Real-World Examples of the Benefits of SAVE

Obtaining a college degree is a well-established route to the middle-class. In August 2023, the Biden-Harris Administration introduced the Saving on a Valuable Education (SAVE) plan to ensure that the burden of student loans does not hinder opportunities afforded by a post-secondary education, particularly for those who come from less-advantaged backgrounds who need to finance their studies with debt. This voluntary, income-driven repayment (IDR) plan adjusts monthly payments based on the borrower’s income, with potential for zero-dollar payments when incomes are low. Compared to previous IDR plans, SAVE protects more income from loan payment calculations, bases payments on a smaller fraction of the unprotected income for undergraduate debt, and to prevent balances from growing, does not carry forward unpaid monthly interest.

Another key feature of the SAVE plan is that it results in substantial loan forgiveness for many borrowers in the long-term by forgiving any remaining balances after the borrower has made all required payments during the repayment period: anywhere from 10-25 years depending various factors. Importantly, this applies not just to new borrowers. Current borrowers (who are on other repayment plans) can enroll in SAVE to lower their monthly payments and get credit for their existing years in good standing to receive early loan forgiveness.

How does SAVE provide regular Americans with more breathing room while paying off their student loans? This brief lays out the details of the SAVE plan and discusses its nuances in the context of example borrowers working in different professions.

How is SAVE Different from Other Repayment Plans?

A standard loan repayment plan typically requires a student to repay their loan over 10 years at a fixed interest rate (most recently 5.5 percent for undergraduate loans) with equal monthly payments based only on a borrower’s initial balance. This payment schedule, combined with the 10-year repayment window (as opposed to 10-25 years for SAVE), means borrowers are likely to have significantly higher monthly payments under the standard plan, leading to a debt-to-income burden that can be especially high in the early years of their career when borrowers often face significant liquidity constraints due to lower starting salaries. Thus, for the majority of borrowers, existing IDR plans provide more liquidity in early years than the standard plan. However, the SAVE plan improves upon the previous IDR plans considerably.

The SAVE plan differs from previous IDR plans in 5 major ways:

- More of a borrower’s income is protected from payments

- SAVE monthly payments are calculated based on a borrower’s discretionary income (income minus the cost of necessities). Compared to previous repayment plans, SAVE increases the amount of income protected so that student loan payments do not prevent borrowers from being able to afford necessities such as housing and groceries.

- Payment rates on discretionary income are lower

- Whereas payment rates under an old IDR plan (REPAYE) were 10 percent of discretionary income, once fully implemented in July 2024, SAVE will charge half of that on undergraduate loans. For borrowers with both undergraduate and graduate loans, the payment rate is a weighted average of the undergraduate rate (5 percent) and the graduate rate (10 percent) based on the composition of their original loan balances. Because loans are forgiven after being in good standing during the repayment period, this reduction in payments can result in substantial loan forgiveness.

- Forgiveness comes sooner for many borrowers

- Borrowers who have taken out smaller loan balances can see forgiveness sooner under the SAVE plan, with loans below $12,000 being forgiven after only 10 years.

- More loan forgiveness

- Because SAVE lowers the required monthly payments for those with low incomes, and the outstanding balance is forgiven at the end of the payment period, SAVE also leads to substantial loan forgiveness for those with higher debt to earnings ratios.

- Unpaid interest is not carried forward and added to the loan balance

- Under a standard loan and previous IDR plans, loan balances can grow if the payments do not cover all the interest. Under SAVE, unpaid interest is not carried forward and added to the principal (as in the old system) so that borrowers will never see their balance grow. This feature of the plan is discussed in an August 2023 CEA blog post.

Real World Examples

Among the many borrowers who will benefit from SAVE are those who provide crucial services such as teachers, child care workers, nurses, and accountants. In fact, SAVE is highly compatible with the Public Service Loan Forgiveness (PSLF) program, which is designed to support borrowers who enter lower-paying public service careers by forgiving remaining loan balances after 10 years of monthly payments while working in the public sector. Whereas the standard loan repayment plan’s shorter timeframe prevents borrowers from taking advantage of PSLF—as loans need to be paid in full within a 10-year window—SAVE allows these borrowers greater immediate liquidity alongside the opportunity to take advantage of public service loan forgiveness.

