The Economics of Administration Action on Student Debt

Higher education financing allows many Americans from lower- and middle-income backgrounds to invest in education. However, over the past 30 years, college tuition prices have increased faster than median incomes, leaving many Americans with large amounts of student debt that they struggle or are unable to, pay off.

Recognizing the burden of this debt, the Biden-Harris Administration has pursued two key strategies for debt reduction and cancellation. The first, student debt relief (SDR), aims to address the ill effects of flaws in the student debt system for borrowers. The second, the SAVE plan, reforms the federal student loan system, improving student loan affordability for future students and providing current graduates with breathing room during the beginning of a new career.

This issue brief examines the factors that precipitated the current student debt landscape, and details how both SDR and SAVE will enhance the economic status of millions of Americans with student debt: enabling them to allocate more funds towards basic necessities, take career risks, start businesses, and purchase homes. This brief highlights credible research, underscoring how the Administration’s student debt relief could boost consumption in the short-term by billions of dollars and could have important impacts on borrower mental health, financial security, and outcomes such as homeownership and entrepreneurship. This brief also details how the SAVE plan makes repaying college costs more affordable for current borrowers and future generations. CEA simulations show that, under SAVE, an average borrower with a bachelor’s degree could save $20,000 in loan payments, while a borrower with an associate degree could see nearly 90 percent savings compared to the standard loan repayment plan. These changes enable more people to pursue education and contribute to the broader economy.

Why do borrowers need relief?

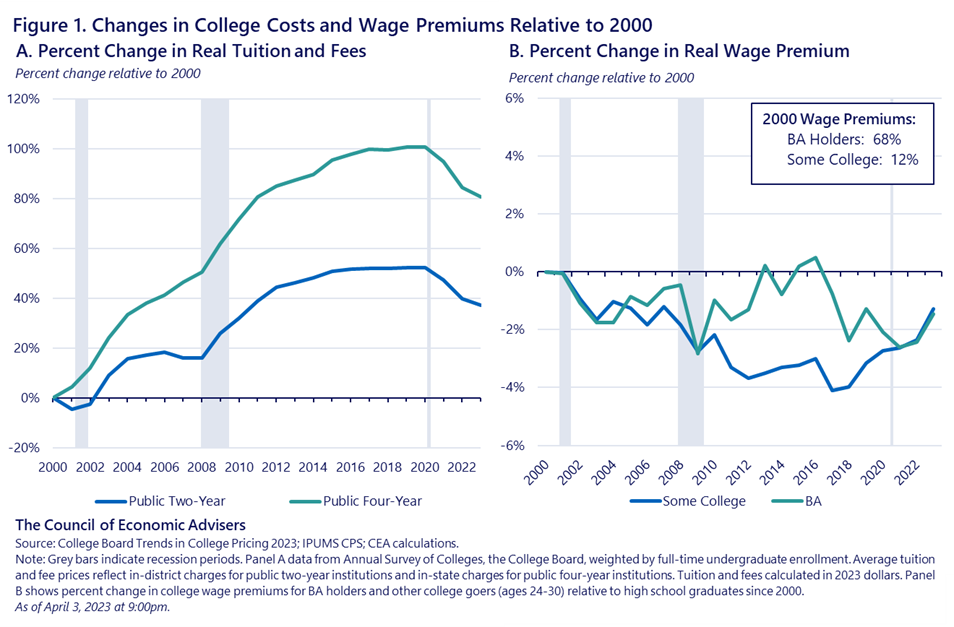

Over the last 20 years especially, the sticker price of college has risen significantly. Despite recent minor declines, sticker prices at public universities (which over 70% of undergraduate students in the United States attend) are 56% higher today than two decades ago.[1] While there are many reasons for this trend, the most rapid increases in tuition often occur during economic downturns as tuitions grow to fill the budgetary holes that are left when states cut their support to public colleges (Webber, 2017; Deming and Walters 2018). This is especially problematic given many people choose to return to school during economic downturns (Betts and MacFarland 1995; Hillman and Orians 2013). Unfortunately, contracting state appropriations have played a role in shifting the responsibility of financing away from public subsidies and toward students and families (Turner and Barr, 2013; Bound et al., 2019)–leading many students to take on more debt.

