Disinflation Explanation, Part 2: Contribution Analysis

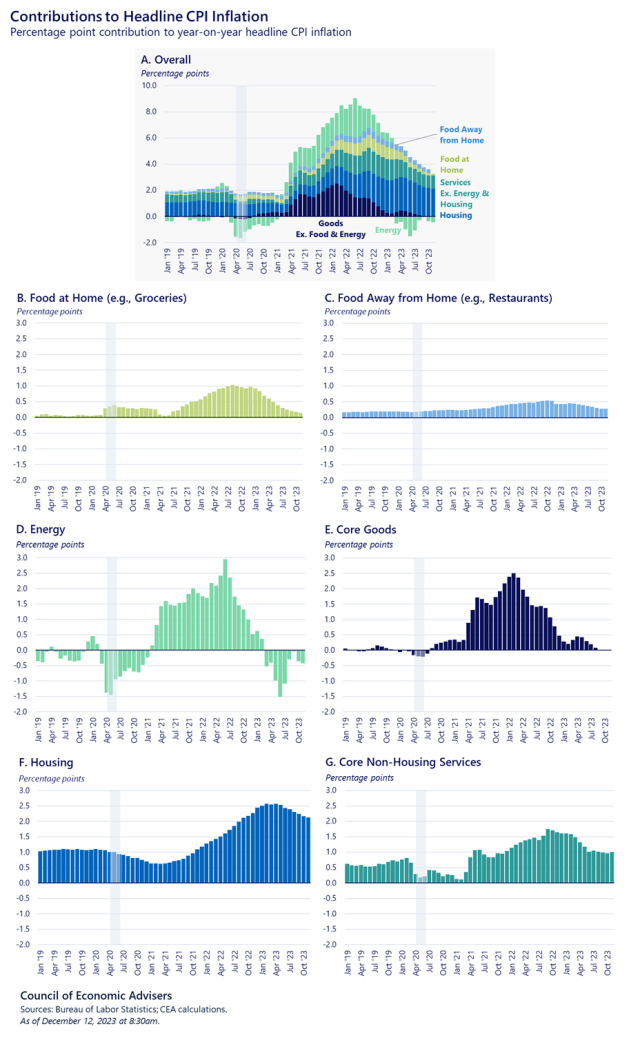

Inflation as measured by the Consumer Price Index (CPI) was 0.1 percent in November, and was 3.1 percent over the past year. The comparable rates of increase for the core CPI, which omits volatile food and gasoline prices, were 0.3 percent (monthly) and 4.0 percent (12-months). As we discuss in our X thread this morning, these growth rates are down substantially from their peak levels.