Below, we simulate the potential savings a typical borrower pursuing one of various professions can expect when enrolling in SAVE. Although many different types of borrowers stand to gain from SAVE, the plan has disproportionately positive impacts on borrowers with higher levels of debt and lower initial earnings in the early years of their career.

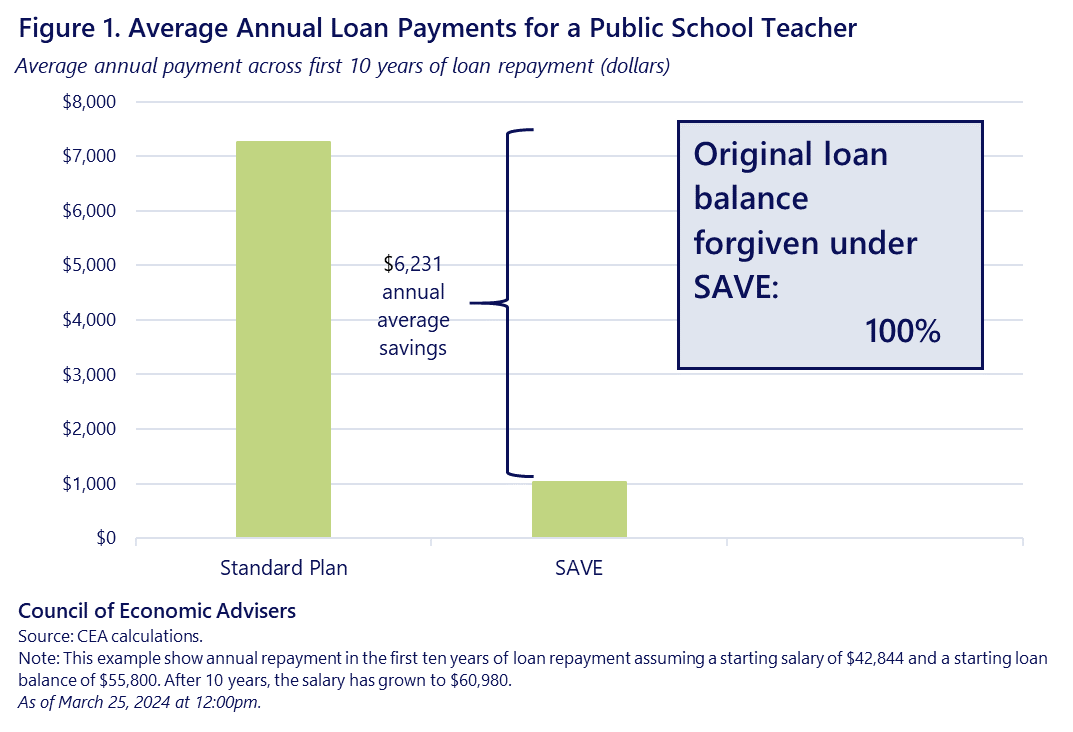

Public School Teacher

A typical public-school teacher has a starting salary of just over $40,000 but can expect to see significant earnings growth over the course of their career. Because teaching typically requires a graduate degree in addition to a bachelor’s degree, teachers are likely to have a high debt to earnings ratio, with the average teacher holding nearly $56,000 in student debt. This group also tends to be disproportionately female.

Take the example of a young teacher who has a master’s degree, with a starting salary of roughly $40,000 and a starting loan balance of close to $56,000.[1] Based on typical earnings growth for public school teachers, the teacher’s monthly payments under the different plans are as follows:

- Standard Plan: roughly $600 per month for 10 years.

- Old IDR Plan (REPAYE): $175 per month in year 1 to $270 per month in year 10.

- SAVE Plan: $60 per month in year 1 to $115 per month in year 10.[2]

- This borrower sees 100 percent of their original loan balance forgiven.

An important feature of SAVE, in comparison to the standard repayment plan, is that SAVE allows borrowers to take advantage of Public Service Loan Forgiveness (PSLF) after 10 years. If the teacher in this example were to enroll in the standard plan, her entire loan would have to be paid within 10 years, making PSLF insignificant for her loan. Under SAVE, not only can she reduce her monthly payments drastically, after 10 years the loan balance will be forgiven by the PSLF program.