At the same time that college sticker prices have risen, the wage premium (the earnings difference between college goers and high school graduates) has not seen analogous growth. While obtaining a college degree remains a reliable entry point to the middle class, the relative earning gains for degree holders began to stagnate in the early 2000s after increasing for several decades. As shown in Figure 1b, since 2000, the wage premium for both bachelor’s degree holders and those with “some college” education (which includes anyone who enrolled in college but didn’t earn a BA) saw declines around the 2001-02 and 2008-10 recessions and a slow, inconsistent recovery thereafter. The decline is particularly notable for students who didn’t complete a four-year degree, a group that includes two-year college enrollees who have among the highest student loan default rates.[2]

Traditional economic theory tells us that individuals choose to invest in post-secondary education based on the expected costs and wage returns associated with the investment. But rapid and unforeseeable rises in prices and declines in college wage premia have contributed to decades of “unlucky” college-entry cohorts affected by a form of recessionary scarring. For example, a student who entered college in 2006 would have expected a sticker price of roughly $8,800 per year for a four-year college, but actually faced tuition of over $10,000 in their final year of college, a roughly 15% difference. This same student, upon graduation if they worked full time, would have earned about $3,500 less, on average, than what they would have expected upon entering. This example illustrates that many borrowers made sound borrowing decisions with available information, but as a result of these trends ended up with more debt than they could afford to pay off.[3] Consistent with this notion, the default rate for “unlucky” college entry cohorts of the 2000s is much higher than those of other cohorts, with undergraduate default rates doubling between 2000 and 2010: in 2017, 21 percent of undergraduate loan holders and 6 percent of graduate loan holders defaulted within 3 years (CBO, 2020).

It is important to note that sticker prices for public institutions have declined 7 percent since 2021, the same period over which college wage premiums have been rising. Declining tuition, for the first time in decades, coincided with increased investment in higher education through pandemic-era legislation such as the American Rescue Plan, which allocated $40 billion in 2021 to support institutes of higher education and their students. Despite these improvements, as well as significant advances in the return on college investments over the last three years, many current borrowers still need some relief. The Administration has taken significant action to protect future cohorts from similar risks.

How the Administration is providing relief

Retrospective: Student Debt Relief Helps Existing Borrowers

In a commitment to help those who are overburdened with debt, the Administration has already approved Federal student debt cancellation for nearly 4 million Americans through various actions. Today, the Administration announced details of proposed rules that, if finalized as proposed, would provide relief to over 30 million borrowers when taken together with actions to date.

Importantly, much of this debt forgiveness comes from correcting program administration and improving regulations related to laws that were on the books before this Administration took office. This debt relief has affected borrowers from all walks of life, including nearly 900,000 Americans who have dedicated their lives to public service (such as teachers, social workers, nurses, firefighters, police officers, and others), borrowers who were misled and cheated by their institutions, and borrowers who are facing total or permanent disability, including many veterans. By relieving these borrowers of long-held, and in some cases very large burdens of debt, relief can have significant meaning and impact for borrowers, families, and their communities.

By reducing debtors’ liabilities, debt relief raises net worth (assets, including income less liabilities). Debt relief can also ease the financial burden of making payments—leading to greater disposable income for borrowers and their families, which enhances living standards and could positively influence decisions about employment, home buying, and mobility. While there are few direct estimates of the effect of debt cancelation in the literature, estimates based on the relationship between wealth and consumption suggest that this forgiveness could increase consumption by several billions of dollars each year in the next five to ten years.

Additionally, a recent study suggests that student debt cancellation can lead to increased earnings (due to greater geographic and career mobility), improved credit scores, and lower delinquency rates on other debts (Di Maggio, Kalda, and Yao, 2019). This can facilitate access to capital for starting a business or buying a car or home. As home mortgages often require a certain debt-to-income ratio and depend heavily on credit scores, student debt cancellation could potentially increase home ownership. Indeed, based on the mechanical relationship between housing industry affordability standards and debt-to-income ratios, industry sources have suggested that those without student debt could afford to take out substantially larger mortgages (Zillow, 2018). Other research also indicates a negative correlation between student loan debt and homeownership (Mezza et al., 2020).