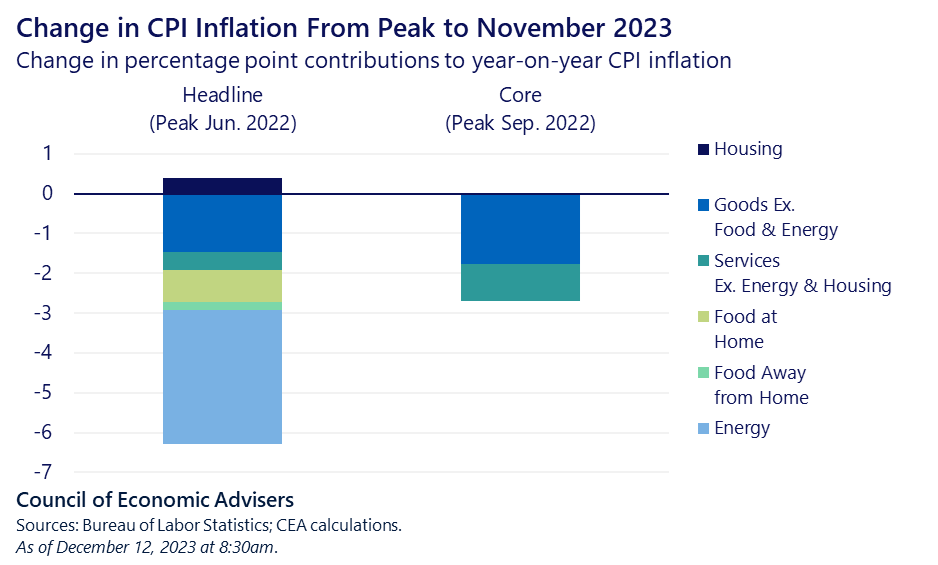

In this post, we dig a bit more into that disinflation, breaking core inflation into three separable categories: goods, housing, and non-housing services (NHS). We then show what each component has contributed to the 2.6 percentage point decline in core inflation (from September 2022). Overall inflation is down 6 percentage points (ppts) from its peak of 9.1 percent in June 2022 year-on-year, and we also show the contributions from energy and food to that disinflation.

Core Goods: As CEA has highlighted in various posts, as global supply chains have largely unsnarled, goods inflation has fallen back to pre-pandemic levels. At its peak in early 2022, this part of the index was rising at a double-digit yearly rate, over 12 percent in during the twelve months through February of that year. Given November’s yearly rate of 0.0 percent, it has fallen by a whopping 12.3 (ppts). Core goods—think clothes, cars, medical care commodities—get a fairly hefty weight in the price index, about 20 percent for the overall index and 25 percent for the core. Thus, as goods inflation has eased, the category’s contribution to disinflation has been important, accounting for 1.8 ppts of the overall decline in core inflation from its peak.

Housing: As we show in a tweet today, housing costs in the CPI continue to follow CEA’s model based on lagged market rents. Housing costs were up 0.5 percent on a monthly basis in November, down from 0.7 percent last November. In contribution terms, housing costs, which account for a third in their weight in the overall index, have played no core inflationary or disinflationary role (i.e., they contributed the same in November 2023 as they did in September 2022), as shown in the figure above. If, however, housing inflation continues to track the CEA model as it has thus far, its contribution to disinflation will increase.

Core non-housing services: NHS inflation has been stickier than core goods inflation but it too has eased and is also contributing to disinflation. While this component is a wide-ranging and disparate category of prices, some of its components are sensitive to labor costs such that the cooler job market and gradual normalization of nominal wage growth are likely putting some downward pressure on this component. Earlier work by CEA found that the wage-sensitive parts of NHS inflation responded to slower nominal wage growth, though only after a considerable lag, which we estimated to be around 10 months.

Food and energy: While these three components add up to core inflation, food and energy costs, which are of course important costs to consumers, round out the difference with overall inflation. According to AAA data, the price of retail gasoline is down from a national average of $5.02 on June 14, 2022, to $3.15 as of yesterday morning, a decline of $1.87 or 37 percent. On a contribution basis, energy costs contributed 3.4 ppts to headline CPI disinflation since June 2022.

Food costs tell a more ambiguous story. Groceries’ inflation was 0.1 last month and 1.7 percent during the past 12 months, the lowest annual grocery inflation since June 2021. But while “food away from home” inflation, i.e., the cost of eating out, has come down from its peak, it remains elevated, such that restaurant costs overall are a minor contributor to disinflation, explaining only 0.2 pp thus far, again relative to peak yearly CPI inflation in June of last year.

Looking ahead, while any one month can bounce any which way, most forecasters expect the broad, disinflationary trend to persist. Barring an unforeseen shock, supply chains should remain relatively unsnarled, shelter costs should continue tracking our model, and as the labor market cools, nominal wage pressures on NHS should continue to ease.[1] Given that energy and food are largely global prices, and are inherently more volatile, their future contribution is harder to discern.

The ongoing disinflation has been a welcomed trend, especially given that it has occurred while the job market has remained fairly strong, a pattern that has led to rising real wages (see footnote 1). CEA will continue to track these trends as they evolve.

[1] It is important to note that while nominal wage growth has slowed, inflation has slowed more, such that real wages have been rising in recent months. In November, real wages were up 0.3 percent over the month and 0.8 percent over the past year.