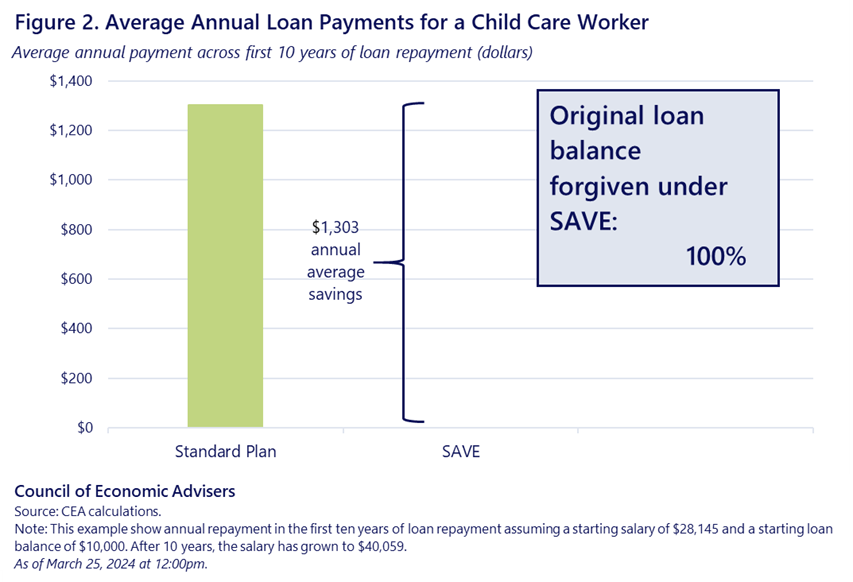

Child Care Worker

Child care workers are a vital component of a functioning economy, as they play two important roles: providing high quality care to the next generation, and allowing working parents—especially mothers—to participate in the labor market. Child care workers tend to be disproportionately women of color. Child care workers often have a sub-baccalaureate credential, such as an Associate degree (AA) in early childhood education, and thus have taken out smaller student loan amounts than those with a BA. On the flip-side, child care workers, although tasked with important work, are typically low-paid. The average child care worker has an expected starting salary of roughly $28,000 per year and a low expected salary growth rate.

Take the example of a young child care worker with a starting salary of roughly $28,000 and a starting loan balance of $10,000.[3] In this example, we assume that the child care worker is not eligible for PSLF, although some in the sector do meet eligibility criteria. Their monthly payments under the different plans are as follows:

- Standard Plan: roughly $110 per month for 10 years.

- Old IDR Plan (REPAYE): $52 per month in year 1 to $100 per month in the final complete year of payment.

- SAVE Plan: $0 per month until forgiveness in year 10.

- This borrower sees 100 percent of their original loan balance forgiven.

Importantly, the SAVE program helps people who graduated years ago and are currently making payments, not just new borrowers. Consider a child care worker who took out more than $10,000 in loans to finance her education. After completing her education with $16,000 in loans, she took a job that paid her roughly $2,300 per month. Making payments towards her loan under a standard plan would be burdensome given her low income, so she enrolled in REPAYE (an old IDR plan). After making the minimum payments of roughly $50-75 per month for several years, her loan balance has actually increased because she was unable to cover the interest payment. In other words, the loan has accrued interest faster than she could pay. After taking out an initial loan of $16,000, this teacher (after 8 years) now has a balance of nearly $17,000. This type of loan balance growth tends to be disproportionately common for Black borrowers (NCES 2023). By enrolling in SAVE, however, that borrower can bring her monthly payment down to $0, and after 6 more years (14 years in total) see her entire loan balance forgiven.