It is important to note that, while these pecuniary benefits are important, the benefits associated with debt relief are not merely financial. Experimental evidence has linked holding debt to heightened levels of stress and anxiety (Drentea and Reynolds, 2012), worse self-reported physical health (Sweet et al., 2013), and reduced cognitive capacity (Robb et al., 2012; Ong et al., 2019). Studies also show that holding student debt can be a barrier to positive life cycle outcomes such as entrepreneurship (Krishnan and Wang, 2019), and marriage (Gicheva, 2016; Sieg and Wang, 2018). Student debt relief has the potential to improve these key outcomes for millions of borrowers.

Prospective: The SAVE Plan Helps Prevent Future Challenges

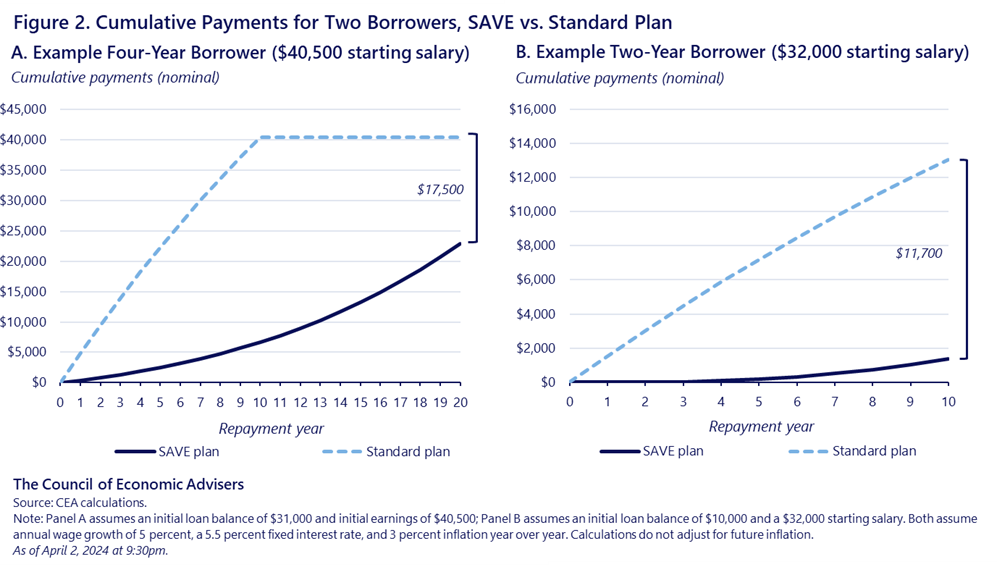

To address unaffordable education financing moving forward, the Administration has also introduced the Saving on a Valuable Education (SAVE) loan repayment program. The SAVE plan prospectively helps student borrowers by ensuring that once they graduate, they never have to pay more than they can afford towards their student loan debt. Importantly, the SAVE plan protects borrowers from being “unlucky” by ensuring that high tuition or low earnings do not result in loan payments that borrowers can’t afford. The CEA has detailed the real benefits of SAVE for borrowers in issue briefs and blogs, underscoring that SAVE is the most affordable student loan repayment program in U.S. history. By substantially reducing monthly payment amounts compared to previous income driven repayment (IDR) plans and reducing time to forgiveness to as little as 10 years for people who borrowed smaller amounts, the SAVE plan can mean tens of thousands of dollars in real savings for borrowers over the course of repayment.

Figure 2 gives the example of two representative borrowers. Take the first, a 4-year college graduate who has $31,000 in debt and earns about $40,500 per year. Under a standard repayment plan, this borrower would pay roughly $330 dollars each month for 10 years. Under SAVE, this borrower would pay about $50 per month for the first ten years, and on average about $130 per month for the next 10 years. Over a 20-year period, this borrower would make roughly $17,500 less in payments, not accounting for inflation over that period. This represents a 56 percent reduction in total payments compared to the standard repayment plan and includes considerable loan forgiveness. Similarly, the representative 2-year college graduate has $10,000 in debt and earns about $32,000 per year. Under a standard plan, this borrower would pay $110 dollars each month for 10 years. Under SAVE, this borrower would pay $0 per month for the first two years, and under $20 per month for the next eight years before their debt is forgiven at year 10. Overall, this borrower would be responsible for roughly $11,700 less in lifetime payments, not accounting for inflation. This borrower sees nearly 90 percent savings compared to the standard plan and receives considerable loan forgiveness.

