December 2023 CPI Report

Inflation as measured by the Consumer Price Index rose 0.3 percent in December, and by 3.4 percent in 2023 (from Dec. ’22 to Dec. ’23; see CEA’s X thread for more analysis of today’s report). Compared to December 2022 CPI inflation, CPI inflation fell by 3.1 percentage points, from 6.5 percent in December 2022 to 3.4 in December 2023. Core inflation, which leaves out volatile food and energy prices, came in at 3.9 percent this year, down 1.8 points from its 12-month Dec 2022 rate of 5.7 percent.

While these are large calendar-year declines in inflation, they are not unprecedented. In 2008, for example, Dec-Dec headline CPI inflation fell by four percentage points. In 1991, it fell by three percentage points. But there’s a big difference between those years and what we learned this morning about 2023. In December of 1991, the unemployment rate was 7.3 percent, one percentage point higher than in December 1990. In 2008, the unemployment rate was also 7.3 percent, up 2.3 points from the previous December.

This is the typical, historical pattern wherein diminished economic activity leads to lower inflation, one embodied in the workhorse Phillips curve model that plots inflation against some measure of economic slack. In fact, last year some economists argued that the jobless rate would have to climb numerous points to get inflation to significantly fall.

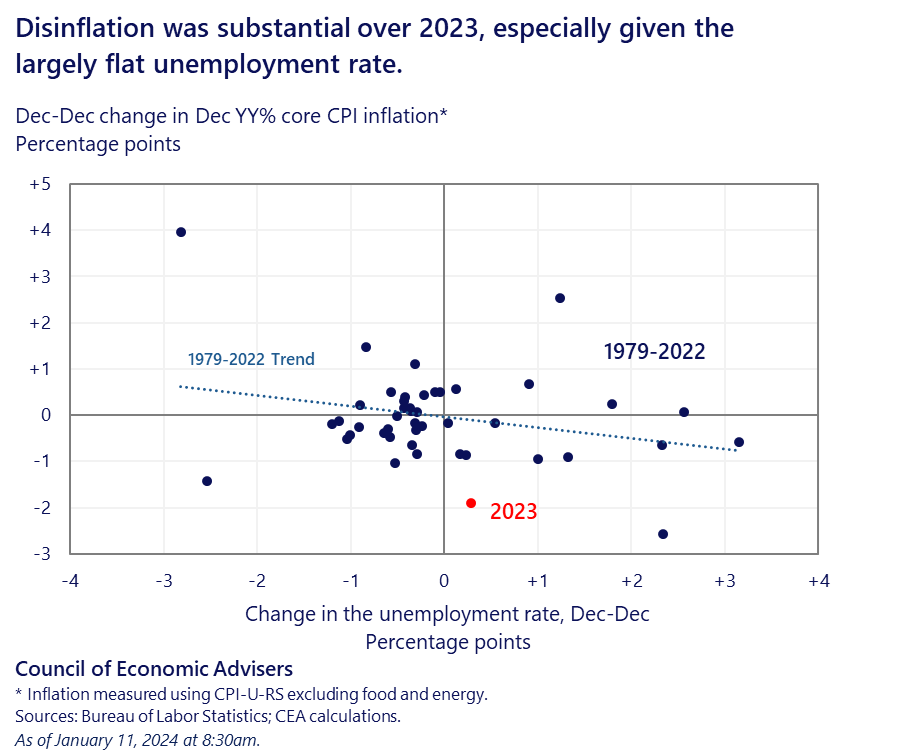

But last month the unemployment rate was a historically low 3.7, up only slightly (0.2 points) from December 2022, meaning disinflation in 2023 bucked the usual pattern. The scatterplot below shows yearly changes in core CPI inflation (Dec/Dec) against the Dec-Dec change in the unemployment rate.[1] The ’23 disinflation of just under 2 points is highlighted in red in the figure and it is an outlier relative to the regression line, implying more inflation reduction against a smaller change in unemployment than the usual historical pattern.

As we have discussed elsewhere, most of the recent disinflation appears associated with improvements in supply chains, increased labor supply, and some job-market cooling not related to higher unemployment, such as declines in job openings and voluntary quits (for headline inflation, the decline in the retail gas price, from about $5/gallon in mid-22 to about $3 now, has been an important contributor as well).

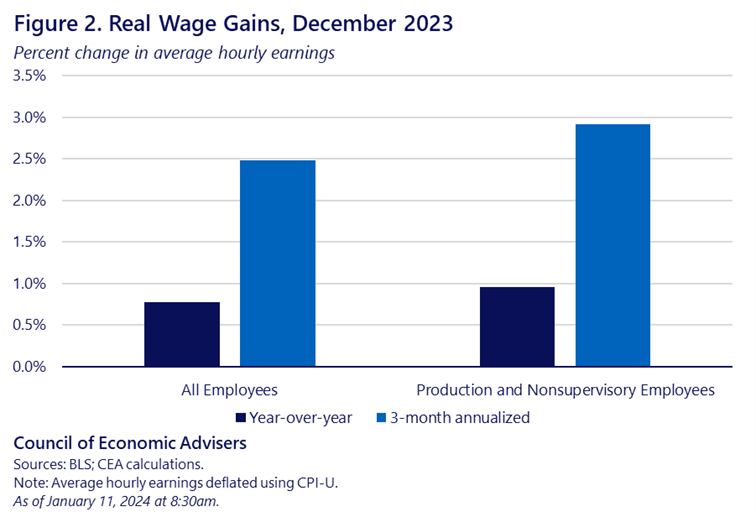

These developments are behind a favorable equation helping American workers: maintaining tight labor markets amidst easing inflation equals real wage growth. Real hourly wages of private-sector workers rose slightly last month (up 0.1 percent), were up 0.8 percent over the past year, and have accelerated in recent months, up 2.5 percent annualized over the past three months. The figure below shows the yearly and 3-month annualized real wage gains for all private and for middle-wage workers,[2] with the latter group up almost 3 percent over 2023Q4. Relative to their level before the pandemic (Dec 2019), real hourly wages are up 1.1 percent for all private workers and 3.3 percent for mid-wage workers, a good example of how persistently tight labor markets disproportionately helps middle and lower-paid workers.

Our administration has more work to do to build on these gains, to provide families more breathing room, and to continue pushing to lower costs in key areas of consumer spending, including health care, energy, groceries, and more. But the outlier in the scatterplot above show the significant disinflation that occurred last year, and the real wage gains over most of the year underscore how important lower inflation has been for working families.

[1] We use core CPI-R-US as it is historically consistent, i.e., it reflects various changes to CPI methods over the history of the series.

[2] The 80 percent of the workforce that’s blue collar in manufacturing and non-managers in services.