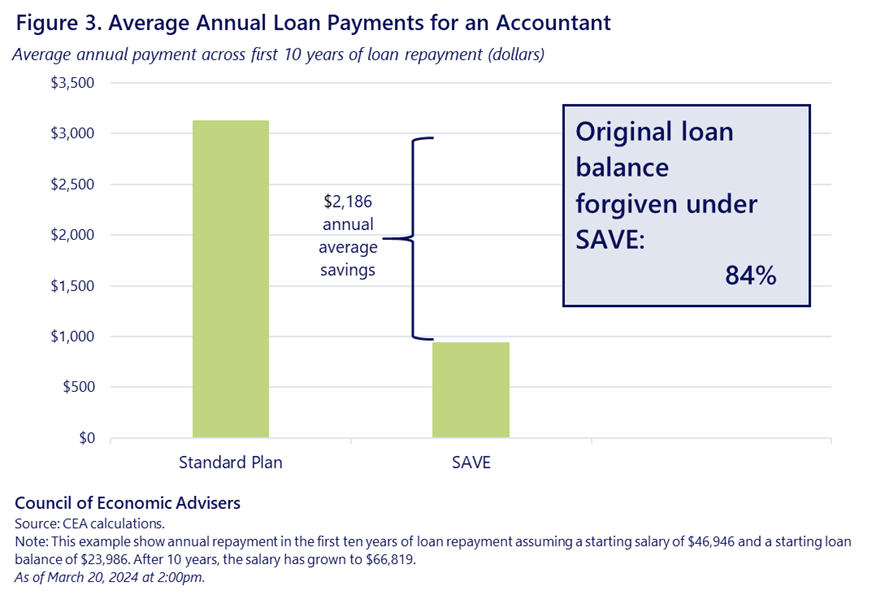

Accountant

A typical accountant has a starting salary of close to $47,000, but can expect to see that salary grow to nearly $100,000 as they progress in their career. Because accounting usually requires a bachelor’s degree or equivalent, accounting students often take out significant loans.

Take the example of a young accountant with a starting salary of roughly $47,000 and a starting loan balance of close to $24,000.[4] Based on typical earnings growth for accountants, that accountant’s monthly payments under the different plans are as follows:

- Standard Plan: roughly $260 per month for 10 years.

- Old IDR Plan (REPAYE): between $100 per month in year 1 to over $300 per month in year 20.

- SAVE Plan: between $60 per month in year 1 to roughly $170 per month in year 20.

- This borrower receives 84 percent forgiveness on their original loan balance.

Registered Nurse

While most borrowers benefit from SAVE, the benefits are less pronounced for professions with higher starting salaries—consistent with the aims of the program. This can be seen in our simulation of a typical registered nurse (RN), whose relatively high starting salary and relatively lower debt load means they likely will not reap additional financial benefits in the long-run under SAVE. However, similar to the accountant, the SAVE plan could benefit the RN by easing the constraints on their liquidity in early years through lower monthly payments compared to other plans.

Take the example of a young registered nurse with a starting salary of roughly $65,000 and a starting loan balance of $22,000.[5] We assume in this example that the nurse is not eligible for PSLF, although many nurses who work in non-profit hospitals are eligible. Their monthly payments under the different plans are as follows:

- Standard Plan: roughly $240 per month for 10 years.

- Old IDR Plan (REPAYE): $359 per month in year 1 to over $400 per month in the final complete year of payment.

- SAVE Plan: $134 per month in year 1, growing to roughly $215 per month.

- This borrower earns enough that they see none of their original loan balance forgiven.

[1] Starting salary for teachers comes from a national survey of starting teacher pay (NEA 2023). Average loan amounts come from a separate survey from the same group (NEA 2021).

[2] This calculation assumes an annual salary growth rate of 4 percent and a payment rate of 7.5 percent, meaning that the loan portfolio composition is 50 percent undergraduate loans and 50 percent graduate loans. The loan balance is forgiven after year 10 if the teacher is eligible for PSLF.

[3] Starting salary for child care workers comes from an average of online job-posting sources for entry-level child care worker salaries. Average loan amounts assume two years at a public, two year institution (NCES 2023).

[4] Starting salary for accountants comes from an average of online job-posting sources for entry-level accountant salaries. Average loan amounts come from an analysis of College Scorecard data (Brookings 2020).

[5] Starting salary for RNs comes from an average of online job-posting sources for entry-level RN salaries. Average loan amounts come from an analysis of College Scorecard data (Brookings 2020).