SAVE can also have benefits beyond the individual borrower. More money in borrowers’ pockets due to lower payment obligations under SAVE could boost consumption and give borrowers breathing room to make payments on other debt. This consumption effect is bolstered by a large literature documenting the benefits of easing liquidity constraints (see, for example, Aydin, 2022; Parker et al., 2022). Additionally, by shortening time to forgiveness for undergraduate borrowers, SAVE can lead to positive debt-relief outcomes (as discussed above) for many more borrowers.

Another key aspect of income-driven repayment plans like SAVE is that they protect borrowers from having to make large payments when incomes are low. Specifically, the required payments are not based on the initial loan balance, but on one’s income and household size so that those cohorts who need to borrow more to pay for college do not make larger payments unless they make more income. SAVE also protects more of a borrower’s income as discretionary and, when the full plan is implemented in Summer 2024, will limit monthly payments on undergraduate loans to 5 percent of discretionary income. In fact, for single borrowers who make less than $33,000 per year, the required monthly payments will be zero dollars. From a finance perspective, the SAVE plan provides a form of insurance against tuition spikes and economic downturns–taking some of the risk out of investing in one’s education while also bringing costs down.

A common concern, and one that could mute these benefits, is that increases in the generosity of education financing may encourage institutions to raise tuition and fees in response, a phenomenon commonly referred to as the Bennett Hypothesis (for an excellent overview of research, see Dynarski et al., 2022). Theoretically, in a market when sellers are maximizing profits, any policy that increases demand will also increase prices. However, this is less likely to impact the over 70% of U.S. undergraduates who attend public colleges, which are not profit-driven and often have statutorily set tuition. Consistent with this notion, the evidence in support of the Bennett Hypothesis primarily comes from for-profit colleges, which are highly reliant on students who receive federal financial aid (Cellini and Goldin, 2014; Baird et al, 2022).[4] Importantly, although the for-profit sector enrolls some of the country’s most vulnerable students, enrollment in the sector in 2021 accounted for only 5 percent of total undergraduate enrollment, suggesting that aggregate tuition increases in response to changes in education financing may be modest. Furthermore, the Biden-Harris Administration has taken action to crack down on for-profit colleges that take advantage of, or mislead, their students. And, recent regulations, such as the Gainful Employment (GE) rule, add safeguards against unaffordable debt regardless of more generous education financing.

Although the SAVE plan stands to benefit borrowers of all backgrounds, the plan has important racial and socioeconomic equity implications because it is particularly beneficial for those borrowers with the lowest incomes. Centuries of inequities have led to Black, Hispanic, and Native households being more likely than their White peers to fall in the low end of the income distribution. This means that, mechanically, the SAVE plan’s benefits could accrue disproportionately to these groups. Indeed, using completion data from recent years, an Urban Institute analysis estimates that 59 percent of credentials earned by Black students and 53 percent of credentials earned by Hispanic students are likely to be eligible for some amount of loan forgiveness under SAVE, compared to 42 percent of credentials earned by White students (Delisle and Cohn, 2023). Finally, the interest subsidy described in an August 2023 CEA blog, prevents ballooning balances when a borrower cannot cover their entire monthly interest payment, a phenomenon that has historically led to many borrowers in general, and Black borrowers in particular, to see loan balances that are higher than their original loan amount, even several years out from graduating with a bachelor’s degree (NCES, 2023).

Broader economic impacts

The benefits associated with SDR and SAVE for millions of Americans are considerable. In the short run, under both SDR and SAVE, those who receive relief may be able to spend more in their communities and contribute to their local economies. Summing the likely consumption effects of the Administration’s student debt relief and SAVE programs results in billions of dollars in additional consumption annually. Despite the modest effect on the macroeconomy as a whole (note that the U.S. economy is roughly $28 trillion with a population of roughly 320 million), these consumption effects represent incredibly meaningful impacts on individual borrowers’ financial security and the economic wellbeing of their communities.

