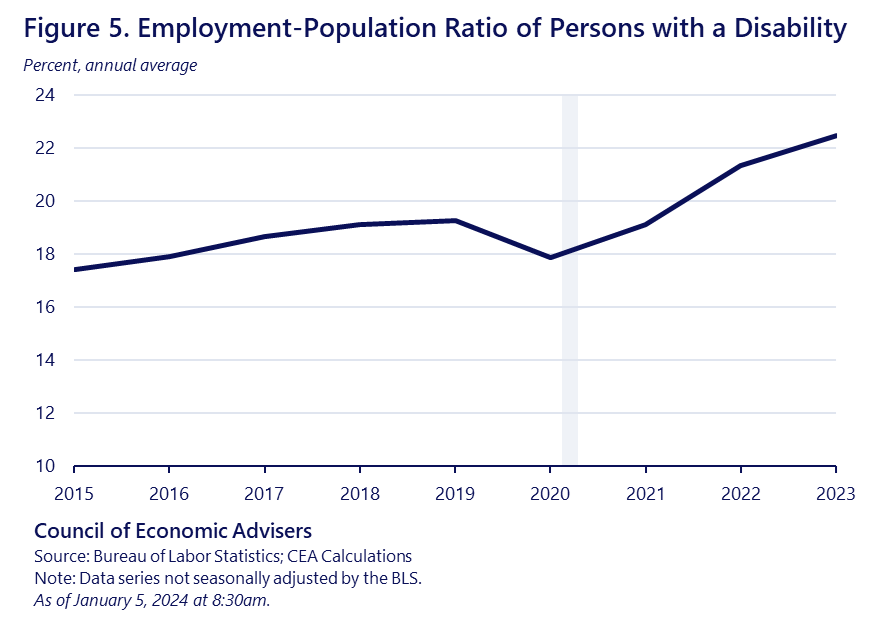

Last year was also a strong year for those with disabilities, another group that typically has a more difficult time finding jobs. The employment-to-population ratio of this group posted another gain, rising 1.3 percentage points, further highlighting how another year of strong labor markets was beneficial to groups of workers that depend on tight labor markets to get a fair chance.

Another remarkable development over this year was the continued decline in inflation while the unemployment rate stayed historically low. Figure 6 below shows that despite widespread claims that lower inflation would require a recession accompanied by much higher unemployment, the blue bars show unemployment virtually unchanged over the past three Decembers, while the inflation bars cascade down from about 7 percent to about 3 percent.

As the president consistently reminds us, we have more work to do to build on this progress. Americans need to see lower costs and our top goals include implementing measures to lower health care and energy costs, while working to eliminate junk fees. But as the 2023 labor-market data reveal, persistently low unemployment and strong job gains amid easing inflation are providing Americans with robust labor market opportunities and real wage gains.

[1] These data do undergo various revisions, some while we expect the broad trends to remain intact, specific numbers will change.