SAVE, because it brings down the cost of taking out loans to go to college, has the potential to lead to longer-term economic growth if it leads to greater educational attainment. This increased attainment can occur both through improved retention and completion of post-secondary education, and also the movement of students into college who would not have otherwise enrolled. There is a long macroeconomics literature linking educational attainment in a nation to GDP growth (see, for example, Lucas, 1988; Hanushek and Woesmann, 2008). While identifying the causal effect of schooling on GDP is challenging, researchers, using a variety of approaches, find that a one-year increase in average education (for the entire working population) would increase the real GDP level by between 5 and 12 percent (Barro and Lee, 2013; Soto, 2002) —a result that is in line with the micro-founded relationship between years of education and earnings (Lovenheim and Smith, 2022).

To put this relationship in perspective and highlight the growth potential of increasing educational attainment, the CEA simulated the hypothetical effect on GDP of increasing the college-going rate by 1, 3, and 5 percentage points, respectively. This range represents the kinds of changes in college going that have been observed over several years: the college enrollment rate for 18- to 24-year-olds declined 4 percentage points between 2011 and 2021 after increasing by 6 percentage points between 2000 and 2011 (NCES 2023). CEA simulations show that by 2055, a policy that increased the college going rate by 1, 3, and 5 percentage points could increase the level of GDP in 2055 (thirty years from now) by 0.2, 0.6, and 1 percent respectively. This represents hundreds of billions of dollars of additional economic activity in the long run.

While increased growth is an exciting possibility, it would only occur insofar as SAVE leads to increased educational attainment, which is uncertain. The academic literature has found that student loans can promote academic performance (Barr, et. al. 2021), and increase educational attainment by increasing transfers from 2-year to 4-year colleges and increasing college completion among enrollees (Marx and Turner, 2019). At the same time, increases in college-going due to SAVE are by no means guaranteed. While, historically, policies that reduce the cost of college through direct means—such as providing students with generous grant aid, or reducing tuition—have succeeded at raising college enrollment levels (Dynarski, 2003; Turner, 2011), a pair of recent studies show that prospective students may only respond to cost changes when they are salient, i.e., they are framed and marketed in the right way (Dynarski et al., 2021), and relatively certain (Burland et al., 2022). However, evidence suggests that there is demand for plans like SAVE (Balakrishnan et al., 2024), particularly as SAVE can provide sizable benefits to borrowers in terms of reducing their long-term debt burden and keep monthly payments low (dependent on a borrower’s income) after they finish school.

This highlights the importance of communicating the benefits of the SAVE program to prospective students who otherwise would not enroll in college due to cost concerns, including potential barriers to paying off student loans in the future. Doing so could lead to meaningful increases in college enrollment, and the resulting improvements in productive capacity could increase the size of the U.S. economy for years to come.

Concluding remarks

The Biden-Harris Administration has taken bold action to address a student debt problem that has been decades in the making. This student debt cancellation will provide well-deserved relief for borrowers who have paid their fair share, many of whom had the proverbial rug pulled out from under them with concurrent rapidly rising tuition and declining returns to a college degree. The relief has and will improve economic health and wellbeing of those who have devoted years of their life to public service, those who were defrauded or misled by their institutions, and those who have been doing all they can to make payments, but have still seen their loan balances grow. Looking to future generations, the Administration implemented the SAVE plan to protect borrowers against tuition spikes and poorer than expected labor market outcomes that often plague students graduating into a period of economic downturn (Rothstein, 2021; Schwandt and von Wachter, 2023).

Both student debt relief and SAVE will enhance the economic status of millions of Americans with student debt: enable them to allocate more funds towards basic necessities, take career risks, start businesses, and purchase homes with the understanding that they will never have to pay more than they can afford towards their student loans. Moreover, the SAVE plan makes repayment more affordable for future generations, which helps borrowers manage monthly payments, but also enables more people from all walks of life to explore their full potential and pursue higher education, enhancing the potential of the U.S. workforce and the economy more broadly.

[1] In 2021, 51% of total undergraduates attended public 4-year universities and 21% attended public 2-years in 2021.

[2] The BA group excludes those with a graduate degree, or any education beyond a bachelor’s degree.

[3] Recent research shows that, despite a positive return on investment (ROI) for many, including the average student, the distribution of ROI has widened over the last several decades such that the likelihood of negative ROI is higher than it has historically been, particularly so for underrepresented minority students (Webber 2022).

[4] There is also some evidence in support of the Bennett Hypothesis at the graduate level (Black et al. 2023).